FORBES INSIGHTS

COMMONWEALTH BANK OF AUSTRALIA

Introduction

Developing nations aren’t the only ones with poor infrastructure. Across the U.S., examples of citizens, government officials and the press criticizing the condition of their roads and bridges, airports, schools or other infrastructure are easy to find. This should come as no surprise, says Scott Pattison, CEO of the U.S. National Governors Association (NGA), “because as a nation, we are critically underinvesting in our infrastructure.”

Developing nations aren’t the only ones with poor infrastructure. Across the U.S., examples of citizens, government officials and the press criticizing the condition of their roads and bridges, airports, schools or other infrastructure are easy to find. This should come as no surprise, says Scott Pattison, CEO of the U.S. National Governors Association (NGA), “because as a nation, we are critically underinvesting in our infrastructure.”

Believing Pattison—and many others—might be right, Forbes Insights partnered with Commonwealth Bank of Australia (Commonwealth Bank) and surveyed 200 infrastructure executives to get their thoughts on U.S. infrastructure. The survey was followed by a roundtable of leading global investors and global infrastructure providers. The insights from this event and research are highlighted in this report.

Key Findings in the Survey of Infrastructure Executives

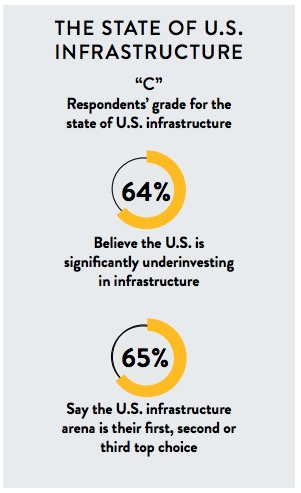

- Underinvesting and a possible crisis: 64% of global infrastructure executives and government officials believe the U.S. is underinvesting in its infrastructure, and 36% believe a crisis may emerge.

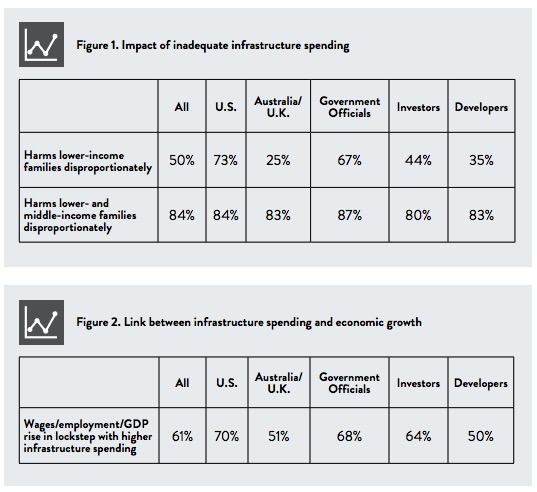

- Pain for the middle class—and the poor: 84% say inadequate infrastructure spending in the U.S. harms the middle and lower class disproportionately; 50% say the same for the poor.

- Sustainability matters: 63% say project sponsors (state, local or federal officials pursuing projects) are significantly increasing their requirements relating to issues of environmental, social and economic sustainability.

- Uncertainty remains around federal assistance: The current U.S. administration is proposing $1 trillion in “targeted federal investments,” but uncertainty remains, with 49% believing that such efforts will be unsuccessful in addressing the nation’s infrastructure shortfalls.

- Public is wary of infrastructure spending: 79% believe more must be done by governments to gain the trust of citizens, and 68% say government officials need to do a better job of “selling” infrastructure investments.

- Structural challenges remain: 40% of respondents describe the impact of current regulations as severely negative, and three out of four agree that much more needs to be done to streamline permitting and environmental review processes in infrastructure.

- Greater innovation is essential: 69% say the public sector needs to do significantly more to enable the sale or lease of infrastructure to the private sector, and 49% say officials need to reduce restrictions on the sale or lease of government assets. These actions could free up capital stored in government-owned assets and enable the use of public/private partnership structures or “P3.”

