NATIONAL CENTER FOR SUSTAINABLE TRANSPORTATION

UC DAVIS INSTITUTE OF TRANSPORTATION STUDIES

Executive Summary

The United States and California have both made commitments to an 80% reduction in energy-related greenhouse gases (GHGs) from 1990 levels by 2050 in order to help stabilize atmospheric concentrations of greenhouse gases. These commitments do not specifically target transportation or an individual transport mode.

This white paper reviews previous studies and provides a new investigation into the feasibility of achieving an 80% reduction in CO2-equivalent (CO2e) GHG emissions in the United States and California from trucks in the 2050 time frame (“80-in-50”). We assess the technological and economic potential of achieving deep market penetrations of low-carbon vehicles and fuels, including vehicles operating on electricity, hydrogen, and biofuels.

This paper provides a side-by-side comparison of potential truck technologies and fuels, and analyzes the technical, economic, and other challenges associated with the various options. Finally, it presents several scenarios for achieving an 80-in-50 target for trucks.

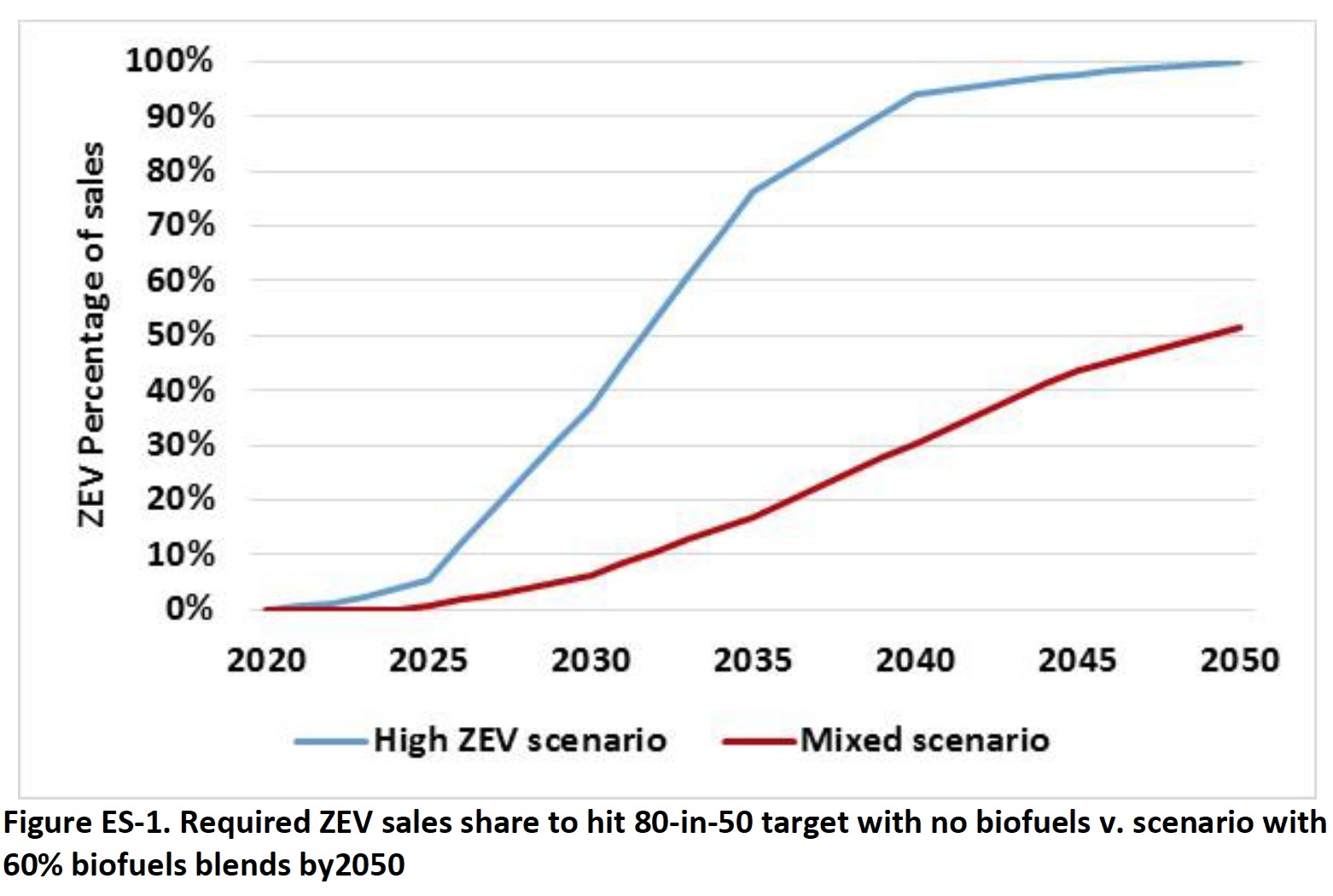

Overall, we find that achieving such a target for trucks will be very challenging and, if focused on hydrogen and electric zero emission vehicle (ZEV) technologies, will require strong sales growth beginning no later than 2025 and nearly a complete transition to sales of these vehicles by 2040 to achieve needed stock shares by 2050. We find that introducing sizable quantities of low-GHG biofuels compatible with today’s diesel engines can ease the transition time to ZEVs or even cut needed ZEV shares significantly, but this involves other very challenging aspects. This paper does not consider local pollutant emissions such as NOx, which in some places (notably California) could require an even faster transition to ZEVs than called for by climate-related goals. We do not attempt to determine which strategy (ZEVs or biofuels) is superior and conclude that a combination is the most likely way to achieve large reductions in GHG emissions going forward. The tradeoffs involved—notably the ease of biofuels’ fleet penetration versus the reduction of criteria pollutants offered by ZEVs—may ultimately determine which path is chosen in different markets.

