INSTITUTE ON TAXATION AND ECONOMIC POLICY

Executive Summary

• State gasoline and diesel taxes (often just called “gas taxes”) are the most important source of transportation funding under the control of state lawmakers. Every state levies both of these taxes.

• Unfortunately, most state gas taxes are built to fail. Thirty six states levy only a fixed-rate tax that collects the same number of cents in tax, year aft er year, on every gallon of fuel purchased. But as this report shows, inflation has been eating away at these fixed rate taxes as the price of asphalt, concrete, and other transportation construction inputs continues to grow almost every year.

• After adjusting to account for growth in construction costs, the average state’s gas tax rate has effectively fallen by 20 percent, or 6.8 cents per gallon, since the last time it was increased. Among the 36 states levying only a fixed-rate tax, effective gas tax rates have plummeted by 29 percent, or 9.5 cents per gallon since they were last increased. New Mexico (20.1 cents), Montana (18.5 cents), and Maryland (15.8 cents) have seen larger absolute declines in their gas taxes than any state other than Alaska. A 50-state analysis of these trends is available in Appendix A.

• This decline is part of an even longer-term trend. ITEP’s analysis of data from the U.S. Census Bureau shows that state gas taxes are a less significant part of families’ household budgets than they have been in eighty years.

• If every state updated its gas tax rate to match the level of purchasing power it had the last time it was raised, state gas tax revenues would be roughly $10 billion higher per year. Put another way, states have seen their gas taxes plummet by a combined $10 billion due to their failure to plan for inevitable increases in the cost of transportation construction. A number of states where transportation funding has been a hot-butt on issue in recent years are among those experiencing the largest losses. Iowa and Oklahoma are each losing over $300 million per year, for example, while annual losses in Maryland and New Jersey are over $500 million per state.

• State gas tax erosion has had disastrous effects on the nation’s transportation infrastructure. The $10 billion annual gas tax revenue loss described above has played a big role in what the American on the economy in the form of higher vehicle repair costs and travel time delays. These costs could be greatly reduced if lawmakers had the foresight and courage to raise sufficient revenues for state roadways and transit systems. As things currently stand, however, these costs are actually expected to increase dramatically in the years ahead.

• Lawmakers’ shortsightedness when it comes to the gas tax has also resulted in an increasing amount of pressure on other areas of state budgets. In 2011 alone, Nebraska, Utah, and Wisconsin all passed new legislation authorizing long-term raids on their general funds in order to finance transportation. Oklahoma and Virginia’s governors are pushing for lawmakers to enact similar legislation in 2012.

• The chronic under-funding of state transportation networks should be addressed in the short-term with gas tax increases, and in the longer-term by reforming state gas taxes so their revenues can keep pace with the rising cost of building and maintaining a transportation network. Fourteen states, including those with such varied geographies and politics as Georgia, Nebraska, and New York, already levy taxes that tend to grow over time. The best structural reform possible is to link, or “index,” the gas tax rate to some official measure of transportation construction cost growth. (See Recommendations #1 and #2, pages 7 and 8).

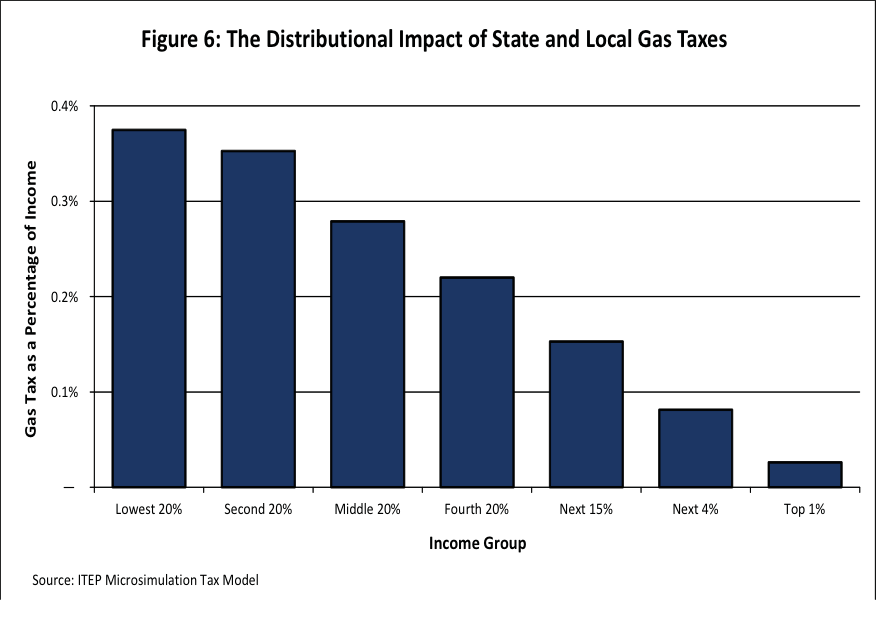

• While gas taxes are important revenue sources, they’re also regressive — meaning that they require low-income families to pay more of their income in tax than wealthy drivers. But state gas tax reform does not have to negatively impact low-income families. New or expanded low-income tax credits can shield these vulnerable families from much of the disproportionate impact of the gas tax, thereby allowing states to improve their transportation networks without paying for those improvements on the backs of those who can least aff ord it. (See Recommendation #3, page 9).

About the Institute on Taxation and Economic Policy

http://www.itepnet.org

“The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan research organization that works on federal, state, and local tax policy issues. ITEP’s mission is to ensure that elected officials, the media, and the general public have access to accurate, timely, and straightforward information that allows them to understand the effects of current and proposed tax policies. ITEP’s work focuses particularly on issues of tax fairness and sustainability. ITEP works directly with lawmakers, non-governmental organizations, the public, and the media to achieve these goals.”

Tags: Carbon Tax, Gas tax, Sustainbility

RSS Feed

RSS Feed