Underinvesting and a Possible Crisis

A primary finding from the research is that the U.S. is significantly underinvesting in its infrastructure, with many believing a crisis will emerge. But just how bad are conditions really? No doubt the American Society of Civil Engineers (ASCE) has a vested interest—infrastructure projects are their members’ livelihoods. Nonetheless, the group grades U.S. infrastructure a “D+,” and pegs the current U.S. infrastructure investment gap through 2025 at over $1.4 trillion, and expects it to grow to over $4 trillion by 2040.

Our survey respondents offer a slightly higher, but much more respectable-sounding, grade: “C.” Worth noting, this grade is remarkably consistent across all sub-segments, whether government official, investor or provider; whether from the U.S. or the U.K./Australia. Though a “C” is better than a ‘D+,” it is still a less than desirable grade, but at least it appears rooted in reality.

“I don’t believe any reasonable person could argue that the country and this region in particular are not burdened by an investment deficit measuring in the trillions [of U.S. dollars],” says Pat Foye, former executive director of the NY-NJ Port Authority and the newly appointed president of the New York State Metropolitan Transit Authority (MTA), which is responsible for subways, commuter rails, bridges and tunnels.

This view is mirrored by Pattison, whose association collaborates closely with the CEOs—the governors—of all 50 states regarding infrastructure. Conditions are so dire that even amid today’s partisan politics, says Pattison, “the need to address infrastructure [attracts] strong, bipartisan support.”

Underinvestment is so severe that over a third of survey respondents, 36%, believe the U.S. may be on the verge of an infrastructure crisis, with any downfall possibly occurring sooner rather than later. Fifty-seven percent of respondents who believe the U.S. is on the verge of an infrastructure crisis see that crisis materializing within just six to 10 years.

Crisis or not, the U.S. remains a very attractive market for infrastructure investors and providers. Two-thirds of survey respondents (65%) say the U.S. infrastructure arena is their first, second or third choice when it comes to the most attractive marketplaces. Another third (34%) call it an important market but say that three or four others are more attractive.

Pain for the Middle Class–and the Poor

Whether it’s the middle class, the poor or both, failure to adequately invest in infrastructure harms U.S. citizens. Eighty-four percent of respondents believe inadequate infrastructure investment does significant harm to the former. This in turn, says Pattison, “has a severely negative impact on regional growth.” Indeed, this view is shared by 61% of survey respondents: Wages/employment/GDP rise in lockstep with higher infrastructure spending.

Though inadequate infrastructure spending hurts all, the fact is, says Foye, “job seekers and the poor are perhaps the hardest hit” by lack of regional development. “The state of the nation’s infrastructure creates a significant drag on job creation and economic development.”

The issue isn’t helped by an “under appreciation of how widespread the benefits of infrastructure can be,” says Adam Hesketh, CFO North America for Transurban, a major developer/operator of toll roads in the U.S. and Australia. “Every dollar invested creates income for local companies, who hire more workers, who in turn increase household spending. This in turn increases secondary economic activity throughout the community, benefiting all who live and work there,” says Hesketh.

Then once the infrastructure is complete, the improved public services stimulate population growth and attract new business investment so the effects continue. It’s a virtuous cycle, says Hesketh “where for every dollar you invest in infrastructure, you return two or two and a half to the local economy during construction, and the same again once construction is finished.” These impacts also have tangible tax benefits, continues Hesketh, as they not only improve economic and employment metrics, but “each phase generates sales and payroll tax revenue, which can in turn be used to fund additional infrastructure investment. This is one of the key benefits of asset recycling that needs to be better communicated to government.”