Presently, trucks dominate goods movement in the U.S., carrying 72% of the tonnage, 42% of ton-miles, and 70% of the goods value. The truck scenarios developed for this paper include eight different truck types, with a high share of truck miles and fuel use accounted for by long haul Class 8 trucks, although short haul heavy-duty trucks and commercial pickup trucks are also important.

In reviewing three prominent studies of low-carbon truck futures, we note the lack of a clear consensus of an optimal pathway or even the feasibility of achieving 80-in-50. Two studies focused primarily on the potential for significant utilization of biofuels for heavy-duty vehicles, with both studies projecting emissions reductions far short of an 80% reduction target. A broader third study in 2012, by the California Air Resources Board (ARB), achieved an 80-in-50 target with massive uptake of ZEV trucks, but even this approach did not meet ARB’s 2032 NOx targets. These three studies, along with the new scenarios presented in this paper, suggest that without strong adoption of very low-carbon biofuels, it will take a very rapid ramp-up of ZEV trucks (i.e. fuel cell and/or electric trucks) beginning shortly after 2020, with a full penetration of these vehicles by 2040, to have a chance for an 80% reduction in CO2e emissions by 2050. The urgency of this transition to ZEV trucks could be eased considerably by concurrently introducing large quantities of low-carbon biofuels.

The new truck technologies and propulsion systems discussed here include diesel hybrids, liquefied natural gas (LNG),fuel cell, plug-in hybrid, and battery electric vehicles (with only fuel cells and pure battery electric vehicles considered as ZEVs). Given what is known today, the cost of owning and operating these alternative technologies and fuels would exceed that of diesel trucks, at least in the near term. In the case of biofuels, the vehicle capital cost is the same, but near-term fuel costs are significantly higher. If costs of technologies (like hydrogen fuel cells and batteries) and of fuels (like biofuels) decline as we assume in our 2030 cost projections, the costs of a very low-carbon scenario over the next two to three decades appear moderate in the context of overall trucking costs. In the case of our projections for heavy-duty long haul trucks, the costs between 2030 and 2050 actually are below those in the base case due to rising fuel savings. But transition costs over the next decade or two may be high.

