BALL STATE UNIVERSITY

CENTER FOR BUSINESS AND ECONOMIC RESEARCH

By Michael J. Hicks, PhD,

Director, CBER George & Frances Ball Distinguished Professor of Economics, Miller College of Business

Introduction

The United States has taxed gasoline since the Great Depression, initially as a revenue source for dwindling tariff and income tax revenues. Though some states taxed gasoline prior to World War I, it was not until after the federal tax was established that most states began consistently taxing gasoline.

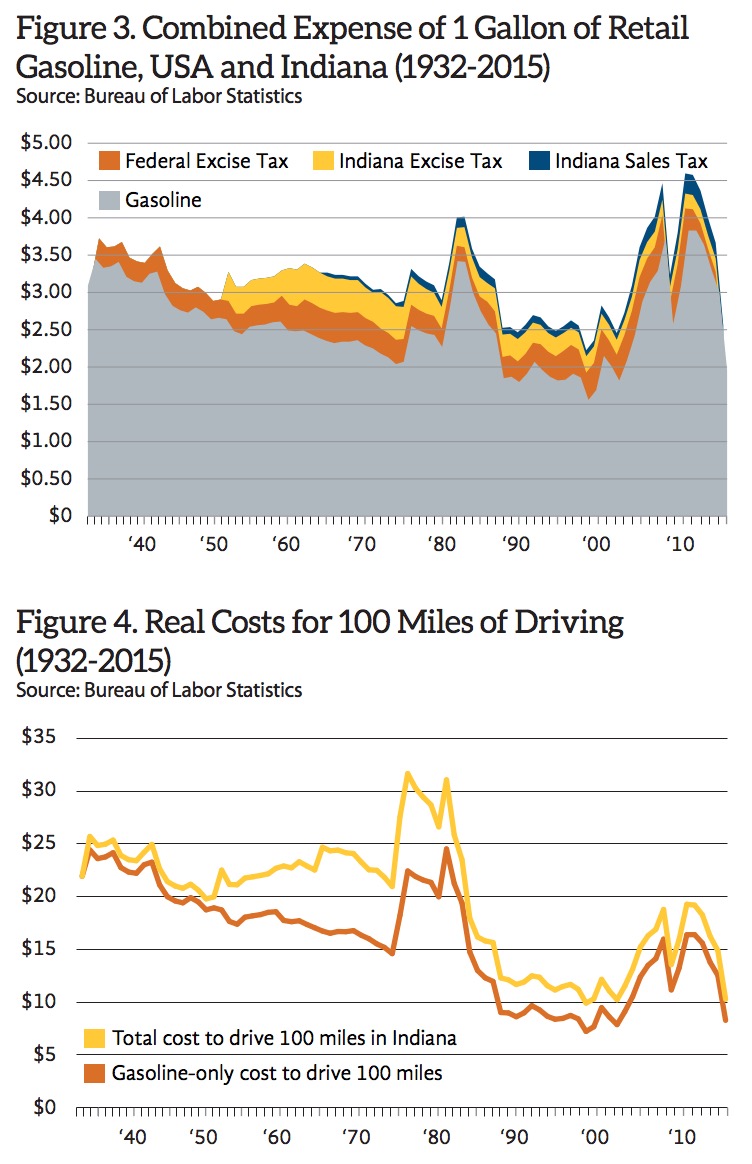

In order to fund the newly authorized interstate highway system, the Highway Revenue Act of 1956 created the Highway Trust Fund and raised federal gasoline taxes from 2 cents per gallon to 3 cents per gallon. By 1963, Indiana implemented a gasoline tax, introducing an original excise tax of 2.0 cents per gallon, which increased to 18 cents today, just slightly below the federal rate of 18.4 cents per gallon in 2015. The excise tax rates for both federal and Indiana have been raised several times since inception, but have also been eroded by the effects of inflation. Figure 1 illustrates the inflation-adjusted tax per gallon of gasoline in 2014 dollars.