Sustainability Matters

Adding to the challenges—and the short-term costs—facing U.S. infrastructure are the growing demands for sustainable development. Dr. Cynthia Rosenzweig is the co-director of the Urban Climate Change Research Network (UCCRN) based at the Columbia University Earth Institute and the NASA Goddard Institute for Space Studies (GISS). According to Dr. Rosenzweig, “We’re seeing climate patterns and events around the world that, if nothing else, are unfamiliar.” A wake-up call was Superstorm Sandy, which hit New York and New Jersey, “inflicting massive damage,” says Dr. Rosenzweig.

Prior to the storm, New York City was “a leader in planning for climate change,” and had been working on resiliency/sustainability guidelines. But, says Dr. Rosenzweig, “they were operating only in low gear.” Post-Sandy, however, “everything is in high gear—leaders are seizing the opportunity presented by Sandy to get things done.” New York City has developed a set of recommended “climate resilience guidelines” that are based on the New York City Panel of Climate Change’s (NPCC) extensive research. The Urban Climate Change Research Network has also developed a wide array of resources for government officials and civic planners around the world.

Numerous states and municipalities are taking notice. Consider the case of the Los Angeles International Airport (LAX). LA’s premier airport is the second-busiest airport in the U.S. and the largest measured by origin and destination (those arriving aren’t racing for connecting flights, they’re visiting the city). Mark Waier is the director of communications for Los Angeles World Airports (LAWA), the City of Los Angeles’ department responsible for both LAX and the nearby Van Nuys airports. These airports, says Waier, are “crucial to the city and to the California economy—they are an engine of economic growth.”

Driven by this essential role, LAX is in the midst of improving the way guests access the airport terminals by building three core components: an automated people mover, two intermodal transport facilities and a consolidated rental car center. But as massive as such investments might be, sustainability, says Waier, “is at the forefront.” In practice, this leads to a wide range of planning and design requirements. For example, “we make certain the landscaping is drought-tolerant.” Similarly, all construction must be LEED-certified, including associated “design and reuse” elements.

“We’re thinking about future uses with everything we build,” explains Waier. “For example, on any parking facilities, instead of sloped floors for drainage, they’re level so the building can be more easily adapted to other use.” The ceilings are also higher than for a typical parking structure, leaving room for HVAC when/if needed, and conduits are pre-installed in case, later on, more wiring needs to be run as electric vehicle demand increases.

This fast-evolving need to address sustainability is by no means lost on industry participants. Nearly two-thirds of respondents (63%) say project sponsors (state, local or federal officials pursuing projects) are significantly increasing their requirements around environmental, social and economic sustainability. In addition, 65% of respondents believe private enterprises (investors and providers of infrastructure) are finding it necessary to invest significantly greater resources into understanding and providing sustainable (environmental, social and economic) solutions.

What this all means is that the infrastructure industry needs to “up” its focus. As Waier explains, “Sustainability is now second nature here: Everything is adaptive and everything is environmentally conscious.” And while this indeed adds costs to design and construction, “we know it’s a needed investment and will pay off in the long run.”

One area of particularly critical concern, explains Dr. Rosenzweig, is the need to address the cascading effects of multiple system failures. One of the lessons from Sandy, she explains, “is that first, the power fails, and then transportation, water, and communications systems all fail as well.” That is because “planners have traditionally managed infrastructure in silos.” Going forward, she insists, “there needs to be much greater understanding of the interrelationships between major systems.”

Download full version (PDF): Filling the Gap

About Forbes Insights

www.forbes.com/forbesinsights

Forbes Insights is the strategic research and thought leadership practice of Forbes Media. By leveraging proprietary databases of senior-level executives in the Forbes community, Forbes Insights conducts research on a wide range of topics to position brands as thought leaders and drive stakeholder engagement.

About the Commonwealth Bank of Australia

www.commbank.com.au

CommBank is Australia’s leading bank. Our financial services include retail, premium, business and institutional banking, funds management, superannuation, insurance, investment and share-broking products and services.

Tags: Commonwealth Bank of Australia, Forbes Insights, Infrastructure Executive Survey, Infrastructure Executives, Survey of Infrastructure Executives

RSS Feed

RSS Feed