AMERICAN COUNCIL OF ENGINEERING COMPANIES

Written by Gerry Donohue

Engineering firms working in the aviation infrastructure market are flying high right now. The airlines are profitable, and many airports—especially the large hubs—are planning or in the middle of huge upgrade programs.

Engineering firms working in the aviation infrastructure market are flying high right now. The airlines are profitable, and many airports—especially the large hubs—are planning or in the middle of huge upgrade programs.

“It is a perfect storm,” says Burns & McDonnell Aviation Vice President Bret Pilney. “There is a lot of capital spending going on, by both airlines and airports. They are reinvesting in their terminals and facilities. It has been great.”

Some of the largest programs include Chicago O’Hare International Airport ($15 billion), Los Angeles International Airport ($14 billion), Hartsfield-Jackson Atlanta International Airport ($6 billion), New York LaGuardia Airport ($4 billion), John Glenn Columbus International Airport ($1.3 billion) and Kansas City International Airport ($1 billion).

“The airports face a lot of development needs,” says Greg Heaton, vice president at Crawford, Murphy & Tilly. “Facilities are old, passenger counts continue to climb, regulations and security requirements are expanding, and aircraft are changing.”

For a long time, these needs were unmet because airlines and airports had an often fractious relationship. The airlines have struggled to be consistently profitable and begrudged contributing to airport infrastructure improvements. For their part, airports have been constrained by limited federal funding.

“There has not been the kind of money and political fortitude in the past to upgrade our airports,” says Tina Millan, who directs WSP’s U.S. aviation practice. “Now everyone is getting really aggressive.”

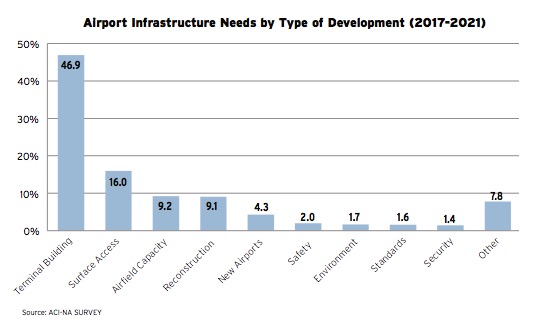

A recent survey by the Airports Council International – North America reported that U.S. airports have plans for up to $100 billion in infrastructure improvements through 2021, although anticipated funding only covers about half of that.

“Maybe they will get to $50 billion,” says Millan, “but I expect the spend will be closer to $25 or $30 billion.”

Even at that level, though, the aviation infrastructure market will be robust for the foreseeable future.

Public Funding

Federal programs account for almost half of airport infrastructure funding.

The Airport Improvement Program (AIP) provides about $3.35 billion in grants for capital improvements. That level has held steady since 2012. The grants are limited to “airside” projects, such as runways and taxiways. They may not be used for “landside” projects, such as for buildings or making improvements to attract commercial enterprises.

According to the Federal Aviation Administration’s (FAA) most recent National Plan of Integrated Airport Systems report, U.S. airports have about $32.5 billion in AIP-eligible projects through 2021, but that is more than twice the current funding level.

Most airports also levy a Passenger Facility Charge (PFC) on each passenger using the airport on originating and connecting flights. The funds can only be used for FAA-approved projects aimed at reducing noise; enhancing safety, security or capacity; or increasing air carrier competition. Congress raised the PFC to $4.50 per flight segment in 2000 but has been unwilling to increase it since then.

“The PFC is now worth about half of what it once was,” says C&S Cos. Senior Vice President Michael Hotaling. “Increasing the PFC has been a battleground between the airports, which consider it to be a user fee, and the airlines, which see it as a tax.”

ACEC and the airports have lobbied Congress to increase the AIP and raise the PFC limit, but the House passed its FAA reauthorization bill earlier this year without any increases. The legislation does include, however, $1 billion in a new competitive grant program for small and midsize airports.

“We are very excited to see that additional $1 billion,” says Heaton. “Maybe Congress is beginning to understand the pent-up demand for airport infrastructure investment.”

Private Funding

With public funding flatlined, airports and airlines are relying more on private financing sources, including public-private partnerships (P3s).

“We have been doing P3s for a long time, but we did not call them P3s,” says Millan. She points to car rental centers at airports, which are typically funded through the revenue from the car rentals.

There have been several attempts to create P3s for entire airports, but only one has gone through—San Juan Luis Muñoz Marín Airport in Puerto Rico. Better, Millan says is to “get away from thinking of an airport as one major thing and break it down into a lot of different funding opportunities.”

For example, Denver International Airport wanted to include solar in its power grid. The airport contracted with a solar company to install the array on its land. The airport takes its share of the power, and the company sells the rest.

This common financing arrangement, called “soft P3s,” is one in which the airport and one or more airlines collaborate on a project.

Philadelphia and an airline on more than $1 billion in infrastructure improvements to Philadelphia International Airport,” says David Yeamans, president, aviation & federal, Burns & McDonnell. Philadelphia Area Industrial Development, or PAID, the bond authority on behalf of the city, sells the bonds. The airline executes the contract for design and construction, which it then turns over to the airport. The airline then becomes a tenant. “This method allows the projects to get done more affordably and in about half the time because the city has lengthy procurement requirements,” Yeamans says.

C&S Cos. has been working with several airports to improve their land use. “We work with them to identify opportunities that help generate revenue from their land holdings,” says Hotaling. “Using detailed market analytics, we determine the best uses for the land, how to market it for development and to whom.”

Smaller airports are also getting in on the action. Crawford, Murphy & Tilly recently worked with Chicago Rockford International Airport and an airplane maintenance and repair company to build two large fabric structures capable of housing a 747 aircraft.

“This is the largest maintenance facility in the country that is not owned by an airline,” says Heaton. “The airport is using the new facility as an economic generator, to bring traffic and new users to the field.”

Passenger Experience

An increasingly important focus of infrastructure investment for both the airlines and the airports is improving the passenger experience.

“Customer satisfaction numbers are driving how the airlines are investing,” says Yeamans.

The FAA estimates that U.S. airport traffic will increase by 50 percent by 2036 to 1.2 billion passengers annually. Most major airports are geographically constrained, so they cannot build themselves out of the expected congestion. They need to use their space better, getting passengers from the curbside to the jetway faster and more efficiently.

Engineering firms are working with airports and airlines to improve the operational logistics, such as designing security screening to take up less space and move faster and speeding up baggage handling.

“Airports are competing for travelers,” says Pilney. “And the passenger experience has become a huge differentiator.”

Download full article (PDF): Aviation Infrastructure Market Booming

Download full July/August Issue of Engineering, Inc.

About the American Council of Engineering Companies

About the American Council of Engineering Companies

www.acec.org

The American Council of Engineering Companies (ACEC) is the voice of America’s engineering industry. Council members – numbering more than 5,000 firms representing more than 500,000 employees throughout the country – are engaged in a wide range of engineering works that propel the nation’s economy, and enhance and safeguard America’s quality of life. These works allow Americans to drink clean water, enjoy a healthy life, take advantage of new technologies, and travel safely and efficiently. The Council’s mission is to contribute to America’s prosperity and welfare by advancing the business interests of member firms.

Tags: ACEC, Aiports, Airport Infrastructure, American Council of Engineering Companies, Gerry Donohue

RSS Feed

RSS Feed