ENO CENTER FOR TRANSPORTATION

Executive Summary

The current federal program for funding surface transportation infrastructure in the United States is broken. Since 2008, the U.S. Highway Trust Fund (HTF) has repeatedly been on the brink of insolvency, necessitating five infusions from the U.S. Treasury’s General Fund. Many solutions have been proposed to stabilize funding for the federal surface transportation program, but each has confronted substantial political barriers. This study details the circumstances that have led the U.S. transportation program to its current funding situation and explores how other nations have created sustainable mechanisms for ensuring adequate national level investment in surface transportation systems. The findings indicate that while there are reasons the HTF structure in the United States has persisted, other nations have successfully developed durable programs financed through general funds. This research also suggests that embracing a funding model similar to that of other countries could help restore funding consistency to the U.S. program.

The current federal program for funding surface transportation infrastructure in the United States is broken. Since 2008, the U.S. Highway Trust Fund (HTF) has repeatedly been on the brink of insolvency, necessitating five infusions from the U.S. Treasury’s General Fund. Many solutions have been proposed to stabilize funding for the federal surface transportation program, but each has confronted substantial political barriers. This study details the circumstances that have led the U.S. transportation program to its current funding situation and explores how other nations have created sustainable mechanisms for ensuring adequate national level investment in surface transportation systems. The findings indicate that while there are reasons the HTF structure in the United States has persisted, other nations have successfully developed durable programs financed through general funds. This research also suggests that embracing a funding model similar to that of other countries could help restore funding consistency to the U.S. program.

Currently, excise taxes on gasoline and diesel fuel are deposited into the HTF; grants from the HTF are then distributed to state and local transportation authorities through the federal surface transportation program. Historically, fuel taxes were occasionally increased by Congress, and these increases, combined with steady growth in vehicle miles traveled (VMT), helped to ensure funding growth. Since 1993, however, the federal gas tax has remained unchanged at 18.4 cents per gallon. And while many transportation stakeholder groups have been vocal in their support for an increase in the gas tax, Congress and two presidential administrations have demonstrated an unwillingness to raise the tax.

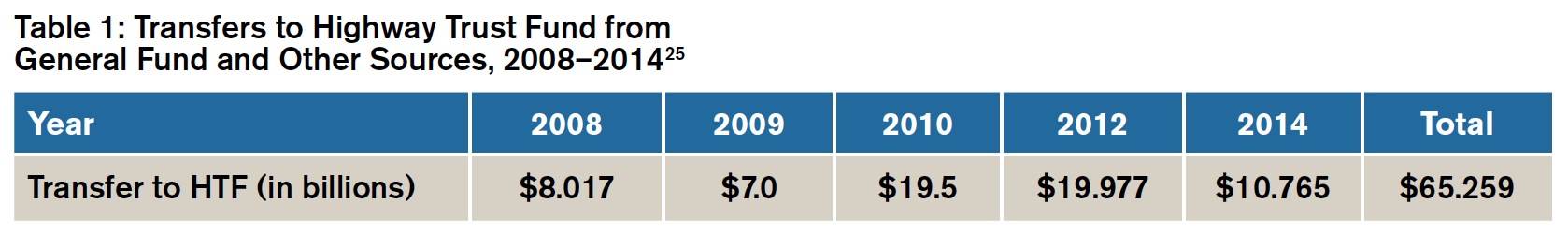

In 2008, the HTF was on the brink of insolvency for the first time in its history. This situation was in part caused by an explicit policy decision to spend down the remaining HTF balance to support a robust spending level in the surface transportation reauthorization bill passed in 2005. In addition, in part due to the recession and rising gasoline prices, Americans were driving less. With these changes, Congress was in a position where they would have to reduce transportation spending, increase gas tax revenues, or identify an alternative solution and doing so in more fuel-efficient vehicles. Congress responded with a stopgap measure, infusing $8 billion from the General Fund into the HTF. Similar infusions were made in 2009, 2010, 2012, and now 2014.

