UNITED STATES DEPARTMENT OF ENERGY (US DOE)

On April 14, 2017, Energy Secretary Rick Perry issued a memorandum requesting a study to examine electricity markets and reliability. With this document, Department of Energy (DOE) staff are delivering a study that seeks not only to evaluate the present status of the electricity system, but more importantly to exercise foresight to help ensure a system that is reliable, resilient, and affordable long into the future. Therefore, while carefully acknowledging history, this study focuses on the present trajectory of trends that are of particular concern in meeting those long-term goals.

On April 14, 2017, Energy Secretary Rick Perry issued a memorandum requesting a study to examine electricity markets and reliability. With this document, Department of Energy (DOE) staff are delivering a study that seeks not only to evaluate the present status of the electricity system, but more importantly to exercise foresight to help ensure a system that is reliable, resilient, and affordable long into the future. Therefore, while carefully acknowledging history, this study focuses on the present trajectory of trends that are of particular concern in meeting those long-term goals.

Specifically, the April 14 memo directed a study that explores the following three issues:

- The evolution of wholesale electricity markets, including the extent to which Federal policy interventions and the changing nature of the electricity fuel mix are challenging the original policy assumptions that shaped the creation of those markets;

- Whether wholesale energy and capacity markets are adequately compensating attributes such as on-site fuel supply and other factors that strengthen grid resilience and, if not, the extent to which this could affect grid reliability and resilience in the future; and

- The extent to which continued regulatory burdens, as well as mandates and tax and subsidy policies, are responsible for forcing the premature retirement of baseload power plants.

The U.S. electricity industry is facing unprecedented changes. Last year, for the first time in history, natural gas replaced coal as the leading source of electricity generation. In 2015, a record-high amount of generating capacity retired. Over the course of the last decade, overall growth in electricity consumption at the national level has stalled, while many generation sources—particularly natural gas, wind, and solar—frequently hit new record levels of penetration.

The stakes are high around these issues because electricity is crucial to modern society and economic activity, and because of the physical and financial magnitude of the industry. As noted in the report, Transforming the Nation’s Electricity System: The Second Installment of The Quadrennial Energy Review (QER 1.2):

The United States has around 7,700 operating power plants that generate electricity from a variety of primary energy sources; 707,000 miles of high-voltage transmission lines; more than 1 million rooftop solar installations;3 55,800 substations; 6.5 million miles of local distribution lines; and 3,354 distribution utilities delivering electricity to 148.6 million customers. The total amount of money paid by end users end for electricity in 2015 was about $400 billion. This drives an $18.6 trillion U.S. gross domestic product and significantly influences global economic activity totaling roughly $80 trillion.

Recognizing how vital electricity is to our society and the health of the U.S. economy, the April 14 memo asked staff to “provide concrete policy recommendations and solutions.” It also offered principles for policy formulation: “the Trump Administration will be guided by the principles of reliability, resilience, affordability, and fuel diversity—principles that underpin a thriving economy.” To that end, this report concludes by outlining policy recommendations to advance those principles.

Section 2 of this study offers a summary of findings. Sections 3 through 6 provide the analytical framework, relevant data, and research. In addition, each of these sections concludes with a “looking forward” note, as many of the issues raised in the April 14 memo are of growing importance. Section 1 presents policy recommendations available—to DOE and others—to address the issues identified in this study. Section 8 outlines potential areas for further research.

Data Used in This Study

This study uses data collected by the Energy Information Administration (EIA) for the years 2002 through 2017, looking back before 2002 on a few specific issues. The 2002–2017 time range captures several important developments:

- Centrally-organized wholesale electricity markets (Regional Transmission Operators [RTOs] and Independent System Operators [ISOs]) were in the early stages of implementation in 2002. Competition within centrally-organized markets among a large segment of merchant generation did not take effect until the mid-2000s. Three RTO/ISOs initiated mandatory capacity markets in 2006–2007: New York ISO (NYISO), PJM Interconnection (PJM), and ISO-New England (ISO-NE).

- The emergence of a large amount of unconventional natural gas production—the shale revolution—started in 2006–2007. The consequent drop in natural gas prices began in 2009 under the combined impacts of low demand during the economic recession and a significant increase in supply.

- The recession contributed to a significant drop in electricity demand in 2008, and it took several years for demand to return to 2008 levels. Although economic activity has picked up in recent years, electricity consumption and gross domestic product (GDP)—which grew together for decades—now appear less correlated as industries have become less energy-intensive and energy efficiency measures have taken full effect.

- Several environmental regulations implemented under statutes enacted in the 1970s and 1990s, which raise capital and operating costs for affected power plants, had compliance deadlines in the period 2010–2017.