As with light-duty vehicles, the challenges for large ZEV trucks include deploying a refueling infrastructure that supports widespread adoption of vehicles, and reducing cost barriers through scale and learning. Strong policies are likely to be needed to overcome these challenges and set ZEV truck sales on a rapid growth trajectory. Ongoing research, development and demonstration (RD&D) programs coupled with fiscal incentives for low-carbon fuel adoption by trucks appear critical; a ZEV requirement in the truck sector, like the California requirement for light-duty vehicles, may also be useful but could be more difficult to manage than for cars given the wide range of truck types and purposes. Fiscal incentives for ZEVs may be an alternative or complementary policy to consider.

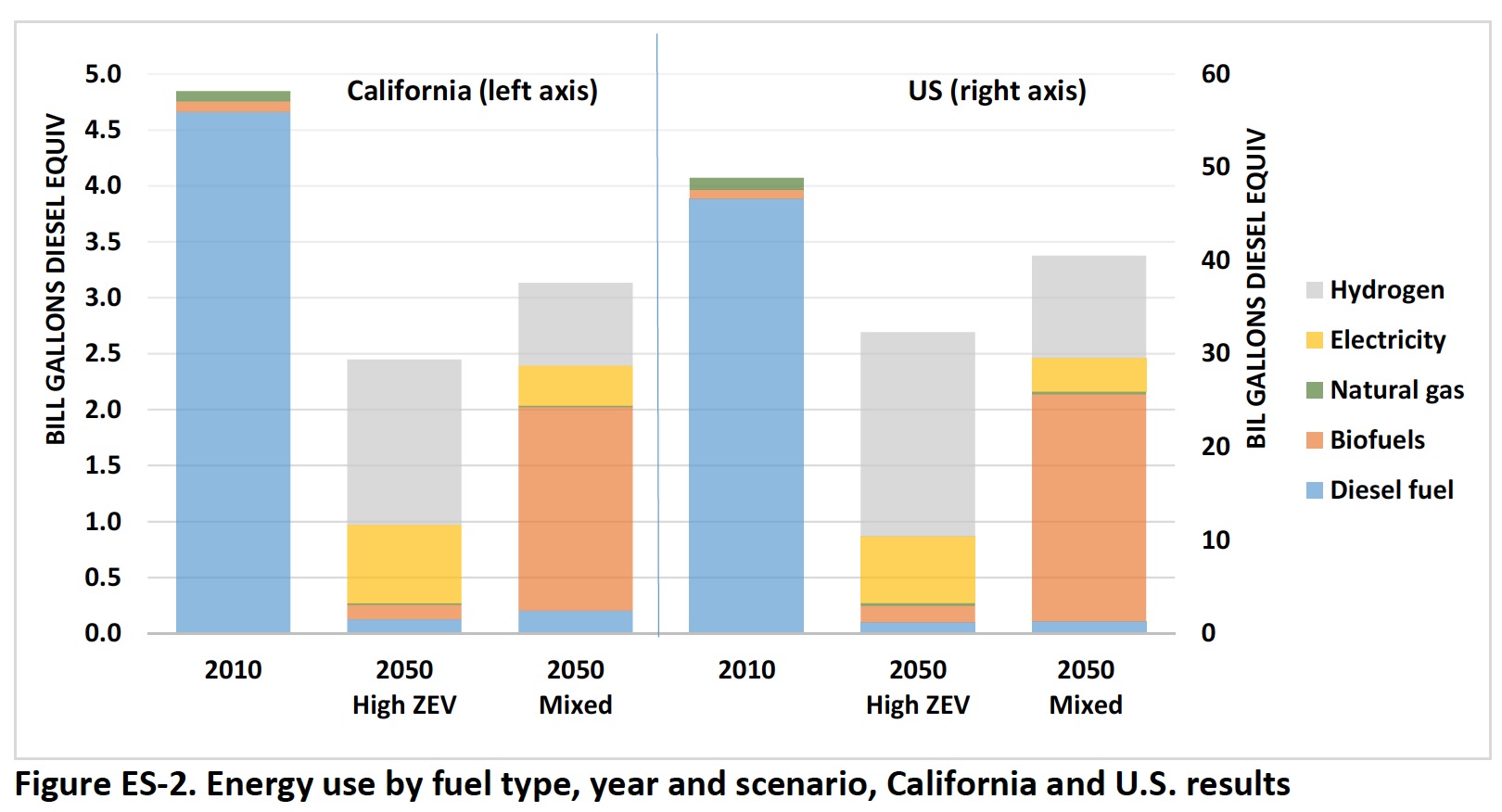

Scenario Results

In the scenarios created for this paper (described and documented in the report and Appendix), separate estimates of vehicle market shares and fuel requirements in 80-in-50 scenarios were made for California and the United States. The underlying growth in truck vehicle miles traveled (VMT) is projected somewhat differently by ARB and the U.S. Energy Information Administration (EIA). ARB projects about a 50% increase in California truck miles between 2010 and 2050, and EIA projects an 80% increase nationally. Given either of these projections, this substantial VMT growth increases the challenge of achieving 80-in-50. However, the scenarios here include enough efficiency improvement in diesel trucks to completely offset VMT growth in California and mostly offset growth nationwide (due to the US Phase 2 efficiency standards and assumed continued tightening of this program over time). Additional efficiency improvement comes from shifts to battery electric and fuel cell trucks, further lowering demand for diesel fuel to 2050 (though requiring orders of magnitude increases in electricity and hydrogen use by trucks compared to today). The final contributions to GHG reductions come from deeply decarbonized energy sources, including for hydrogen, electricity and biofuels.