Beyond these funding challenges, fundamental problems also remain in the way the U.S. government makes transportation investment decisions. Many of these well-documented problems are rooted in the relationship between the way funds are raised and the way they are spent. A tendency to approach transportation planning and investment in terms of modal divisions (e.g., public transit vs. highways) and tensions over how much federal funding is returned to states relative to how much they pay into the HTF in gas tax revenues (also known as the donor–donee issue) are two examples of systemic problems with the existing surface transportation program that are directly related to the way the program is funded. Instead of allocating funds to states or programs that target a particular federal interest or goal, federal funds are distributed to states and transit authorities by formula and are designated for use on specific modes. At the same time, the donor–donee issue leads to persistent battles among members of Congress over whether their states are receiving a “fair” share of HTF funding relative to their gas tax contributions. These challenges have historically overshadowed substantive arguments over policy and hindered the tying of federal funds to national goals or performance measures.

Even though the current structure is not working, Congress and stakeholders have little incentive to change it. In fact, many groups have worked tirelessly to maintain the status quo. Within Congress there are eight committees between the House of Representatives and the Senate that influence how transportation money is spent. And while a moratorium on earmarks has diminished individual members’ ability to send money home to their districts, those who currently hold the power of the purse are unlikely to support reforms that would diminish their control over federal transportation funds. The stakeholder community, which includes state departments of transportation, transit agencies, construction and engineering firms, and trade associations, among others, has a strong interest in ensuring a steady flow of federal funding to state projects. A departure from the current funding structure poses a disruptive threat to a system that has delivered billions of dollars since 1956.

Supporters of the current trust fund structure can also point to economic theory, which has long endorsed the core principle of user pay. User pay is the idea that equity and efficiency objectives are best served if the users of a system—who are presumably the primary beneficiaries of the system (in this case, transportation infrastructure)— pay as directly as possible for the construction, operation, and upkeep of the system. Theoretically, the fee sends a price signal to users that discourages overconsumption and helps minimize externalities, such as congestion and emissions. From a policy perspective, users’ willingness to pay the fee also sends a useful signal about how they value the system. Thus, the total amount of funding collected through the fee defines the appropriate amount to spend on the system. Finally, user fees can be seen as a more equitable means of funding transportation compared to other revenue mechanisms.

…

Given the current situation in the United States, it is clear that maintaining the status quo will lead to continued uncertainty about future transportation funding and will do nothing to address the structural challenges inherent in the existing federal program. Accordingly, the findings of this study highlights three potential solutions:

1. Adjust spending to match revenues;

2. Adopt a hybrid funding approach that relies on both general funds and gas tax revenues, or;

3. Eliminate the HTF and pay for surface transportation exclusively through the General Fund.

Solution 1: Adjust spending to reflect revenues

To align transportation spending with gas tax revenues, Congress has two choices: either 1) reduce spending to no more than current HTF receipts or 2) increase user fee revenues by as much as necessary to cover the desired level of spending. There is little indication that the current Congress or President (or for that matter any future Congress or President) has the appetite for either approach, with both parties vocally opposing an increase in the fuel tax. Adjusting spending to meet revenues, thus creating a smaller, more focused federal role in surface transportation, would shift a much larger share of financial responsibility onto the states and metropolitan areas. Previous research has demonstrated that reducing the federal role in transportation funding would likely diminish overall transportation investment (since it is unlikely that states would be able to replace all lost federal revenue) at a time when there is broad agreement that the United States should be investing more in transportation infrastructure, not less.

Solution 2: Adopt a hybrid funding approach that relies on both general funds and gas tax revenues

A second solution would be to codify the hybrid system that Congress has unintentionally created, but in a way that provides for predictable, long-term General Fund commitments. Politically, this approach would probably be the easiest lift. It represents the smallest change to the existing system but provides some potentially substantial benefits, including a sustainable funding stream and the opportunity to better target funding for transportation investments toward national goals.

