SOLAR ENERGY INDUSTRIES ASSOCIATION

Economic Impact of Extension of the Treasury Grant Program (TGP)

and Inclusion of Solar Manufacturing Equipment in the Investment Tax Credit (MITC)

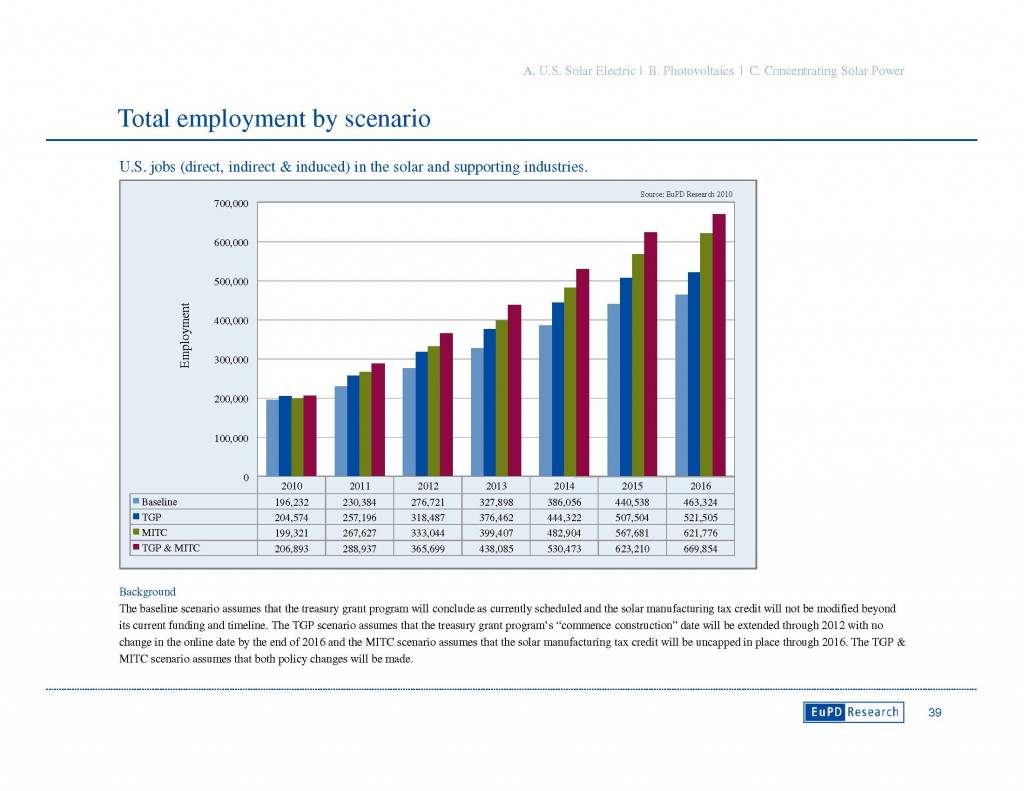

In 2009, the American Recovery and Reinvestment Act created two programs that have helped the solar industry create U.S. jobs and deploy technologies: (1) a cash grant to be used in lieu of tax credits for renewable energy projects (TGP); and (2) tax credits for renewable energy manufacturing investments (MITC). Although the U.S. unemployment level remains high, the TGP is set to expire in December 2010 and the MITC funding allocation has been completely exhausted.