- Driven in part by Federal and state policies, tax incentives, and mandates, significant quantities of variable renewable energy (VRE) resources—specifically wind and solar, and at levels high enough to alter traditional patterns of grid operation—began to impact certain areas around 2010.

- Also around 2010, demand response emerged as a way for customers to compete in most centrally-organized wholesale markets.

Because all of the above factors have emerged over the past 15 years—each affecting power supply and demand in different ways—looking at data since 2002 helps to reveal the impact and interactions of these changes. Additionally, EIA believes that the highly detailed EIA data used in this study (down to the level of individual generators) is most reliable for 2002 forward.

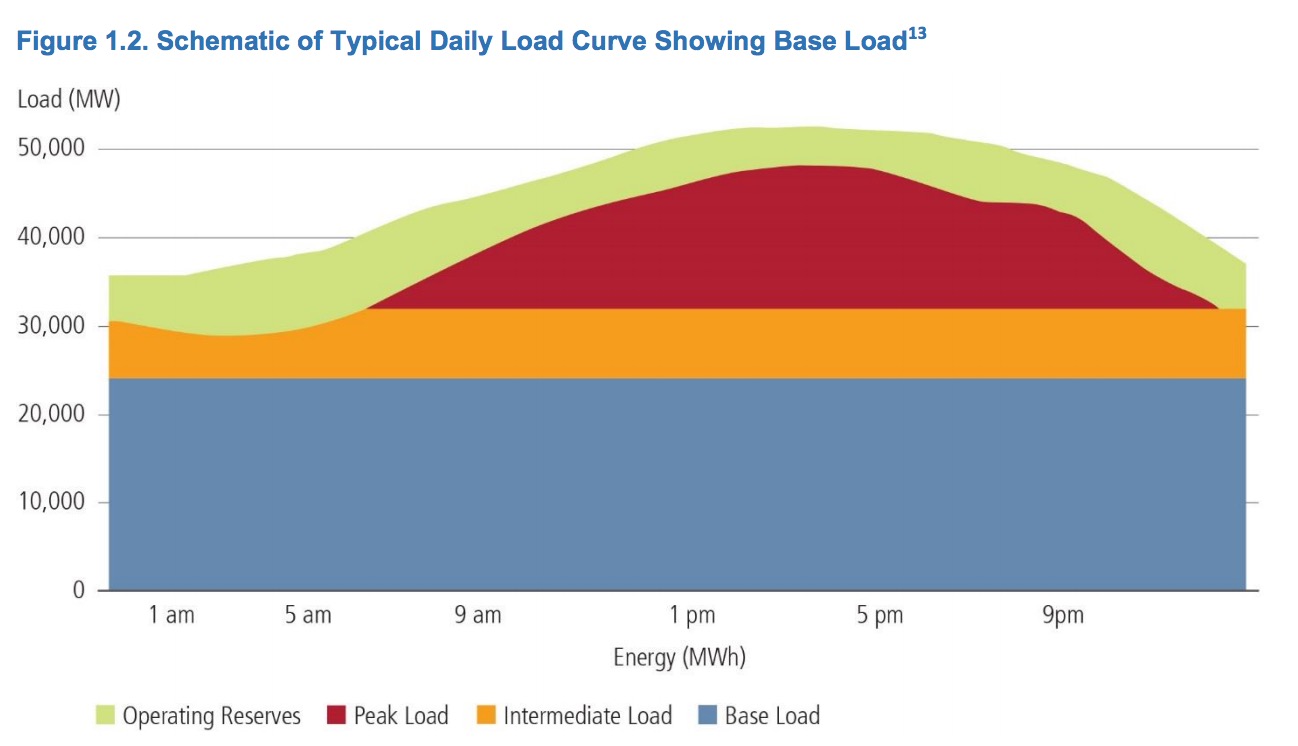

Further, the data used for this study include power plant fuel conversions as retirements for the original fuel source. This study reports power (e.g. generation capacity) and energy (e.g. production or consumption over time) in megawatts (MW) and megawatt-hours (MWh), respectively (unless otherwise noted). Finally, all generation capacity figures reported in this study are net summer capacity as opposed to nameplate (unless otherwise noted).

Defining Regions

The U.S. bulk power system (BPS) is a patchwork of different markets for electricity, shaped over time by technological changes, as well as state, regional, and Federal policies. This patchwork presents organizational and operational challenges, but its diversity also contributes to the system’s robustness.

