HOUSE TRANSPORTATION & INFRASTRUCTURE COMMITTEE

The Panel on Public-Private Partnerships held roundtables, hearings, and meetings to examine the current state

of public-private partnerships (P3s) across all modes of transportation, economic development, public buildings,

water and maritime infrastructure and equipment. The Panel found that P3 procurements have the potential

to deliver certain high-cost, technically complex projects more quickly or in a different manner than would

otherwise occur under traditional procurement and financing mechanisms. However, given the limited number

of high-cost, complex projects, P3 projects have the potential to address only a small portion of the Nation’s

infrastructure needs.

One consistent theme throughout the Panel’s work was that P3s are not a source of funding and should not

be thought of as the solution to overall infrastructure funding challenges. Adequate federal investment in

transportation and infrastructure is a necessary precondition to modernize our Nation’s highways, bridges, rail

and transit systems, airports, ports, waterways, and public buildings – regardless of whether individual projects

are carried out as P3s or not.

P3s are a financing and procurement tool, which in certain circumstances can accelerate the delivery of

high-cost, technically complex projects and leverage private sector resources and expertise while mitigating

construction and/or operations risk for the public sector.

However, regardless of the method of delivery or the source of financing, the cost of infrastructure projects are

borne by the public – there is no free lunch. The Panel learned that a clear and transparent understanding of the

relative costs and benefits of traditional and P3 project procurements to the public sector is a critical element to

ensuring accountability.

The Panel’s work analyzed whether, and under what circumstances, public sector investment can be targeted to

harness the efficiencies generated by the competitive market and commercial incentives of the private sector.

At the same time, the Panel recognized that P3 procurements require higher financing costs and significant additional legal and consultant costs to structure a successful P3 agreement. The Panel found that not all infrastructure projects are suited for a P3, and the cost and benefits of a P3 procurement approach must be carefully assessed.