Indiana also collects a sales tax on gasoline. This is imposed at roughly the sales tax rate established by the state, the slight difference being due to averaging of sales. A more detailed explanation of this is outside the scope of this discussion. Unlike the excise tax, the sales tax is a percentage of total sales, and so associated revenue is influenced by both the price of gasoline and the rate. Adjusting these for inflation, I find that the cost per gallon of gasoline in Indiana is heavily influenced by gasoline prices (Figure 2).

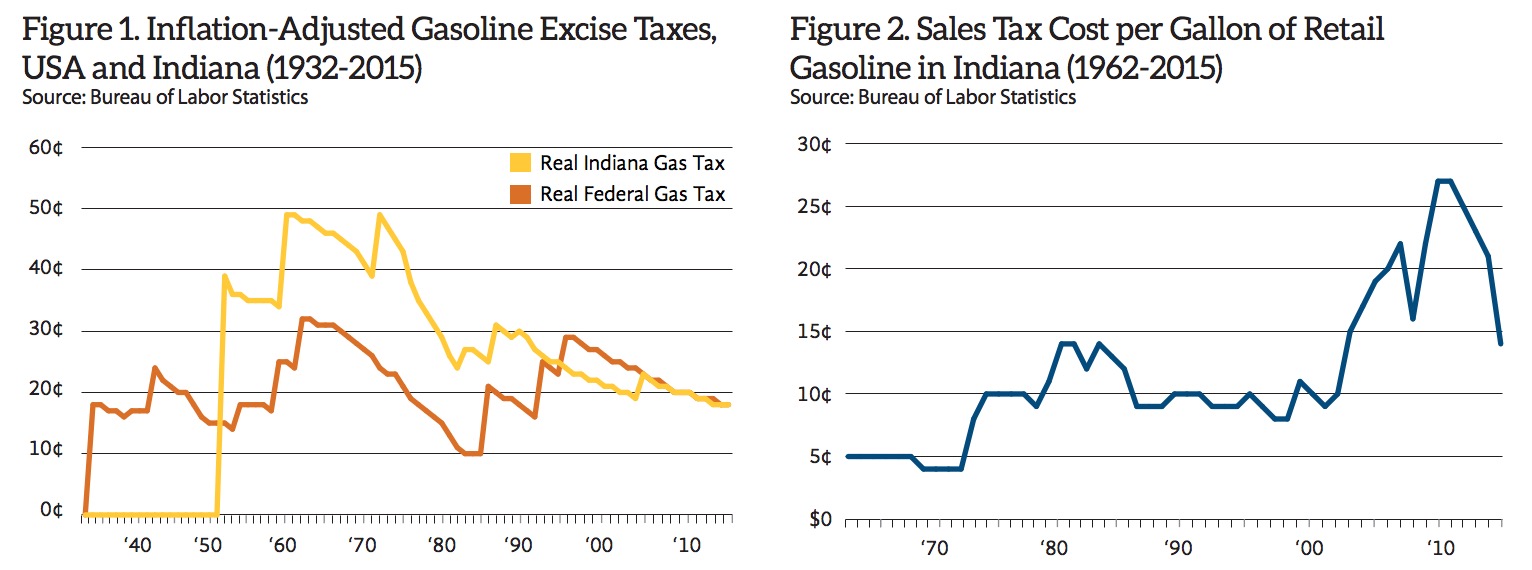

Combining the price of one gallon of gasoline (retail) along with the federal and state excise taxes and the Indiana sales tax, I find that the tax share of the pump price of one gallon of gasoline is now well below its peak of 27 percent in the late 1990s. At that time, more than a quarter of the pump price of a gallon of gasoline was comprised of state and federal taxes. See Figure 3.

Combining the price of one gallon of gasoline (retail) along with the federal and state excise taxes and the Indiana sales tax, I find that the tax share of the pump price of one gallon of gasoline is now well below its peak of 27 percent in the late 1990s. At that time, more than a quarter of the pump price of a gallon of gasoline was comprised of state and federal taxes. See Figure 3.

