INSTITUTE FOR ENERGY RESEARCH

Executive Summary

While headlines have reported declining oil, gas, and coal prices, those declines do not deter from the fact that U.S. energy resources are valuable to our domestic economic growth. The most recent government estimate of those benefits was a 2012 Congressional Budget Office (CBO) study, produced at the request of the House Budget Committee, which analyzed federal lease revenues that could be expected to arise from a proposal to open federal lands and waters to oil, gas, and coal extraction.

Specifically, the study aimed to estimate the fiscal benefits of opening areas that are statutorily or as a matter of administration policy prohibited from leasing. The issue has repeatedly been a hot-button political and economic issue in the past several years, having been discussed at the beginning of the Obama administration and then again as Republican challengers in the 2012 election placed opening the lands and waters at the center of their energy policy. The issue remains relevant in the 2016 election cycle.

This paper highlights the continuing economic effects despite recent price declines, including benefits to economic growth, wages, jobs, and federal, state, and local tax revenues, from opening federal lands and waters to oil, gas, and coal leasing.

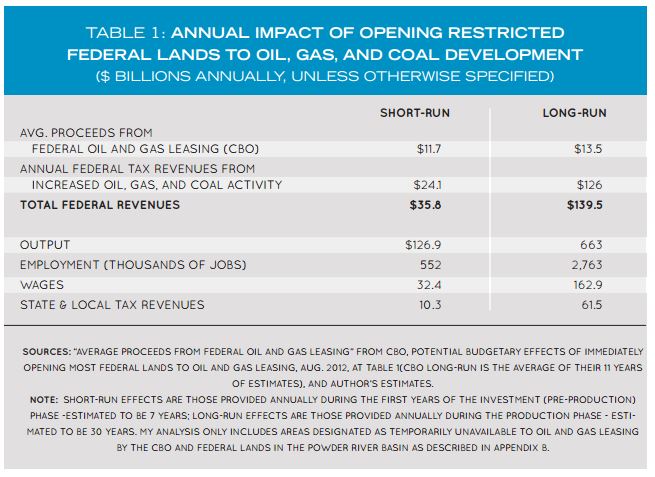

The findings of this paper demonstrate that opening federal land that is currently closed-off because of statutory or administrative action would lead to broadbased economic stimulus, including increasing GDP, employment, wages, and tax revenues. Specifically:

GDP increase:

- $127 billion annually for the next seven years.

- $663 billion annually in the next thirty years.

- $20.7 trillion cumulative increase in economic activity over the next thirty-seven years.

- These estimates include “spillover” effects, or gains that extend from one location to another location. For example, increased oil production in the Gulf of Mexico might lead to more automobile purchases that would increase economic activity in Michigan. Spillover effects would add an estimated $69 billion annually in the next seven years and $178 billion over thirty years

Jobs increase:

- 552,000 jobs annually over the next seven years.

- Roughly 2.7 million jobs annually over the next thirty years.

- Jobs gains would be not only in fields directly related to oil, gas, and coal but more than 75% of the jobs would be in high-wage, high-skill employment like health care, education, professional fields, and the arts.

Wage increase:

- $32 billion increase in annual wages over the next seven years.

- $163 billion annually between seven and thirty years.

- $5.1 trillion cumulative increase over thirty-seven years.

Increase in tax revenue:

- $3.9 trillion increase in federal tax revenues over thirty-seven years.

- $1.9 trillion in state and local tax revenues over thirty-seven years.

- $24 billion annual federal tax revenue over the next seven years, $126 billion annually thereafter.

- $10 billion annual state and local tax revenue over the next seven years, $61 billion annually thereafter.

The federal benefits, when incorporating the CBO’s estimates on leasing revenues, could be as great as $36 billion annually for the next 7 years, and $139 billion annually in the long-run.

The present analysis illustrates the considerable economic value typically ignored in the energy debate. Federal taxes from the increased output could raise as much as $24 billion annually in the short-run, and would continue to produce $126 billion annually in the long-run. The federal benefits, when incorporating the CBO’s estimates on leasing revenues, could be as great as $36 billion annually for the next 7 years, and $139 billion annually in the long-run.

According to the findings of this paper, the effects of the proposal on the larger economy would also be substantial. Output would increase by $127 billion annually over the next 7 years (about 1% of current GDP), and $663 billion annually after that (about 4% of current GDP). Over 552 thousand jobs could be created for the next 7 years with almost 2.7 million jobs after that, aiding economic recovery for workers facing historically high un- and under-employment rates. Wages would increase by $32 billion annually in the short run, with long run annual effects of $163 billion.

The economic impulses created by opening federal lands and waters to oil, gas, and coal extraction could therefore help significantly to spur economic growth — and help break the economy out of its sluggish postrecessionary malaise. Importantly, those benefits would be realized without any increase in direct government spending. Rather, increased output would refill national, state, and local government coffers without additional government outlays.

About the Institute for Energy Research

instituteforenergyresearch.org

The Institute for Energy Research (IER) is a not-for-profit organization that conducts intensive research and analysis on the functions, operations, and government regulation of global energy markets. IER maintains that freely-functioning energy markets provide the most efficient and effective solutions to today’s global energy and environmental challenges and, as such, are critical to the well-being of individuals and society.

Tags: Fossil Fuels, Gas, IER, Institute for Energy Research, Oil

RSS Feed

RSS Feed