AIRPORTS COUNCIL INTERNATIONAL-NORTH AMERICA (ACI-NA)

Executive Summary

Airports are Terminally Challenged

America’s airports are a fundamental component of our nation’s transportation infrastructure. In 2017, 1.7 billion passengers and 31.7 million metric tons of cargo traveled through U.S. airports. With a national economic impact of $1.4 trillion, airports contribute more than seven percent to the U.S. gross domestic product and support over 11.5 million jobs around the country. To meet the capacity demands of the future with safe, efficient, and modern facilities that passengers and cargo shippers expect, airports need to make new investments to maintain and modernize our nation’s airport infrastructure.

While passenger and cargo traffic through airport facilities continues to grow at a record pace, our outdated aviation infrastructure is not keeping up with demand. As a result, far too many airports around the country are overcrowded and cramped. This survey shows that America’s airports require more than $128 billion in infrastructure upgrades by 2023, with more than 56 percent of the needs inside our aging terminals.

Inadequate airport infrastructure that fails to meet the growing needs of local businesses and tourists puts in jeopardy the continued economic growth of American cities, states, and regions. From established metropolitan areas to burgeoning growth regions to small communities, sustained economic growth depends on the expansion of, and investment in, local airports. As the U.S. economy recovered from the significant economic downturn experienced during the Great Recession, the national unemployment rate has decreased and personal discretionary spending has increased. As such, enplanements nationwide have dramatically improved, growing at a compound annual growth rate of 3.8 percent between 2013 and 2017, putting further pressure on our already overloaded airport facilities.

Airport investment also promotes much-needed competition in the airline industry. New investments in airports can be valuable tools in helping local communities attract new air carriers, which increases competition and leads to lower airfares for passengers. Airports need additional resources to build the terminals, gates, and ramps necessary to attract new air carriers and allow existing ones to expand service. The traveling public gets more choices and lower airfares when airports can build the facilities that provide more airline options and more service alternatives.

In addition to the impact on local economies, deferred airport investment over the past two decades has challenged the ability of airports to deal with the evolving threats posed to aviation security. We live in vastly different times than when most U.S. airports were built, and the airports we have today simply were not designed and outfitted for a post-9/11 world that requires us to maximize both efficiency and security.

Airports call on Congress to modernize the outdated federal cap on the Passenger Facility Charge (PFC) in order to give airports more flexibility to self-finance and leverage private investment without the need for additional taxpayer dollars. Air travelers and shippers would greatly benefit from airports having the ability to generate more local revenue for terminals, gates, runways, and taxiways that would increase capacity, stimulate competition, enhance safety and security, and improve the overall passenger experience.

Addressing the Infrastructure Funding Shortfall

With America’s airports facing more than $128 billion in new infrastructure needs across the system and a debt burden of $91.6 billion from past projects, it is time to find the means to rebuild our nation’s aviation infrastructure and improve the passenger experience for millions of travelers.

It is a common misconception that airports are funded with taxpayer dollars or a general tax on all citizens. In reality infrastructure projects at U.S. airports are funded primarily with federal grants through the FAA’s Airport Improvement Program (AIP), a local user-fee called the Passenger Facility Charge (PFC), and airport-generated revenue from tenant rents and fees. Airports often turn to capital markets to debt-finance projects, using both PFC-revenue and airport-generated revenue to repay the bonds. Traditionally AIP grants – which prioritize safety improvements – have been used on airfield projects, while PFC user fees – with greater funding flexibility – have gone towards terminal, ground-access, and major-runway projects. In the case of PFCs, airports often have committed this revenue-stream for years or decades into the future to repay past projects, meaning they have no new money coming into the system to fund future projects.

Thus, under the industry’s current financing-funding model airports lack stable, predictable funding sources that keep pace with travel growth, rising construction costs, and inflation for these intensive capital projects. The PFC cap – last adjusted in 2000 – has seen its purchasing power eroded by 50 percent in the past two decades. And federal airport grants through the AIP have been stagnant for nearly a decade, and will remain so for another five years under the recently enacted FAA reauthorization legislation. Moreover, many airports – even those with sterling credit ratings – have reached their debt capacity and either cannot finance new projects or have had to phase in their projects over a longer timeframe, increasing the costs and delaying the benefits for passengers.

Fortunately, we can rebuild America’s airports without raising taxes or adding to deficit spending by modernizing the federal cap on the PFC. Modestly adjusting the federal cap on local PFCs would allow airports to take control of their own investment decisions and become more financially self-sufficient. Airports could build the appropriate facilities – terminals, gates, baggage systems, security checkpoints, roadways, and runways – to meet the travel demands and customer expectations of their community.