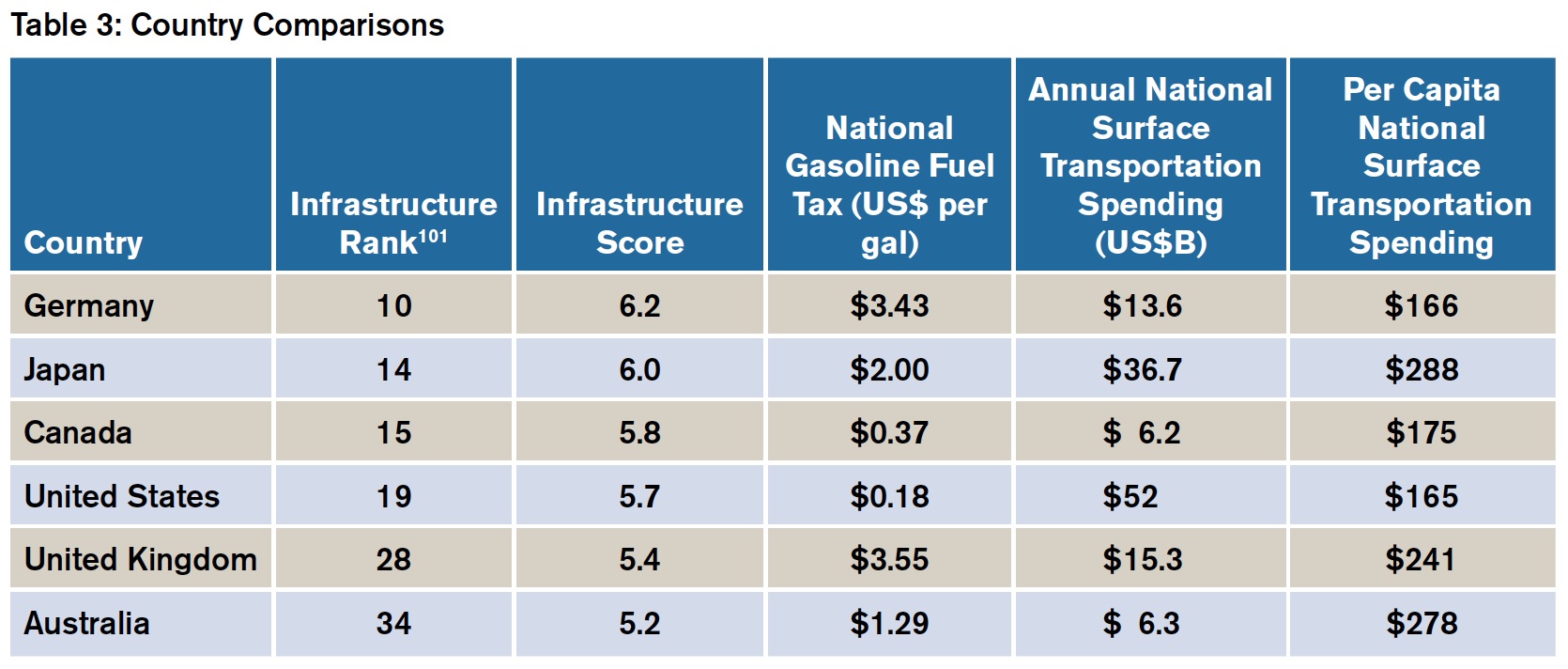

Solution 3: Eliminate the Highway Trust Fund A more permanent solution could be to move toward a system that is more in line with the approach taken by other developed countries that do not rely on gas taxes to fund transportation.

Under this solution, the HTF would be dissolved and the entire surface transportation bill could be funded through the appropriations process. This scenario does not preclude the use of dedicated revenues—income or sales taxes for example—but those revenues would cease to be user fees and would no longer be deposited into a trust fund.

Any of the options above could represent a dramatic improvement over the existing system. However, based on our analysis Solution 3 deserves fair consideration as an effective long-term solution to our national transportation funding problem.

The patchwork of “fixes” that Congress has made to the HTF five times in the last six years should be taken as a clear sign that the United States needs a more sustainable method for funding its national transportation needs. By offering a comprehensive analysis of the current program’s challenges and by reviewing the experience of peer countries, this paper offers a starting point for the substantive policy debate that will be needed to find a practical, politically pragmatic, and ultimately successful solution.

Download full version (PDF): The Life and Death of the Highway Trust Fund

About the Eno Center for Transportation

www.enotrans.org

The Eno Center for Transportation (Eno) is a neutral, non-partisan think tank that promotes policy innovation and leads professional development in the transportation industry. As part of its mission, Eno seeks continuous improvement in transportation and its public and private leadership in order to improve the system’s mobility, safety, and sustainability.

RSS Feed

RSS Feed