UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT

EXECUTIVE SUMMARY

International seaborne trade grows in 2012, but remains vulnerable to downside risks facing the world economy

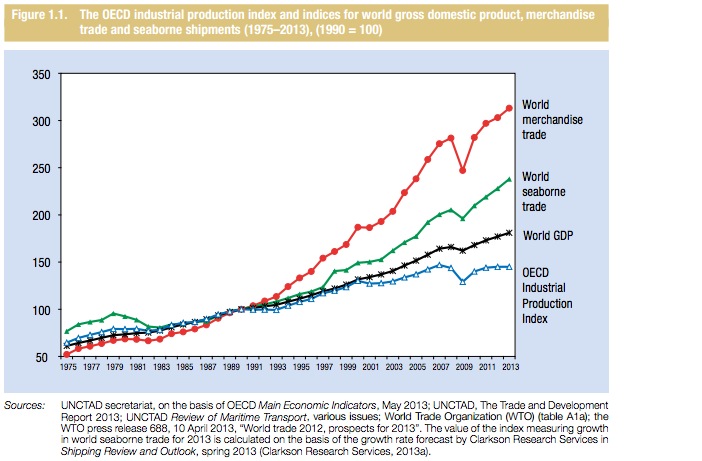

While the reorientation in global production and trade continues, with developing countries contributing larger shares to world output and trade, the performance of the global economy and merchandise trade in 2012 is a reminder of the high level of global economic integration and interdependence. During the year, growth in world gross domestic product decelerated to 2.2 per cent from 2.8 per cent recorded in 2011. In tandem, and reflecting a simultaneous drop in import demand of both developed and developing economies, the growth of global merchandise trade volumes also decelerated to 1.8 per cent year-on-year.

The knock-on effects of the problems in the European Union on developing economies are tangible, while the slowdown in larger developing countries, notably China and India, is resonating in other developing regions and low-income countries. Meanwhile, and driven in particular by a rise in China’s domestic demand as well as increased intra-Asian and South– South trade, international seaborne trade performed relatively well, with volumes increasing by 4.3 per cent during the year. The performance of international seaborne trade remains, nevertheless, vulnerable to downside risks as well as the uncertainty affecting the world economy and trade. It is also unfolding against a background of an operating landscape for maritime transport that is evolving and that entails some potentially game-changing trends and developments.

Evolving trends affecting international shipping and seaborne trade

Some key trends currently affecting international shipping and its operating landscape include the following elements:

- Structural shifts in global production patterns

- Continued negative effect of the 2008/2009 crisis on global demand, finance and trade

- Changes in comparative advantages and mineral resource endowments, in particular oil and gas

- Rise of the South and shift of economic influence away from traditional centres of growth

- Demographics, with ageing populations in advanced economies and fast-growing populations in developing regions and with related implications for global production and consumption patterns

- Arrival of container megaships and other transport-related technological advances

- Climate change and natural hazards

- Energy costs and environmental sustainability.

In this context, a number of challenges and opportunities with implications for international seaborne trade are also arising. Of all the prevailing challenges, however, the interconnected issues of energy security and costs, climate change and environmental sustainability are perhaps the most unsettling. Climate change in particular continues to rank high on the international policy agenda. Emerging opportunities, on the other hand, include for example:

- Deeper regional integration and South–South cooperation

- Growing diversification of sources of supply enabled by technology and efficient transportation

- Emergence of new trading partners and access to new markets facilitated by growing trade and cooperation agreements

- Expansion/opening of new sea routes (for example, expansion of the Panama Canal and Arctic routes)

- Increasing involvement of other developing economies, notably in Africa and South-East Asia, in lower added value and labour-intensive sectors as China moves up the value chain and rebalances towards higher value added sectors

- Growth in global demand induced by a growing world population and a rise in the middle class/ consuming category

- Emergence of developing-country banks (for example, the proposed BRICS bank – Brazil, the Russian Federation, India, China and South Africa) with the potential to raise funding to meet the significant needs for investment in transport infrastructure.

The turn of the largest shipbuilding cycle in history

The year 2012 saw the turn of the largest shipbuilding cycle in recorded history. Between 2001 and 2011, year after year, newbuilding deliveries reached new historical highs. Only in 2012, for the first time since 2001, was the fleet that entered into service during the year less than that delivered during the previous 12 months. In spite of this slowing down of new deliveries, the world tonnage continued to grow in 2012, albeit at a slower pace than in 2011. The world fleet has more than doubled since 2001, reaching 1.63 billion deadweight tons in January 2013.

Since the historical peaks of 2008 and 2009, the tonnage on order for all major vessel types has decreased drastically. As shipyards continued to deliver pre-ordered tonnage, the order books went down by 50 per cent for container ships, 58 per cent for dry-bulk carriers, 65 per cent for tankers and by 67 per cent for general-cargo ships. At the end of 2008, the dry-bulk order book was equivalent to almost 80 per cent of the fleet at that time, while the tonnage on order as of January 2013 is the equivalent of just 20 per cent of the fleet in service.

Since the historical peaks of 2008 and 2009, the tonnage on order for all major vessel types has decreased drastically. As shipyards continued to deliver pre-ordered tonnage, the order books went down by 50 per cent for container ships, 58 per cent for dry-bulk carriers, 65 per cent for tankers and by 67 per cent for general-cargo ships. At the end of 2008, the dry-bulk order book was equivalent to almost 80 per cent of the fleet at that time, while the tonnage on order as of January 2013 is the equivalent of just 20 per cent of the fleet in service.

Download full version (PDF): Review of Maritime Transport 2013

About the United Nations Conference on Trade and Development

unctad.org

“UNCTAD, which is governed by its 194 member States, is the United Nations body responsible for dealing with development issues, particularly international trade – the main driver of development.”

Tags: Maritime, UNCTAD, United Nations Conference on Trade and Development

RSS Feed

RSS Feed