AIRPORTS COUNCIL INTERNATIONAL – NORTH AMERICA

Airport Infrastructure Needs Overview

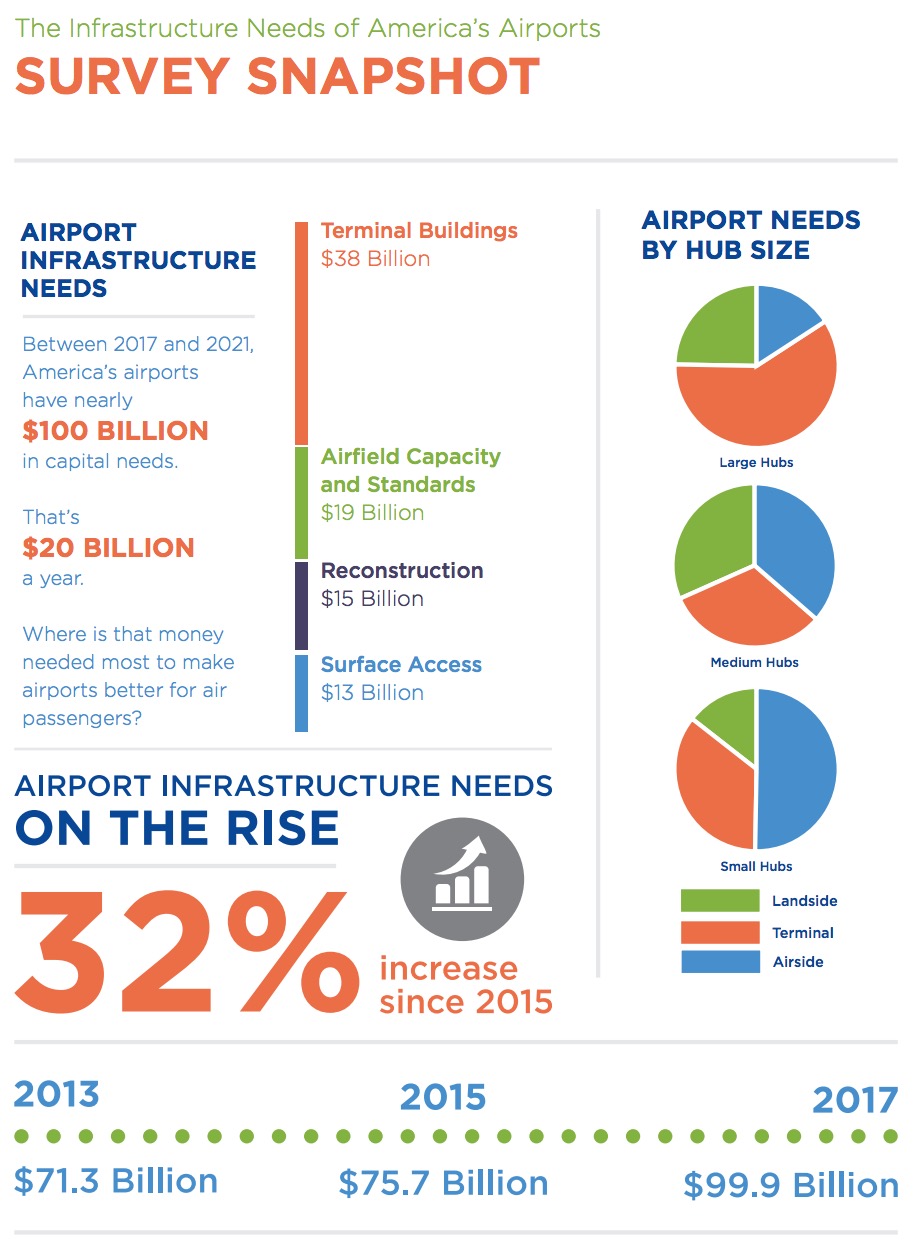

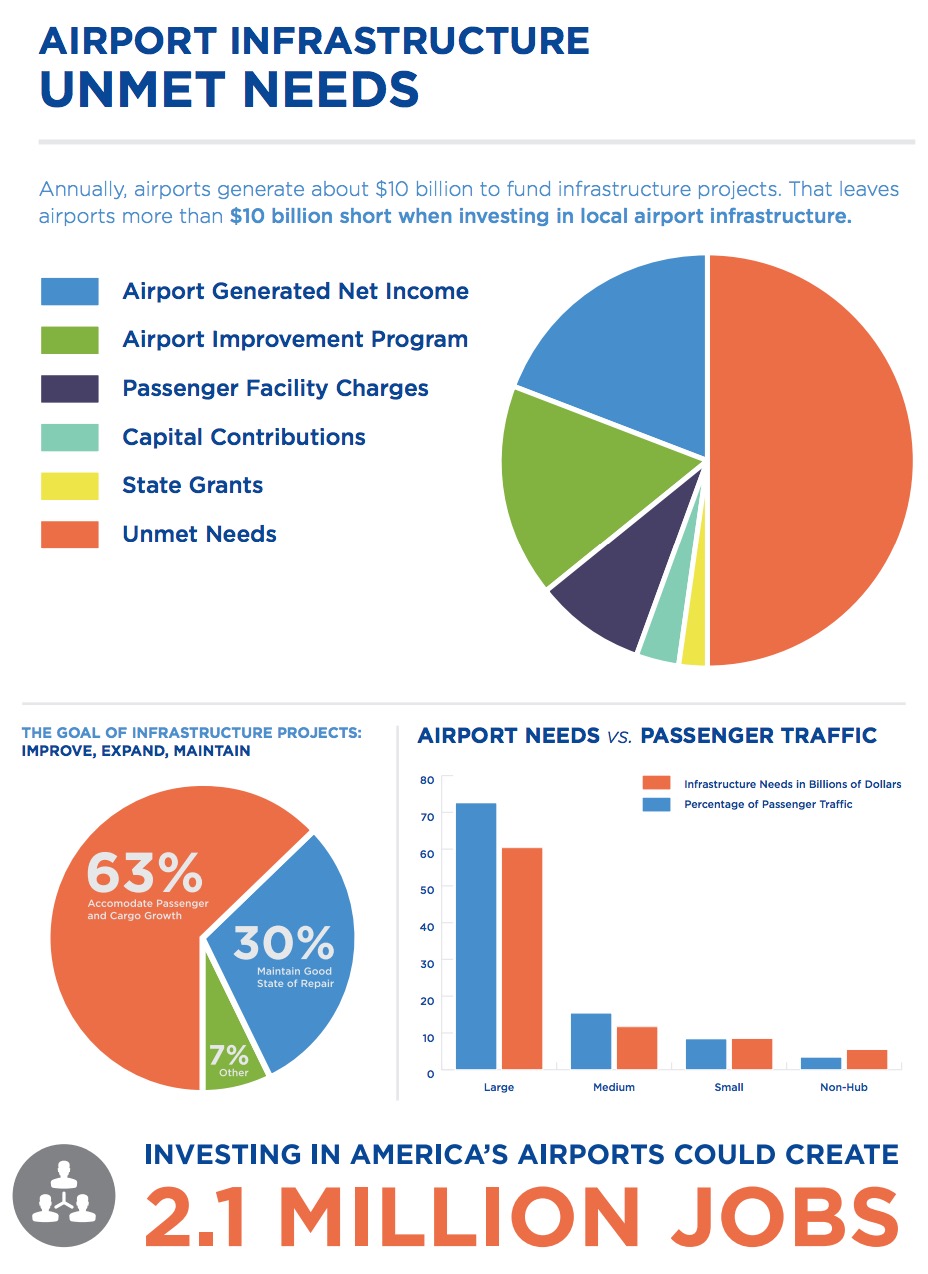

The ACI-NA total estimate of U.S. airports’ infrastructure needs for 2017 through 2021, adjusted for inflation, is nearly $100 billion ($99.9 billion) or almost $20 billion annualized.2 Sixty-three percent of the development is intended to accommodate growth in passenger and cargo activity, and thirty percent is intended to rehabilitate existing infrastructure, maintain a state of good repair, and keep airports up to standards for the aircraft that use them.

This estimate is a 31.9 percent increase over the 20153 estimate of $75.5 billion or $15.1 billion annualized for 2015 through 2019. The estimate for large, medium and small hubs only4 is a 41.8 percent increase over the last estimate. For non-hub, non-primary commercial service, reliever and general aviation airports, ACI-NA relied on the FAA National Plan of Integrated Airport System (NPIAS) 2016 estimate for development costs, which are expected to increase by 2.1 percent from the last report completed in 2014.