However, these data mask the effects of increased fuel efficiency of modern vehicles. Examining the cost of driving 100 miles from the 1930s to today (Figure 4), we see the total cost is roughly half what it was in the Great Depression and less than a third the cost of driving that distance during the early 1970s when gasoline price increased dramatically

From the Great Depression to the present, gasoline excise taxes are levied to construct, maintain and expand the highway system. In general, state taxes on gasoline are partially used to maintain and expand non-federal highways while providing state matching funds for federal highway funding. Over the past 75 years or longer, the lower cost of transportation has been a boon to both households and businesses. As fuel and overall transportation costs have been dropping, in real terms, the cost of moving people and goods is much lower than it was than at any time other than the late 1980s and early 1990s. This trend has held, even with substantial periods of higher gasoline and other transportation fuel costs.

With gasoline taxes static or declining due to inflation, the costs of constructing and maintaining roadways and developing congestion relief has grown. The cost per mile of road maintenance has increased roughly 22 percent since the late 1990s and will certainly continue to grow in the coming years (ITEP, 2013). The real (inflation-adjusted) reduction in the gasoline excise tax reduces the state’s ability to fund highway construction, operations, maintenance and relieve congestion. In addition, there have been other issues that affect the stability of the gasoline excise tax revenue. These are increasing fuel economy and higher vehicle weights. The increasing fuel efficiency of vehicles decreases the amount of gasoline used and associated tax revenue. Heavier commercial vehicles lead to more road damage increasing maintenance costs. Both of these issues serve to weaken the link between tax incidence and cost of providing and maintaining public infrastructure.

The lesson to absorb from these data is that gasoline excise tax revenues have not kept pace with the economy as a whole due to inflation and changes to technology that reduce revenues without an associated impact on costs. This strongly suggests that a reexamination of the current rate structure is warranted.

In order to evaluate the landscape that would influence a change in the gasoline excise tax rate, I report analysis from Hicks (2005), which examined the impact higher taxes would have on total economic activity. In that study of the lower 48 states and District of Columbia, I found that gasoline tax collections among the sample were most affected by real personal income and population in the states. Rising incomes and populations increased gasoline consumption.

These were offset also by increased fuel efficiency, a trend that persisted through the study period. The impact of increased efficiency, at the margin, was lower than both real income and population increases. However, on a per capita basis, gas tax collections declined as population increased. This suggests residents of more populated states likely have other transportation options than those in less populated states.

My 2005 study also found that higher excise tax rates had very small to unmeasurable impacts on consumption when correcting for most other factors. The responsiveness of gasoline consumption to federal gas tax rates was not statistically different from zero. For state tax rates, the impact was virtually zero with an elasticity of –0.03, meaning that a 1.0 percent increase in the state gasoline tax rate is associated with a 0.03 percent decrease in consumption.

The price elasticity of demand was around (in absolute value terms) four times as large as the tax elasticity demand, of roughly –0.12. Notably state and federal taxes are, on average, between a quarter and a third of total consumer gasoline prices as of this writing. This supports most a priori beliefs regarding gas price elasticity of demand. See Table 1 for a review of other elasticity studies.

The impact of rates in surrounding states was also minimal to non-existent. This most likely reflects the reality that rate changes across states are closely timed. My 2005 study reported that gas tax changes occurred as prices in real terms were low and happened to cluster very closely across states. The anecdotal evidence for this is that gas tax increases are now a topic for discussion in most state legislatures. A brief review of gasoline tax rates in surrounding states provides context for this discussion in the Midwest. See Table 2.

These findings offer some important policy considerations for Indiana policymakers. Among these is balancing the trend in real gasoline tax rates with expectations regarding road maintenance, operations and construction in the state. Any increase in Indiana’s gasoline excise tax would likely generate nearly proportional revenue increases.

A brief comment on alternative fuel taxes is warranted. While there are increasing interests in alternative fuels, it seems highly unlikely that anything is likely to present itself in the short term to seriously impact gas tax revenues.

Download full version (PDF): Gasoline Taxes – Some History and Analysis

About the Ball State University Center for Business and Economic Research

www.bsu.edu/cbr

The Center for Business and Economic Research (CBER) conducts timely economic policy research, analysis, and forecasting for a public audience. We share our insight with the community through the Indiana Economic Outlook and the Ball State Business Roundtable.

Tags: Ball State University, Center for Business and Economic Research, Gas tax, Gasoline Tax

RSS Feed

RSS Feed