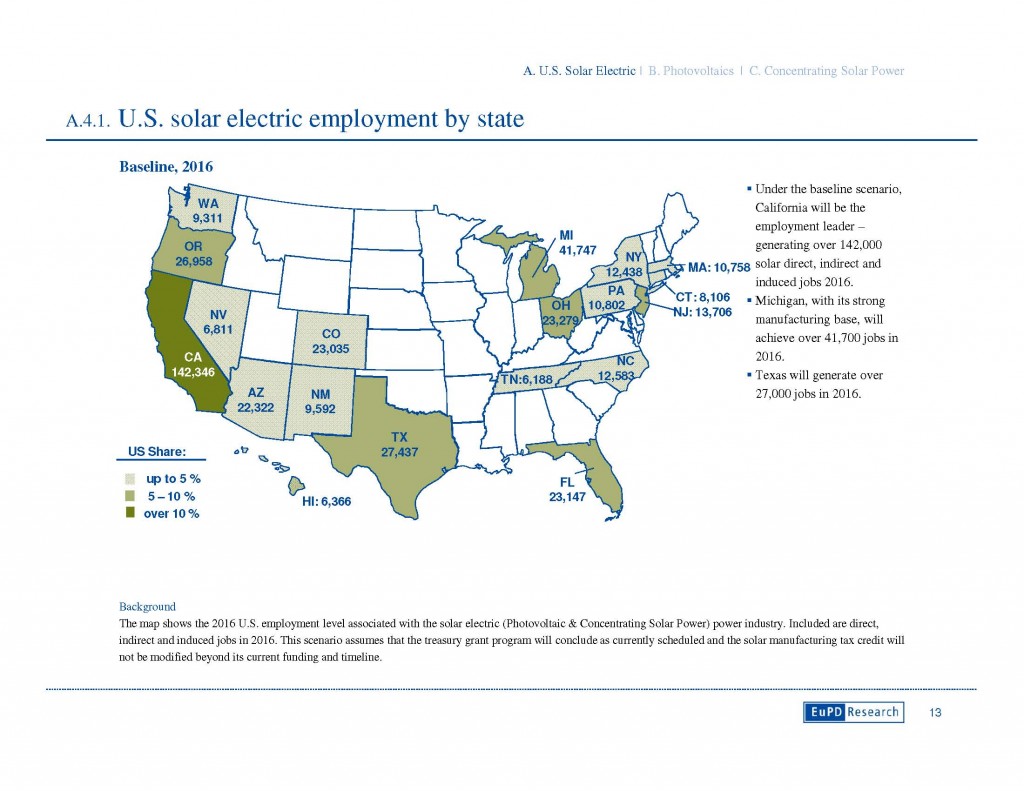

This study analyzes the economic impact in the U.S. of extending the TGP by two years Background through 2012 and allowing solar manufacturing expenditures to be claimed under the current Section 48 30% investment tax credit as a new MITC. The study examines the impact of these policies on job creation and solar electric technology deployment in the period 2010-2016.

…

TGP Extension Only

An extension of TGP from the current expiration date of December 31, 2010 to include projects with a “commence construction” date of December 31, 2012 would have strong effect on almost all CSP and many PV installations.

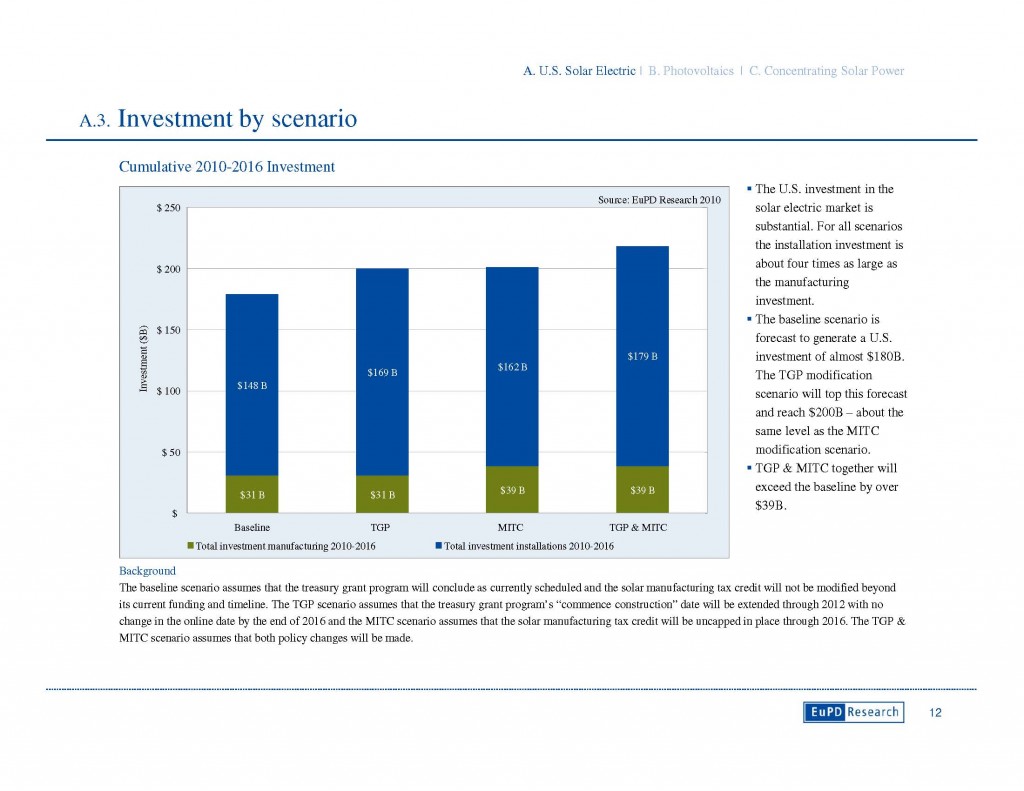

- Cumulative U.S. investment (2010-2016) in solar electric technologies would increase by $21 billion.