The $20 billion in average annual funding needs for U.S. airports is significantly higher than the funding available through annual AIP grants, PFC revenue, and airport generated net income. It is clear that the existing federally mandated funding system cannot meet U.S. airport infrastructure needs for modernizing and expanding airport capacity which is critical for a safe, efficient and globally competitive aviation system.

ACI-NA attributes the increase in airport infrastructure needs to several factors, including the need to upgrade aging infrastructure, the recovering U.S. economy and increasing traffic demand, and airline consolidation and concentration on hub operations.

The ACI-NA total estimate includes all airport improvements that are planned within the next five years including those not eligible for AIP grants. Commercial service airports5 , which accounted for 99.8 percent of passenger enplanements in 2015, account for $86.1 billion (86.2 percent) of the total $99.9 billion for planned investments, while non-commercial-service airports with 0.2 percent of the 2015 enplanements account for $13.8 billion (13.8 percent) of the total $99.9 billion. Within the commercial service airports:

- large hub airports, with 72.6 percent of all enplanements, account for $60.4 billion (60.5 percent);

- medium hub airports, with 15.4 percent of all enplanements, account for $11.7 billion (11.7 percent);

- small hub airports, with 8.4 percent of all enplanements, account for $8.5 billion (8.5 percent), and;

- non-hub airports, with 3.4 percent of all enplanements, account for $5.5 billion (5.5 percent).

Commercial service airports reported a significant increase in infrastructure needs, with an overall increase of 38.4 percent while non-commercial service airports had a 1.7 percent increase. All airport categories showed growth from the previous estimate. Large hubs reported the most significant increase at 50.6 percent followed by medium hubs with a 28.8 percent increase.

Large hubs reported an increase of 50.6 percent, from $40.1 billion to $60.4 billion, and increased their share of total development by 7.5 percent from the 2014 – 2015 survey. Significant development was identified at Detroit, San Diego, Portland, Los Angeles, Atlanta, Chicago O’Hare, Chicago Midway, San Francisco, Orlando, Houston InterContinental, Minneapolis, Salt Lake City, and Phoenix, with more than a 50 percent increase as these airports undertake major infrastructure improvement programs. In particular, Los Angeles International Airport alone reported $10 billion in infrastructure needs between 2017 and 2021, primarily for terminal redevelopment, landside access modernization, and runway safety area rehabilitation and reconstruction.

Medium hubs reported an increase of 28.8 percent, from $9.1 billion to $11.7 billion, and maintained their share of total development needs at around 12 percent. Significant development was identified at Raleigh Durham, Ontario, Nashville, Jacksonville, Omaha, Cincinnati/Northern Kentucky, San Jose, Sacramento, Houston Hobby, Dallas Love Field, Kansas City, Austin, St. Louis, and John Wayne, with more than a 50 percent increase as these airports undertake major infrastructure improvement programs.

Most small hubs reported single-digit increases in infrastructure needs. Major development at Des Moines, Yellowstone, Hawaii Lihue, Manchester-Boston, Burbank, Savannah, and Burlington airports resulted in an increase of over 50.0 percent in their infrastructure improvement programs.

The overall increase shows that, as a result of the recovering economy and increasing traffic demand, coupled with airline consolidation and their strategic shift to focus on hub operations, large and medium hub airports have a particular need to invest in major infrastructure improvement projects. Despite a decrease in flights at many small airports, additional funding is still needed at these airports for upgrading aging infrastructure, meeting federal mandates, and improving the passenger experience.

Download full version (PDF): Airport Infrastructure Needs

About Airports Council International – North America

www.aci-na.org

ACI-NA represents local, regional and state governing bodies that own and operate commercial airports in the U.S. and Canada. ACI-NA’s members enplane more than 95% of the domestic and virtually all the international airline passenger and cargo traffic in North America. ACI-NA’s membership consists of 174 airport operators with 366 airports in the U.S. and 49 airport operators with 180 airports in Canada. Nearly 400 aviation-related businesses are also members of the association. ACI-NA is the largest of the five worldwide regions of Airports Council International (ACI).

About Airports Council International

www.aci.aero

ACI is the only global trade representative of the world’s airports, serving 592 members operating 1,853 airports in 173 countries. ACI is a non-profit organization whose prime purpose is to advance the interests of airports and to promote professional excellence in airport management and operations.

Tags: ACI, ACI-NA, airports, Airports Council International, FAA

RSS Feed

RSS Feed