PricewaterhouseCoopers (PwC)

The US is currently the world’s second largest infrastructure market, having been overtaken by China in 2009, according to PwC analysis. Infrastructure has been hit by the economic downturn over the past few years, with total spending only just recovering to 2008 levels in 2012 by our estimates.

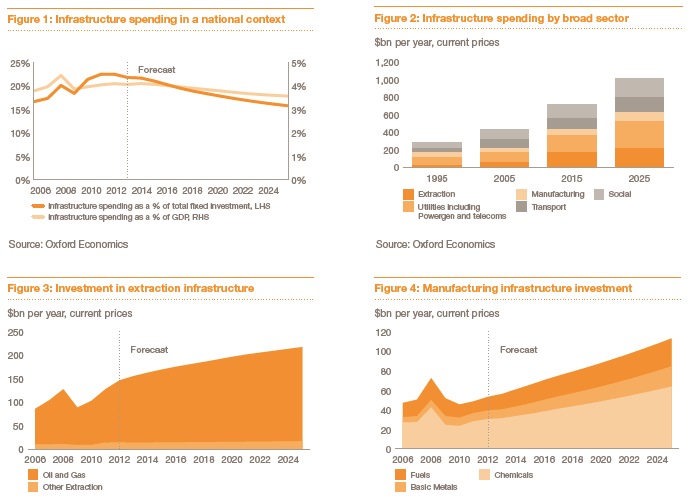

Looking ahead, relatively constrained government finances may slow the pace of investment growth in social and transportation sectors. Driven by a conducive policy environment, we expect shale oil and gas extraction to grow faster in the US than in most other countries, pushing total extractive investment to over $200bn a year by 2025, and the US’s share of total world oil and gas output from 15% or so to 17%.

In turn, lower energy costs may boost competitiveness in heavy energy-using sectors. It is estimated that overall industrial output will likely be around 2% higher in the longterm than in a non-shale scenario. But the impacts are very much concentrated on heavy energy-using sectors such as chemicals and metals. The boon to these sectors could be much greater than the economy-wide impact, spurring faster investment in these sectors than in other high-income economies. But of course, “new economy” sectors will likely also continue to thrive in the US, with substantial investment in telecommunication networks, which we expect to increase from $77bn in 2013 to $160bn in 2025.

By 2025, annual investment in infrastructure across our sectors in the US should top $1trn, having grown by an average of just over 3.5% a year. But the US will likely have been long since left behind by China, where we expect annual spending will reach over three times this level. We estimate that the US’s share of global spending will likely decline gradually over the coming decade to just over a tenth of total global spending by 2025.

Download full version (PDF): Infrastructure Spending in the US

About PwC

www.pwc.com

“We bring a global perspective along with in-depth knowledge of local, state and US issues. In 1998, Price Waterhouse and Coopers & Lybrand merged to create PricewaterhouseCoopers. We have a long history of delivering value-added professional services to our clients. Our accounting practice originated in London during the mid-1800’s…PwC focuses on audit and assurance, tax and consulting services. Additionally, in the US, PwC concentrates on 16 key industries and provides targeted services that include — but are not limited to — human resources,deals, forensics, and consulting services. We help resolve complex issues and identify opportunities.”

RSS Feed

RSS Feed