THE RETHINKX PROJECT

Preface

The analysis in this report is based on detailed evaluation of data on the market, consumer and regulatory dynamics that work together to drive disruption. We present an economic analysis based on existing technologies that have well-known cost curves and on existing business-model innovations. We extrapolate data where we have credible knowledge that these cost curves will continue in the near future. The disruptions we highlight might happen more quickly due to the acceleration of the cost curves (such as has been happening in lithium-ion batteries, for example) or because of step changes in these technologies (such as has been happening in solid-state batteries and artificial-intelligence processing units). New business-model innovations may also accelerate disruption.

The analysis in this report is based on detailed evaluation of data on the market, consumer and regulatory dynamics that work together to drive disruption. We present an economic analysis based on existing technologies that have well-known cost curves and on existing business-model innovations. We extrapolate data where we have credible knowledge that these cost curves will continue in the near future. The disruptions we highlight might happen more quickly due to the acceleration of the cost curves (such as has been happening in lithium-ion batteries, for example) or because of step changes in these technologies (such as has been happening in solid-state batteries and artificial-intelligence processing units). New business-model innovations may also accelerate disruption.

Our findings and their implications are based on following the data and applying our knowledge of finance, economics, technology adoption and human behavior. Our findings show the speed, scale and implications of the disruptions to be expected in a rational context. Scenarios can only be considered in terms of probabilities. We think the scenarios we lay out to be far more probable than others currently forecast. In fact, we consider these disruptions to be inevitable. Ultimately, individual consumers, businesses, investors and policymakers will make the decisions that dictate how these disruptions unfold. We provide insights that anticipate disruption. Hopefully we can all make better decisions to benefit society based on the evidence that we present.

Executive Summary

We are on the cusp of one of the fastest, deepest, most consequential disruptions of transportation in history. By 2030, within 10 years of regulatory approval of autonomous vehicles (AVs), 95% of U.S. passenger miles traveled will be served by on-demand autonomous electric vehicles owned by fleets, not individuals, in a new business model we call “transport-as-a-service” (TaaS). The TaaS disruption will have enormous implications across the transportation and oil industries, decimating entire portions of their value chains, causing oil demand and prices to plummet, and destroying trillions of dollars in investor value — but also creating trillions of dollars in new business opportunities, consumer surplus and GDP growth.

The disruption will be driven by economics. Using TaaS, the average American family will save more than $5,600 per year in transportation costs, equivalent to a wage raise of 10%. This will keep an additional $1 trillion per year in Americans’ pockets by 2030, potentially generating the largest infusion of consumer spending in history.

We have reached this conclusion through exhaustive analysis of data, market, consumer and regulatory dynamics, using well-established cost curves and assuming only existing technology. This report presents overwhelming evidence that mainstream analysis is missing, yet again, the speed, scope and impact of technology disruption. Unlike those analyses, which produce linear and incremental forecasts, our modeling incorporates systems dynamics, including feedback loops, network effects and market forces, that better reflect the reality of fast-paced technology-adoption S-curves. These systems dynamics, unleashed as adoption of TaaS begins, will create a virtuous cycle of decreasing costs and increasing quality of service and convenience, which will in turn drive further adoption along an exponential S-curve. Conversely, individual vehicle ownership, especially of internal combustion engine (ICE) vehicles, will enter a vicious cycle of increasing costs, decreasing convenience and diminishing quality of service.

Summary of findings:

- The approval of autonomous vehicles will unleash a highly competitive market-share grab among existing and new Pre-TaaS (ride-hailing) companies in expectation of the outsized rewards of trillions of dollars of market opportunities and network effects. Pre-TaaS platform providers like Uber, Lyft and Didi are already engaged, and others will join this high-speed race. Winners-take-all dynamics will force them to make large upfront investments to provide the highest possible level of service, ensuring supply matches demand in each geographic market they enter.

- In this intensely competitive environment, businesses will offer services at a price trending toward cost. As a result, their fleets will quickly transition from human-driven, internal combustion engine (ICE) vehicles to autonomous electric vehicles (A-EV) because of key cost factors, including ten times higher vehicle-utilization rates, 500,000-mile vehicle lifetimes (potentially improving to 1 million miles by 2030), and far lower maintenance, energy, finance and insurance costs.