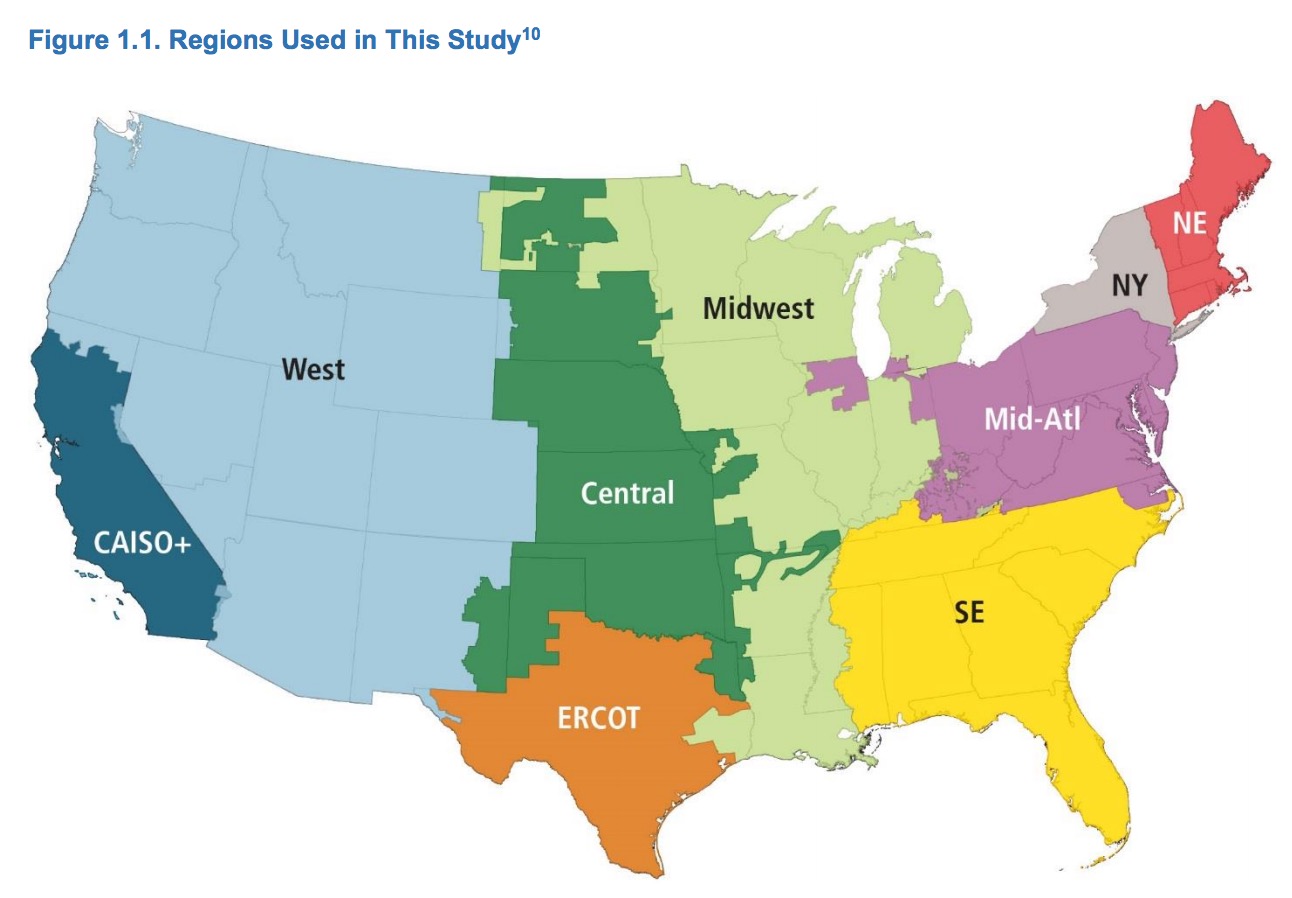

The U.S. power system in the lower 48 states is divided into three synchronized grids: the Eastern Interconnection, the Western Interconnection, and the Electric Reliability Council of Texas (ERCOT).b, 9 There are limited connections between the Eastern and Western Interconnections, and even fewer connections from ERCOT to the other grids.

Issues confronting the BPS vary widely across regions. This study divides the lower 48 states into nine regions that represent either individual or groups of electric systems, known as balancing authority areas (see Figure 1.1). Within these regions, there are 66 balancing authorities (which can be as small as individual utilities or as large as a multi-state region). Using nine balancing authority-based regions for this analysis is a useful way of aggregating electricity data and revealing regional trends.

Download full version (PDF): US DOE: Staff Report on Electricity Markets and Reliability

About the United States Department of Energy (US DOE)

energy.gov

The mission of the Energy Department is to ensure America’s security and prosperity by addressing its energy, environmental and nuclear challenges through transformative science and technology solutions.

Tags: ERCOT, Grid, Natural Gas, United States Department of Energy, US DOT

RSS Feed

RSS Feed