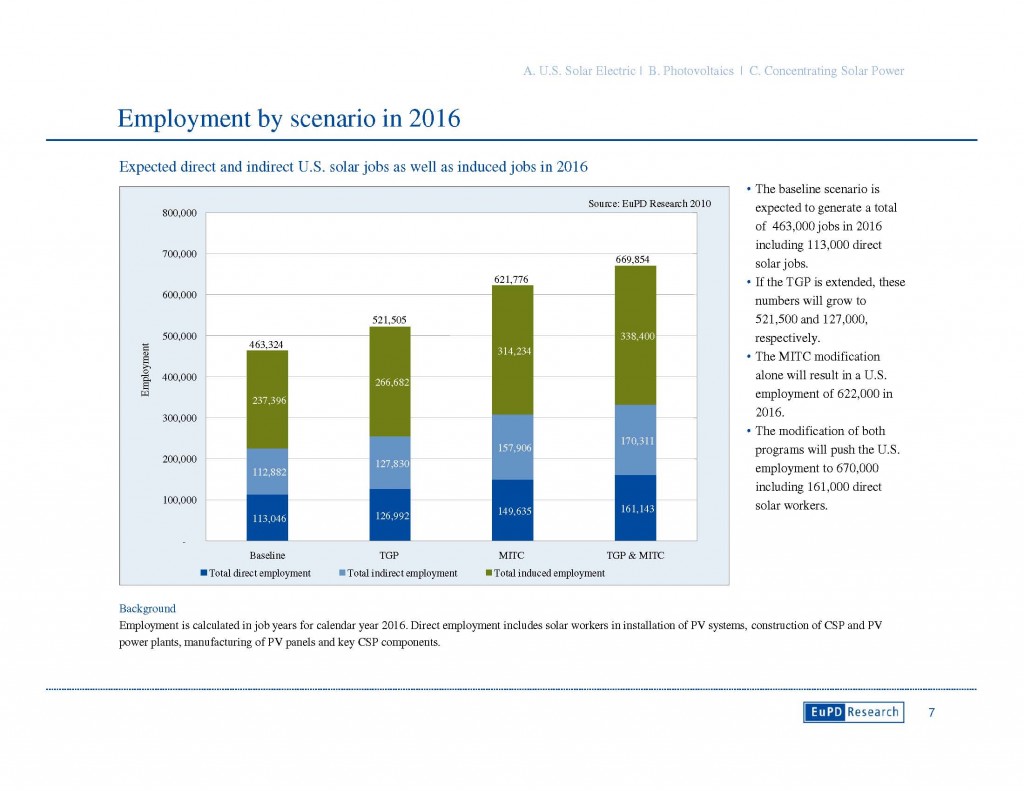

- An additional 67,000 jobs would be generated in 2015.

- The additional cumulative installation (2010-2016) over baseline would be 5,100 megawatts (MWp).

MITC Creation Only

Section 48 MITC creation will be an important factor to improve the competitive position of U.S. CSP and PV manufacturers, reduce prices to U.S. consumers and spur additional demand.

- Cumulative U.S. investment (2010-2016) in solar technologies would increase by $22 billion.

- An additional 158,000 jobs would be generated in 2016.

- The additional cumulative installation (2010-2016) over baseline would be 5,600 megawatts (MWp)

Both TGP Extension and MITC Creation

Promoting both TGP extension and the MITC creation within section 48 would have the strongest impact on the economy.

- Cumulative U.S. investment (2010-2016) in solar technologies would increase by $39 billion.

- An additional 207,000 jobs would be generated in 2016.

- The additional cumulative installation (2010-2016) over baseline would be 9,800 MWp.

Download full report (PDF): U.S. Solar Policy Impact Analysis

Click images below to enlarge

Tags: photovoltaic, SEIA, Solar, Solar Energy Industries Association

RSS Feed

RSS Feed