ANALYSIS GROUP

1. Executive Summary

Overview and Context

In 2009, ten Northeastern and Mid-Atlantic states began the Regional Greenhouse Gas Initiative (known as “RGGI”), the country’s first market-based program to reduce emissions of carbon dioxide (“CO2”) from existing and new power plants. Understanding the program’s performance and outcomes is important given that RGGI states account for one-sixth of the population in the US and one-fifth of the nation’s gross domestic product. Through their development and implementation of the RGGI program, these states have gained first-mover policy experience and have collaborated to form a multi-state emission-control policy that has reduced CO2 emissions and operated seamlessly with well-functioning and reliable electricity markets. Insights and observations gleaned from an analysis of the program’s performance will be valuable in evaluating past policy decisions and future policy recommendations, and may be relevant to other states and regions as they develop their own plans to reduce CO2 emissions in response to the Environmental Protection Agency’s (“EPA’s”) proposed Clean Power Plan.

This Report analyzes the economic impacts of RGGI’s most recent three years, covering the years 2012 through 2014. This analysis follows on our prior November 2011 Report (hereafter “AG 2011 Report”) that assessed the economic impacts of RGGI’s first three years (2009-2011). Since the time of our last economic review, the electric industry has experienced changes in power plant economics, emission-control requirements, and wholesale market structures in the RGGI region. In addition, the RGGI states completed a comprehensive program review during 2012, and modified elements of the program including, most importantly, adopting a significantly lower overall cap on CO2 emissions in the RGGI region.

In light of all of these changes, we not only examine the program’s performance in the 2012-2014 period, but we also review whether and to what extent the lessons learned from our prior assessment should be altered to reflect the economic realities of the three most-recent years. For this Report, we apply the same modeling approach as in the AG 2011 Report, but focus our analysis squarely on the economic impacts of the past three years.

In this report, Analysis Group has tracked the path of RGGI-related dollars as they leave the pockets of competitive-power generators who buy CO2 allowances to demonstrate compliance, show up in electricity prices and customer bills, make their way into state accounts, and then roll out into the economy through various pathways. Our analysis is unique in this way – it focuses on the actual observable flow of payments and economic activity: known CO2 allowance prices; observable CO2 auction results; dollars distributed from the auction to the RGGI states; actual state-government decisions about how to spend the allowance proceeds; measurable reductions in energy use from energy efficiency programs funded by RGGI dollars; traceable impacts of such expenditures on prices within the power sector; and concrete value added to the economy. By carefully examining the RGGI states’ implementation of the program to date, based on real data, we hope to provide a solid foundation for observations that can be used by others in the design of CO2 control programs going forward.

This review is timely for several reasons. First, as the RGGI states look forward to continued program administration in upcoming years, and to possible adoption of RGGI as the core of these states’ plans to meet EPA’s Clean Power Plan compliance requirements, they may benefit from more recent analysis of whether, and to what extent, past program and industry changes have affected the impact of power-sector carbon-control programs on the economies of the states in the Northeast. Such an analysis takes into account how changes in program design and the states’ allocation of the proceeds of CO2-allowance auctions has affected program pricing and the mix of economic costs and benefits.

Perhaps more importantly, the lessons learned from the RGGI program’s implementation and impacts have potential usefulness beyond the RGGI states. With the issuance of EPA’s proposed Clean Power Plan in June 2014 (and anticipating release of its final rule in mid-late summer 2015), states across the country have begun to consider compliance alternatives. Over the next several years, states will have to decide how to approach their Clean Power Plan compliance, including: what control measures and approaches to adopt; whether to select rate-based or mass-based compliance mechanisms;3 whether to allow averaging or bubbling of emissions within states; whether to go it alone or enter into compliance agreements with other states; whether to join an existing (or create a new) regional CO2 mass-based market trading system, like RGGI; and whether to opt for the EPA to issue a federal implementation plan, rather than develop a state plan. In this context, having historical real-world information on the economics and program-design features of an existing CO2 compliance program may be a valuable input into state decision-making. Six years of successful administration of RGGI provides a wealth of data and insights into key decisional factors for states around prospects for collaboration, joint governance and administration, program design and evolution, electricity price changes, and impacts on state and regional economies.