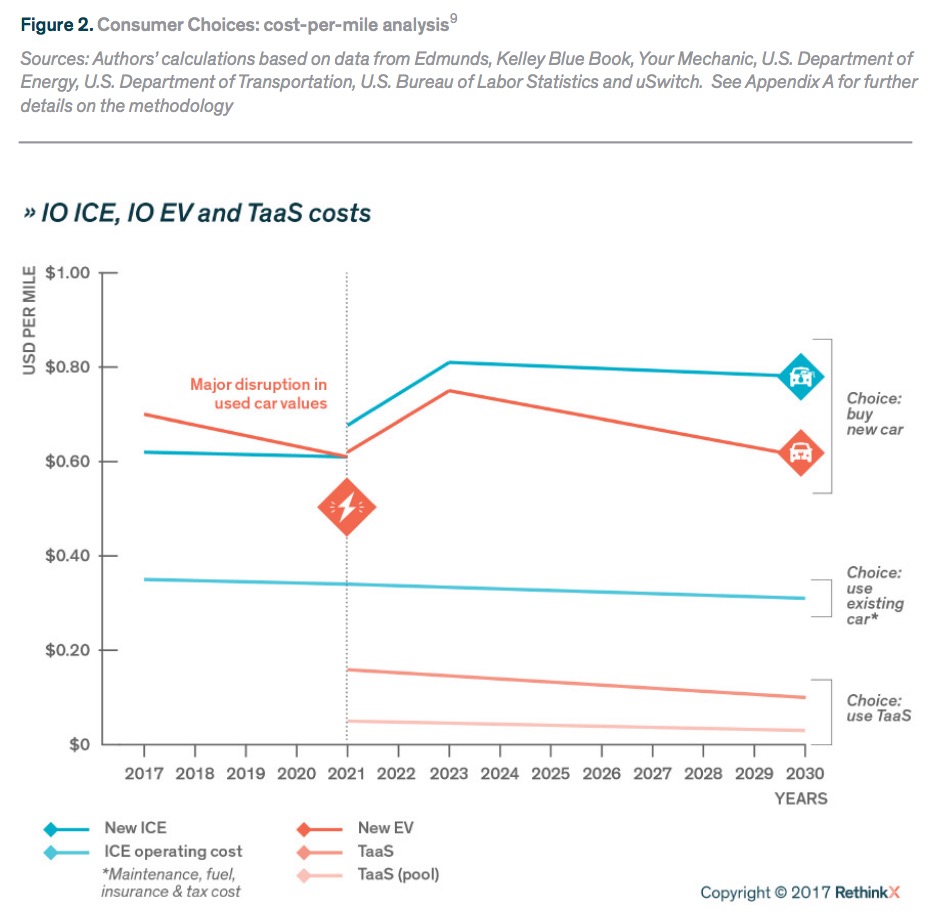

- As a result, transport-as-a-service (TaaS) will offer vastly lower-cost transport alternatives — four to ten times cheaper per mile than buying a new car and two to four times cheaper than operating an existing vehicle in 2021.

- Other revenue sources from advertising, data monetization, entertainment and product sales will open a road to free transport in a TaaS Pool model, as private and public transportation begin to merge.

- Cost saving will also be the key factor in driving consumers to adopt TaaS.

- Adoption will start in cities and radiate outward to rural areas. Nonadopters will be largely restricted to the most rural areas, where cost and wait times are likely to be higher.

- High vehicle utilization (each car will be used at least 10 times more than individually owned cars) will mean that far fewer cars will be needed in the U.S. vehicle fleet, and therefore there will be no supply constraint to the speed and extent of TaaS adoption that we forecast.

Taken together, this analysis forecasts a very fast and extensive disruption: TaaS will provide 95% of the passenger miles traveled within 10 years of the widespread regulatory approval of AVs. By 2030, individually owned ICE vehicles will still represent 40% of the vehicles in the U.S. vehicle fleet, but they will provide just 5% of passenger miles.

Behavioral issues such as love of driving, fear of new technology or habit are generally believed to pose initial barriers to consumer uptake. However, Pre-TaaS companies such as Uber, Lyft and Didi have invested billions of dollars developing technologies and services to overcome these issues. In 2016, Pre-TaaS companies drove 500,000 passengers per day in New York City alone.1 That was triple the number of passengers driven the previous year. The combination of TaaS’s dramatically lower costs compared with car ownership and exposure to successful peer experience will drive more widespread usage of the service. Adopting TaaS requires no investment or lock-in. Consumers can try it with ease and increase usage as their comfort level increases. Even in suburban and rural areas, where wait times and cost might be slightly higher, adoption is likely to be more extensive than generally forecast because of the greater impact of cost savings on lower incomes. As with any technology disruption, adoption will grow along an exponential S-curve.2

The impacts of TaaS disruption are far reaching:

Economic

- Savings on transportation costs will result in a permanent boost in annual disposable income for U.S. households, totaling $1 trillion by 2030. Consumer spending is by far the largest driver of the economy, comprising about 71% of total GDP and driving business and job growth throughout the economy.