The tradeoff between ZEV sales and the use of biofuels is depicted in Figure ES-1, where a “High ZEV” scenario focused mainly on ZEVs along with very low GHG hydrogen or electricity, is compared with a “Mixed” scenario of 60% blends of very low-carbon GHG biodiesel blended into fossil diesel fuel by 2050. The difference is striking, particularly in the 2030-2040 timeframe, when in the High ZEV scenario very high sales shares of ZEVs must be achieved to be on a path to 80% GHG reduction, whereas these sales shares can be much lower in the Mixed scenario. In the High ZEV scenario, with a flat rise in ZEV market share over time, ZEVs must account for close to 40% of new truck sales by 2030 and account for nearly all new trucks by 2040 in order to hit an 80-in-50 target. If ZEVs are not close to achieving this type of market share growth by 2030, it probably means they will not be able to achieve an 80-in-50 goal without the help of very large volumes of biofuels.

Watch video here (InfrastructureUSA.org)

About the National Center for Sustainable Transportation

ncst.ucdavis.edu

The National Center for Sustainable Transportation (NCST) is one of five national centers funded by the U.S. Department of Transportation’s Office of the Secretary for Research and Technology under the University Transportation Centers (UTC) program. UC Davis, the lead university of the NCST consortium, was previously the home of the Sustainable Transportation Center, a Tier 1 center in the UTC program. The strategic goal of the NCST is Environmental Sustainability, and we are one of five UTCs that share this common goal.

About the UC Davis Institute of Transportation Studies

www.its.ucdavis.edu

The Institute of Transportation Studies at UC Davis (ITS-Davis) is the leading university center in the world on sustainable transportation. It is home to more than 60 affiliated faculty and researchers, 120 graduate students, and a budget of $12 million. While our principal focus is research, we also emphasize education and outreach.

Tags: ITS, National Center for Sustainable Transportation, Trucking, Trucks, UC Davis, UC Davis Institute of Transportation Studies, University of California

RSS Feed

RSS Feed