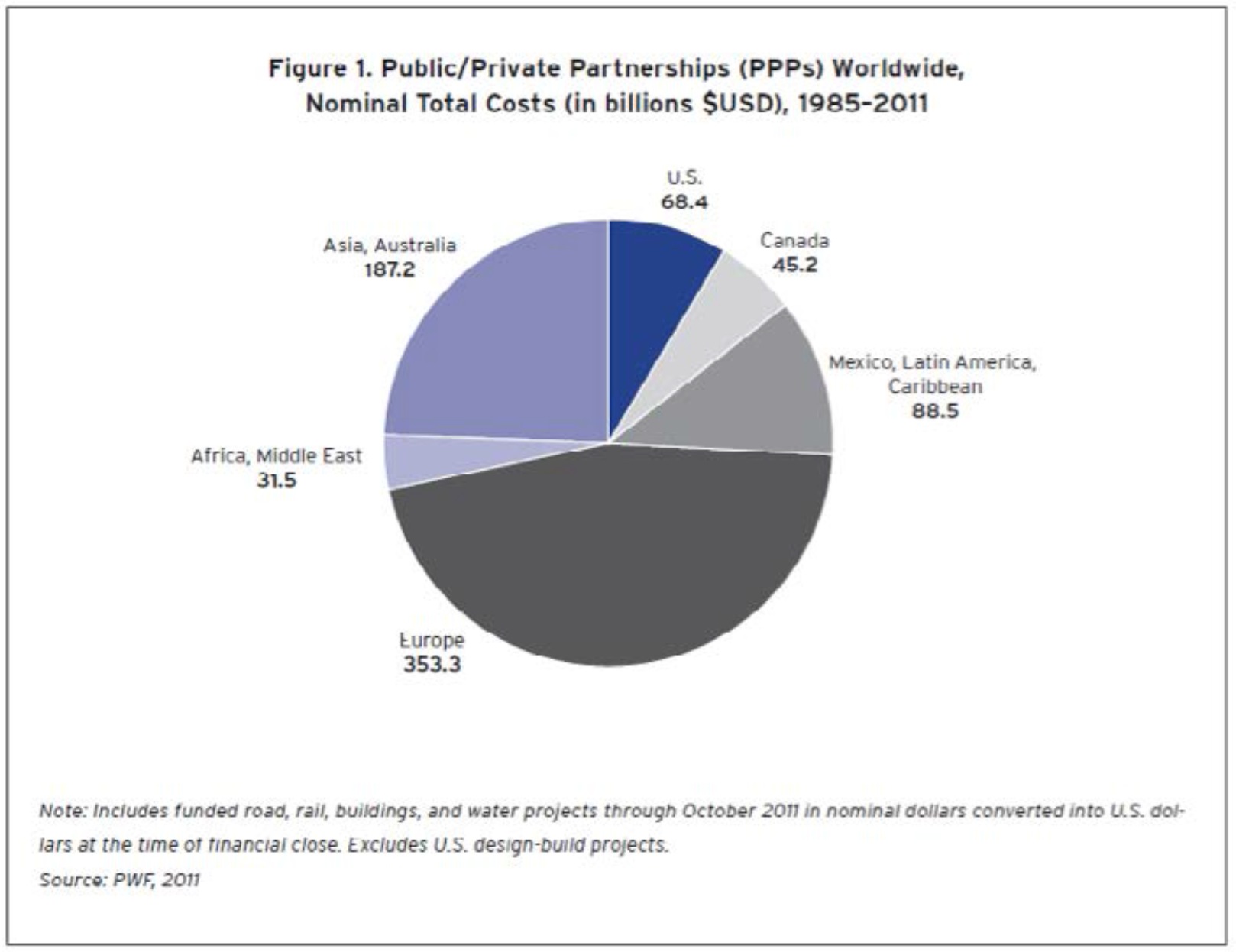

Around the world, P3s play a significant role in the development and delivery of transportation and infrastructure projects. Internationally, P3s have had a mixed record of success and failure. The Panel found that successful P3s have several common elements, including leveraging the strengths of the public and private sectors, appropriate risk transfer, transparent and flexible contracts, and alignment of policy goals.

Unlike most other countries, the United States possesses a robust municipal bond market of approximately $3.7 trillion, of which a significant portion is for infrastructure financing. The Panel found that this is one major reason why the U.S. P3 market has not grown as quickly as in other countries (which do not offer tax-exempt municipal bonds) and why the potential for P3s in the United States is limited.

Despite the robust U.S. municipal bond market, there remain billions of dollars in infrastructure needs in the United States that are in search of funding. The Panel’s work concluded that, in certain circumstances, a well-executed P3 can enhance the delivery and management of transportation and infrastructure projects beyond the capabilities of government agencies or the private sector acting independently. The Panel’s work highlighted that the participation of the private sector in financing a project can bring discipline and efficiency to project delivery, which is too often lacking in the traditional public procurement process. Innovative solutions to complex infrastructure challenges, as well as injecting greater discipline and accountability into project delivery and performance, should be the standard for all infrastructure projects, regardless of how they are procured.

In certain circumstances, P3 projects can bring innovative solutions to infrastructure challenges as the private sector can bring a broad array of interested and invested parties to the project, often with substantial experience in the particular type of project being procured. In a P3 project, the oversight of investors and bondholders provides additional rigor and financial incentive to deliver a project on-time and on-budget. Furthermore, this focus on efficiency can also generate innovation. In many long-term concession agreements, the private partner is responsible for operations and maintenance of the asset. As a result, during design and construction of the project, the private partner will consider life-cycle costs to meet these long-term goals. The Panel found that traditional project delivery processes (i.e., design-bid-build methods) are not appropriately incentivized to focus on the long-term sustainability of the asset, and Congress should address this issue.

The Panel found that P3 agreements often involve significant federal assistance through credit and tax programs, such as the Transportation Infrastructure Finance and Innovation Act (TIFIA) program and Private Activity Bonds (PABs). The Panel found that TIFIA and PABs are often critical elements of P3 project financing. The important role that TIFIA and other federal credit programs play in lowering the cost of capital for infrastructure projects makes these projects more feasible for private sector investment.

Finally, the Panel found that state and locally elected officials are reluctant to raise infrastructure fees, such as highway tolls or water rates, which can lead to a lack of necessary funding for long-term capital infrastructure improvements. A well-structured P3 agreement may address this issue. However, such agreements, which often last 30 years or more, also circumscribe the ability of legislators to manage public assets in the future. It is critically important that P3 agreements protect the public interest because they often affect both current and future generations.

As a result of these findings, the Panel recommends a series of actions to balance the needs of public and private sectors when considering, developing, and implementing P3s to finance important infrastructure projects across the United States.

Download full version (PDF): Public Private Partnerships

About the House Transportation & Infrastructure Committee

transportation.house.gov

The Transportation and Infrastructure Committee has jurisdiction over all modes of transportation: aviation, maritime and waterborne transportation, highways, bridges, mass transit, and railroads. The Committee also has jurisdiction over other aspects of our national infrastructure, such as clean water and waste water management, the transport of resources by pipeline, flood damage reduction, the management of federally owned real estate and public buildings, the development of economically depressed rural and urban areas, disaster preparedness and response, and hazardous materials transportation.

Tags: Congress, House Transportation and Infrastructure Committee, P3, Public-Private Partnerships, T&I

RSS Feed

RSS Feed