KACHAN & CO

Executive summary

The global economy is undergoing a fundamental change. Companies are under increasing pressure to produce and consume more efficiently. This pressure is creating innovation and, above all, opportunity in cleantech.

In recent years, the cutting edge of cleantech has received outsized investment and headlines and weathered the challenges of outsized expectations. It will continue to provide solid returns in the medium and long-term. The more important story is that of the steady, iterative advancement of products and services that improve the efficiency, waste profile and manufacturing cost of existing analogs, but are not market disruptors. This type of cleantech is becoming ubiquitous—from cheaper, more efficient lighting to advanced heating software. Cleantech in all of its forms is poised for even more rapid expansion, especially now that the largest companies in the world have discovered the opportunity and imperative of cost savings.

Reflecting these trends, capital is being invested in cleantech products and services by a variety of sources, from venture capital to cities, businesses, states, universities and individuals, among others. In 2012, cleantech attracted nearly a quarter of the venture capital (VC) available, capturing $6.4 billion, of nearly $26 billion in VC investment across all sectors. Adding to this, the world’s largest companies are now buying their way into cleantech. Large cap firms are acquiring cleantech companies in an effort to build the portfolios of clean products and services required to remain competitive and modernize their current offerings. These are impressive achievements for an 11 year old category. What will the next decade hold for cleantech as companies rush to take advantage of new efficiencies and opportunities for bottom line improvement?

The good news is that investors haven’t missed a bull run. Cleantech will continue to happen in big ways. Disruptive technologies will continue making old sectors obsolete, while well-known brands, products and companies will adopt clean technologies and products to improve their balance sheets and investors’ bottom lines. The pragmatic, undeniable opportunity for savings and efficiencies that are driving cleantech’s adoption today will continue to propel mass market acceptance and mainstream adoption. Fundamental drivers of change—from growing resource constraints to consumer

demand—will also continue to move the market in this direction. Finally, cleantech is starting to add value at the macroeconomic level and is becoming a significant source of jobs and tax revenue for regional economies.

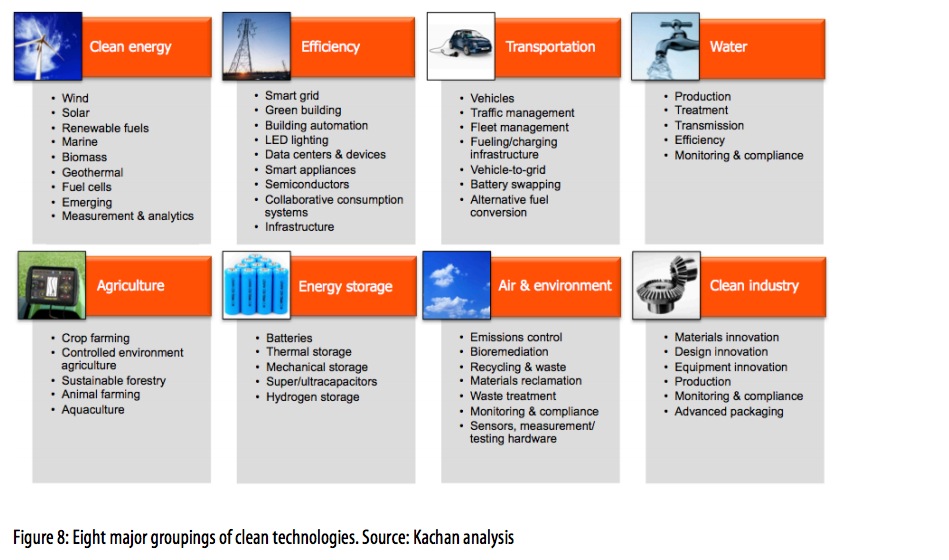

This paper presents the recent investment research currently available on clean infrastructure and technology investment. We have synthesized research across a number of industries and major impact areas, identifying key value drivers and market size projections for these industries. We have also included examples of products and technologies currently on the market. Finally, we highlight various large, mid and small cap firms and funds as possible points of entry for institutional and individual investors within each industry. It’s an exciting time to be investing in cleantech. The opportunities are lucrative and vast, and the potential for growth is extremely promising.

Read full report (PDF) here: Cleantech Redefined

About Kachan & Co

www.kachan.com

“Our cleantech research helps market watchers track and understand cleantech innovation. Our cleantech advisory services help organizations raise their profiles, solve problems or identify opportunities in cleantech. We also help companies connect with cleantech capital, corporate customers and partners. From offices in San Francisco, Vancouver and Toronto, we’ve done business in Beijing, Brussels, the Middle East and elsewhere, and leverage global best practices and contacts in every engagement.”

Tags: Clean Technology, Cleantech, Kachan & Co

RSS Feed

RSS Feed