Fortunately, we can rebuild America’s airports without raising taxes or adding to deficit spending by modernizing the federal cap on the PFC. Modestly adjusting the federal cap on local PFCs would allow airports to take control of their own investment decisions and become more financially self-sufficient. Airports could build the appropriate facilities – terminals, gates, baggage systems, security checkpoints, roadways, and runways – to meet the travel demands and customer expectations of their community.

It is important to note that PFCs are not taxes – they are local user fees determined locally and used locally to help pay the costs of building airport infrastructure that benefits customers by improving the passenger experience and spurring airline competition. PFCs are imposed by states or units of local government that own or operate airports; so they are not collected by the federal government, not spent by the federal government, and not deposited into the U.S. Treasury. Instead, PFCs go directly to fund local airport projects approved by the FAA with input from airlines and local communities.

At a time of mounting pressure to reduce federal spending, modernizing the federal government’s PFC cap is the simplest and most free-market option for providing airports with the locally controlled self-help they need to finance vital infrastructure projects. It would allow airports of all sizes to reduce costs and start building essential infrastructure projects more quickly to meet the travel demands of today and challenges of tomorrow.

—

Results In Brief

The ACI-NA total estimate of airports’ infrastructure needs for 2019 through 2023, adjusted for inflation, is $128.1 billion or $25.6 billion annualized. About 65.9 percent of the development is intended to accommodate growth in passenger and cargo activity, and 27.8 percent is intended to rehabilitate existing infrastructure, maintain a state of good repair, and keep airports up to standards for the aircraft that use them.

This estimate is a 28.3 percent increase over the 2017 estimate of $99.9 billion or $20 billion annualized for 2017 through 2021. The estimate for large, medium and small hubs only3 is a 34.0 percent increase over the last estimate. For non-hub, non-primary commercial service, reliever and general aviation airports, ACI-NA relied on the FAA National Plan of Integrated Airport System (NPIAS) 2017 estimate for development costs, which are expected to increase by 4.3 percent from the last report completed in 2016.

The $25.6 billion in average annual funding needs for U.S. airports is significantly higher than the funding available through annual AIP grants, PFC collection, and airport generated net income. It is clear that the existing funding system cannot meet U.S. airport infrastructure needs for modernizing and expanding airport capacity which is critical for a safe, efficient and globally competitive aviation system.

ACI-NA attributes the increase in airport infrastructure needs to several factors, including the need to upgrade aging infrastructure, the healthy U.S. economy and increasing traffic demand, and airline consolidation and concentration on hub operations.

The ACI-NA total estimate includes all airport improvements that are planned within the next five years including those not eligible for AIP grants. Commercial-service airports4 , which accounted for 99.8 percent of passenger enplanements in 2017, account for $113.7 billion (88.7 percent) of the total $128.1 billion for planned investments, while non-commercial-service airports with 0.2 percent of the 2017 enplanements account for $14.5 billion (11.3 percent) of the total $128.1 billion. Within the commercial-service airports:

- Large Hub Airports: 72.0% of all enplanements, $81.1 billion of all total needs

- Medium Hub Airports: 16.2% of all enplanements, $17.5 billion of all total needs

- Small Hub Airports: 8.3% of all enplanements, $9.4 billion of all total needs

- Non-Hub Airports: 3.4% of all enplanements, $5.7 billion of all total needs

Commercial service airports reported a significant increase in infrastructure needs, with an overall increase of 34.0 percent while non-commercial service airports had a 4.9 percent increase. All airport categories showed growth from the previous estimate. Medium hubs reported the most significant increase at 49.5 percent followed by large hubs with a 34.3 percent increase.

Medium hubs reported an increase of 49.5 percent, from $11.7 billion to $17.5 billion, and increased their share of total development by 2 percent from the 2016/17 survey. Significant development was identified at Burbank, Pittsburgh, San Jose, Austin, Indianapolis, Omaha, Southwest Florida, Jacksonville, Milwaukee and Dallas Love Field, with more than a 50 percent increase as these airports undertake major infrastructure improvement programs.