- Productivity gains as a result of reclaimed driving hours will boost GDP by an additional $1 trillion.

- As fewer cars travel more miles, the number of passenger vehicles on American roads will drop from 247 million to 44 million, opening up vast tracts of land for other, more productive uses. Nearly 100 million existing vehicles will be abandoned as they become economically unviable.

- Demand for new vehicles will plummet: 70% fewer passenger cars and trucks will be manufactured each year. This could result in total disruption of the car value chain, with car dealers, maintenance and insurance companies suffering almost complete destruction. Car manufacturers will have options to adapt, either as low-margin, highvolume assemblers of A-EVs, or by becoming TaaS providers. Both strategies will be characterized by high levels of competition, with new entrants from other industries. The value in the sector will be mainly in the vehicle operating systems, computing platforms and the TaaS platforms.

- The transportation value chain will deliver 6 billion passenger miles in 2030 (an increase of 50% over 2021) at a quarter of the cost ($393 billion versus $1.481 billion).

- Oil demand will peak at 100 million barrels per day by 2020, dropping to 70 million barrels per day by 2030. That represents a drop of 30 million barrels in real terms and 40 million barrels below the Energy Information Administration’s current “business as usual” case. This will have a catastrophic effect on the oil industry through price collapse (an equilibrium cost of $25.4 per barrel), disproportionately impacting different companies, countries, oil fields and infrastructure depending on their exposure to high-cost oil.

- The impact of the collapse of oil prices throughout the oil industry value chain will be felt as soon as 2021.

- In the U.S., an estimated 65% of shale oil and tight oil — which under a “business as usual” scenario could make up over 70% of the U.S. supply in 2030 — would no longer be commercially viable.

- Approximately 70% of the potential 2030 production of Bakken shale oil would be stranded under a 70 million barrels per day demand assumption.

- Infrastructure such as the Keystone XL and Dakota Access pipelines would be stranded, as well.

- Other areas facing volume collapse include offshore sites in the United Kingdom, Norway and Nigeria; Venezuelan heavy-crude fields; and the Canadian tar sands.

- Conventional energy and transportation industries will suffer substantial job loss. Policies will be needed to mitigate these adverse effects.

Environmental

- The TaaS disruption will bring dramatic reductions or elimination of air pollution and greenhouse gases from the transport sector, and improved public health. The TaaS transport system will reduce energy demand by 80% and tailpipe emissions by over 90%. Assuming a concurrent disruption of the electricity infrastructure by solar and wind, we may see a largely carbon-free road transportation system by 2030.

Geopolitical

- The geopolitical importance of oil will vastly diminish. However, the speed and scale of the collapse in oil revenues may lead to the destabilization of oil-producing countries and regions with high dependence on oil “rents.” This may create a new category of geopolitical risks. The geopolitics of lithium and other key mineral inputs to A-EVs are entirely different from oil politics. There will be no “Saudi Arabia of lithium.” Lithium is a stock, while oil is a flow. Disruption in supply of the former does not impact service delivery. (See page 54 for further detail.)

Social

- TaaS will dramatically lower transportation costs; increase mobility and access to jobs, education and health care (especially for those restricted in today’s model, like the elderly and disabled); create trillions of dollars in consumer surplus; and contribute to cleaner, safer and more walkable communities.

- We foresee a merging of public and private transportation and a pathway to free transportation in the TaaS Pool model (a subset of TaaS that entails sharing a ride with other people who are not in the passenger’s family or social group — the equivalent of today’s Uber Pool or Lyft Line). Corporations might sponsor vehicles or offer free transport to market goods or services to commuters (i.e. Starbucks Coffee on wheels4).

- The role of public transportation authorities (PTA) will change dramatically from owning and managing transportation assets, to managing TaaS providers to ensure equitable, universal access to lowcost transportation. Many municipalities will see free TaaS as a means to improve citizens’ access to jobs, shopping, entertainment, education, health and other services within their communities.

About the RethinkX Project

www.rethinkx.com

RethinkX is an independent think tank that analyzes and forecasts the speed and scale of technology-driven disruption and its implications across society. We produce compelling, impartial data-driven analyses that identify pivotal choices to be made by investors, businesses, policymakers and civic leaders.

Tags: RethinkX, TaaS, The RethinkX Project, transportation

RSS Feed

RSS Feed