NATIONAL RENEWABLE ENERGY LABORATORY

Executive Summary

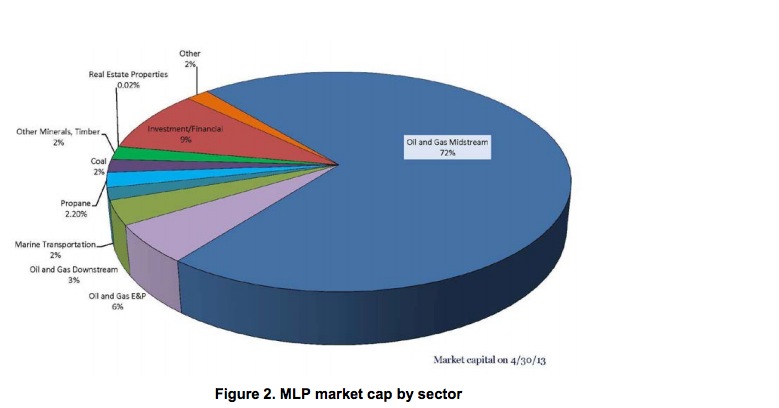

Master Limited Partnerships (MLPs) and Real Estate Investment Trusts (REITs) are two proposed investment vehicles that have the potential to lower the high cost of capital for renewable energy assets—a critical factor in the U.S. Department of Energy’s goal for renewable energy to achieve grid-parity with traditional sources of electric generation. Due to current U.S. federal income tax laws, regulations, and administrative interpretations, REITs and MLPs cannot finance a significant portion of the cost of renewable energy assets. Efforts are underway to alter these rules by changing the definition of “real property” (REIT) and “qualified income” (MLP). However, even with rule changes, both investment vehicles have structural challenges to efficiently finance renewable energy assets. Among them are (1) effectively utilizing the U.S. federal income tax incentives; (2) administratively structuring the investments to not be overly onerous or complicated, given the potential for pooling a relatively large amount of small assets; and (3) attracting and retaining a large enough investment community to participate in the funding opportunities. This report summarizes these challenges so that if proposed federal changes are made, stakeholders have an understanding of the possible outcomes.

The first section of this report summarizes current MLP and REIT markets and proposed rule changes. The second and third sections detail challenges to financing renewable energy assets with REITs and MLPs, respectively. Finally, the fourth section discusses possible investor responses to a renewable energy REIT or MLP.

Introduction to Master Limited Partnerships and Real Estate Investment Trusts

Master Limited Partnerships (MLPs) and Real Estate Investment Trusts (REITs) are investment vehicles organized under sections 7704 and 856 of the U.S. Internal Revenue Code (Code or IRC), respectively. These business structures combine advantages similar to those of a traditional publicly traded corporation with those of a private partnership. Public trading provides broad access to capital and liquidity, while a partnership-like model can avoid the double taxation that would otherwise occur at both the corporate and investor level in a public corporation.

MLPs and REITS are in many ways like a mutual fund; in fact, REITs are modeled directly off of the mutual fund structure. Mutual funds are equity investments registered with the Securities and Exchange Commission (subject to various federal and state regulations) and publicly traded on market exchanges. Like mutual funds, MLPs and REITs are designed to allow a typical retail investor to make investments that the investor may not otherwise have the opportunity to make; namely, modest investments in assets (or pools of assets), such as real estate or natural gas pipelines. MLP and REIT assets have certain attractive qualities similar to debt, Treasuries, or high-quality bonds because they are designed to produce long-term, stable cash flow distributions for their passive investors.

Key advantages of MLPs and REITs are highlighted as follows:

- Long-term, stable cash flows, typically through long-term, stable contracts

- Little to no MLP or REIT level tax, resulting in lower overall taxes on investment

- Transferable ownership units, available to a wide pool of investors (accredited, institutional, retail, or otherwise)

- Liquidity of investment, providing for easier exit

- Public exposure, providing transparency in price

- Portfolio of assets, offering diversification benefits

- Historically higher yields to investors than the S&P 500

- Ability to raise capital for corporate needs, such as acquisitions, through public market sale of units.

About the National Renewable Energy Laboratory

www.nrel.gov

“At the National Renewable Energy Laboratory (NREL), we focus on creative answers to today’s energy challenges. From fundamental science and energy analysis to validating new products for the commercial market, NREL researchers are dedicated to transforming the way the world uses energy. With more than 35 years of successful innovation in energy efficiency and renewable energy, today our discoveries provide sustainable alternatives for powering our homes, businesses, and our transportation system.”

Tags: Master Limited Partnerships, MLPs, National Renewable Energy Laboratory, NREL, Real Estate Investment Trusts, REITs, U.S. Department of Energy

RSS Feed

RSS Feed