RGGI has now been operating for over six years. In every year, the emission allowances – or rights to emit CO2 – have been almost entirely dispersed into the market through coordinated (centralized) regional auctions. Owners of fossil-fueled power plants have spent nearly $2 billion to buy CO2 allowances over the six years, and include the cost of allowances in their offer prices in wholesale electricity markets in New England, New York, and parts of the PJM region. The grid operators in these regions take these offer prices – including allowance costs – into account as they dispatch the plants on the system. As a result, consumers now pay electricity rates that reflect a price on CO2 emissions without grid operators superimposing any other dispatch rule to account for emissions.

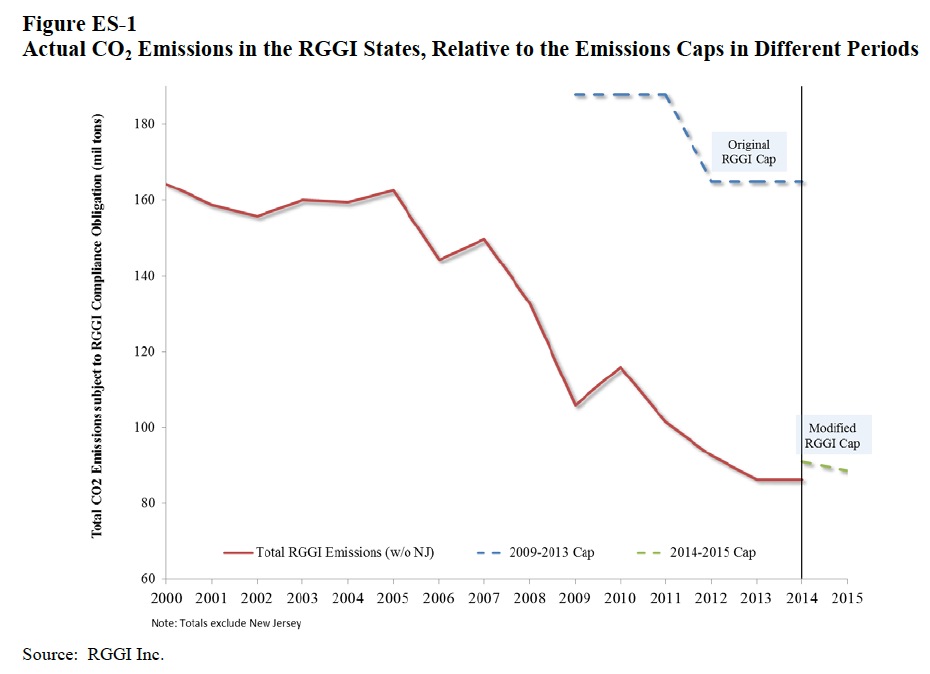

Throughout the RGGI program’s implementation, power system reliability has been maintained and CO2 emissions from power generation have decreased, affected by RGGI’s original design, subsequent alteration of the RGGI cap, and broader economic and industry factors. As shown in Figure ES-1, CO2 emissions (shown through 2014) have declined throughout the RGGI program life.

About the Analysis Group

www.analysisgroup.com

Since 1981, Analysis Group has provided expertise in economics, finance, health care analytics, and strategy to top law firms, Fortune 500 companies, global health care corporations, and government agencies. Our work is grounded in a collaborative approach that allows us to effectively integrate the best ideas from leading academic and industry experts with our more than 600 professionals. As a result, our clients receive thoughtful, pragmatic solutions to their most challenging business and litigation problems. Through our work in thousands of cases across multiple industries, we have become one of the largest economics consulting firms in North America, with 11 offices in the United States, Canada, and China.

Tags: Analysis Group, Clean Power Plan, Environmental Protection Agency, EPA, Greenhouse Gases, Mid-Atlantic, Northeast

RSS Feed

RSS Feed