UC DAVIS INSTITUTE OF TRANSPORTATION STUDIES

RICE UNIVERSITY CENTER FOR ENERGY STUDIES

Introduction

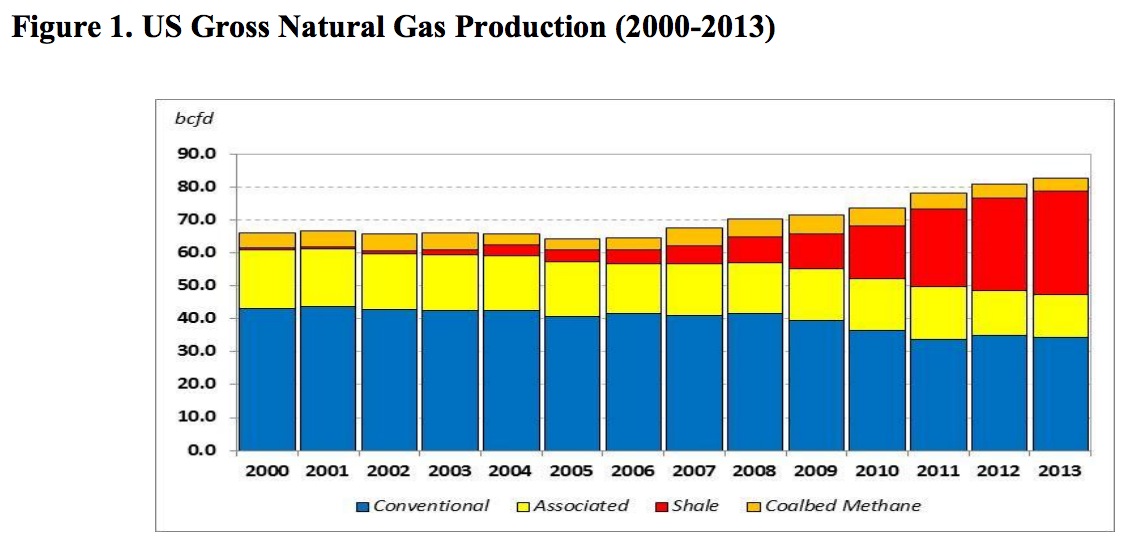

The last decade has been witness to an incredible transformation in the US energy fortune. The combination of hydraulic fracturing and horizontal drilling in upstream operations targeting ultra-low porosity, ultra-low permeability hydrocarbon bearing shale formations has unlocked a bounty of natural gas and crude oil resource. This transformative innovation has literally turned the US energy market on its head. Fewer than ten years ago a number of large capital players were developing liquefied natural gas (LNG) regasification terminals with an eye toward importing large volumes of natural gas to the US from distant locations. Today, there is a prevailing expectation that the US will soon be an exporter of LNG, largely due to the rapid growth in natural gas production from shale that has occurred in the last 8 years (see Figure 1). In fact, US gross natural gas production has risen from an annual average rate of 64.3 billion cubic feet per day (bcfd) in 2005 to 82.7 bcfd in 2013, driven primarily by growth in production from shale from less than 4 bcfd to over 31 bcfd.

What Made the US Energy Renaissance Possible?

We begin by addressing the factors that made the upstream successes witnessed in the US during the past decade possible. This is also detailed in Medlock (2014).1 First, we note that geology matters, but while the right geology is a necessary condition, it is not sufficient to ensure that profitable resource development will occur. Sufficiency requires a number of above-ground factors to be aligned. This thesis is upheld by the fact that shale resources outside the US are assessed to be significant, yet shale oil and gas production on a global scale is still limited primarily to the US. As detailed in Medlock (2014), the factors include:

- A regulatory and legal apparatus in which upstream firms can negotiate directly with landowners for access to mineral rights on privately-owned lands.

- A market in which liquid pricing locations, or hubs, are easily accessed due to liberalized transportation services that dictate pipeline capacity is unbundled from pipeline ownership.

- A well-developed pipeline network that can facilitate new production volumes.

- A market in which pipeline development is relatively seamless due to a well-established governing body, for example the Federal Energy Regulatory Commission (FERC) in the US, and a comparatively straightforward regulatory approval process.

- A market in which demand pull is sufficient to provide the opportunity for new supplies to compete for market share in the energy complex.

- A market where a well-developed service sector already exists that can facilitate fast-paced drilling activity and provide rapid response to demands in the field.

- A service sector that strives to lower costs and advance technologies in order to gain a competitive advantage.

- A sizeable rig fleet that is capable of responding to upstream demands without constraint.

- A deep set of upstream actors, such as the independent producers in the US, that can behave as the “entrepreneur” in the upstream thereby facilitating a flow of capital into the field toward smaller scale ventures than those usually engaged by vertically integrated majors.

If any of the above features is absent, a potential barrier to market entry and upstream development is presented, usually in the form of higher costs. Moreover, some of the above listed conditions can be co-dependent on others. For example, a well-developed service sector relies on a large set of upstream players to create significant demands for its products and services, just as the population of upstream actors in the upstream, for example the thousands of independent producers in the US, might not be so large absent a well-developed service sector. In short, the interdependence of the conditions listed above speaks to the notion that welldesigned market institutions and regulatory frameworks can be self-reinforcing.

About the UC Davis Institute of Transportation Studies

www.its.ucdavis.edu

Our Mission: To serve the needs of society by organizing and conducting multidisciplinary research on emerging and important transportation issues, disseminating this research through conferences and scholarly publications, and enhancing the quality and breadth of transportation education.

About the Rice University Center for Energy Studies

bakerinstitute.org/center-for-energy-studies

The mission of CES will to provide policymakers, corporate leaders, and the public with quality, data-driven analysis of issues that influence energy markets. Like all Baker Institute research, the energy and environmental issues studied by the CES will provide a nonpartisan voice in areas that can be politically divisive.

Tags: CA, California, Center for Energy Studies, Institute of Transportation Studies, KENNETH B. MEDLOCK III, Natural Gas, PH.D., Rice University, UC Davis, University of California

RSS Feed

RSS Feed