Large hubs reported an increase of 34.4 percent, from $60.4 billion to $81.1 billion, and increased their share of total development needs by close to 3 percent. Significant development was identified at New York John F. Kennedy, Newark Liberty and LaGuardia, Denver, Washington Dulles, Tampa, Las Vegas, Baltimore/Washington, Orlando, and Charlotte with more than a 50 percent increase as these airports undertake major infrastructure improvement programs. In addition, Los Angeles International Airport alone reported over $13 billion in infrastructure needs between 2019 and 2023, primarily for terminal and concourse redevelopment and renovation, landside access modernization, and intermodal transportation and consolidated rental car facilities.

Most small hubs reported moderate increases in infrastructure needs. Major developments at Albany, Huntsville, Reno, Madison, Fresno, Sarasota, Palm Springs and Savannah resulted in an increase of over 50 percent in their infrastructure improvement programs.

The overall increase shows that, as a result of the healthy economy and increasing traffic demand, coupled with airline consolidation and their strategic shift to focus on hub operations, large and medium hub airports have a particular need to invest in major infrastructure improvement projects. Despite a decrease in flights at many small airports, additional funding is still needed at these airports for upgrading aging infrastructure, meeting federal mandates, and improving the passenger experience.

—

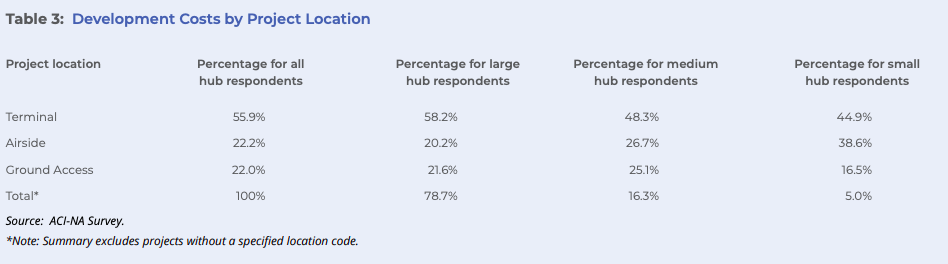

Development Costs by Location

As shown in Table 3, for 2019 through 2023, terminal projects represent 55.9 percent of the total infrastructure development costs for responding airports10, followed by airside projects that represent 22.2 percent of total costs and ground access projects that represent 22.0 percent of total costs. Compared to the 2016/17 estimates, terminal projects continue to represent over half of airports’ infrastructure needs.

Development Costs by Project Type

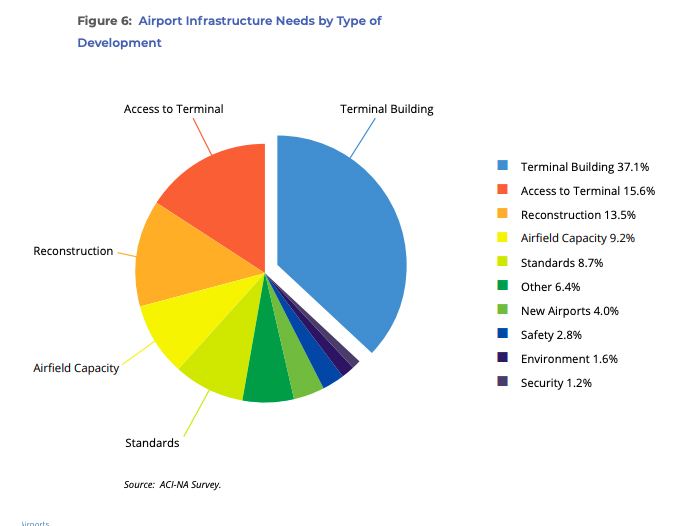

Figure 6 shows that terminal building projects account for 37.1 percent of the total development needs of all airports for 2019 through 2023. Such projects are needed to accommodate more passengers and larger aircraft, implement new security requirements, facilitate increased competition among airlines, and enhance the passenger experience. Surface projects to improve access options and relieve ground access congestion make up 15.6 percent of all projected airport developments.

Download full version (PDF): Terminally Challenged

Link to ACI-NA’s state by state airport needs

About Airports Council International – North America

www.aci-na.org

ACI-NA represents local, regional and state governing bodies that own and operate commercial airports in the U.S. and Canada. ACI-NA’s members enplane more than 95% of the domestic and virtually all the international airline passenger and cargo traffic in North America. ACI-NA’s membership consists of 174 airport operators with 366 airports in the U.S. and 49 airport operators with 180 airports in Canada. Nearly 400 aviation-related businesses are also members of the association. ACI-NA is the largest of the five worldwide regions of Airports Council International (ACI).

Tags: ACI-NA, Airport Infrastructure, Airports Council International - North America, Passenger Facility Charge, PFC

RSS Feed

RSS Feed