URBAN LAND INSTITUTE (ULI)

CENTER FOR SUSTAINABILITY AND ECONOMIC PERFORMANCE

Chapter 1: Introduction

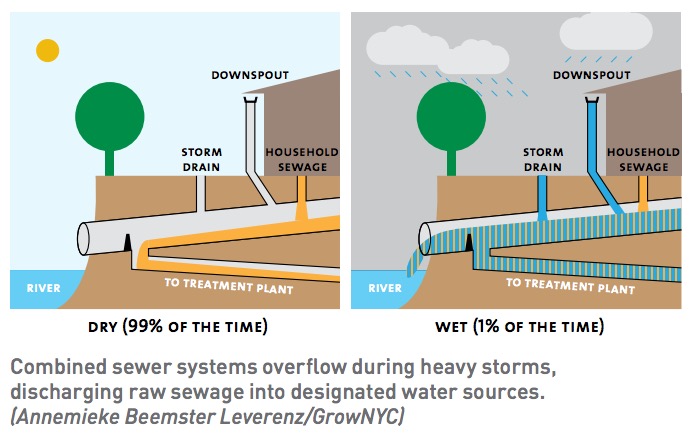

Water abundance and scarcity are topics of increasing importance in cities across America. With growing concern about flooding, weather-induced overflows from sewer systems, and extreme storms, communities are seeking strategies to better manage stormwater runoff, improve local water quality, and decrease pressure on overloaded sewer systems. At the same time, water is increasingly recognized as a community resource, one that can be harnessed to make cities more sustainable and livable.

Managing Water: The Real Estate Sector’s Role

Private sector developers and designers are playing a growing role in meeting cities’ water goals. Local regulations are seeking increased participation from the private sector, requiring or incentivizing the real estate community to incorporate enhanced water management mechanisms into new development projects. These water management mechanisms have the potential to create value for real estate projects by enhancing aesthetics, operational efficiency, and building user experience.

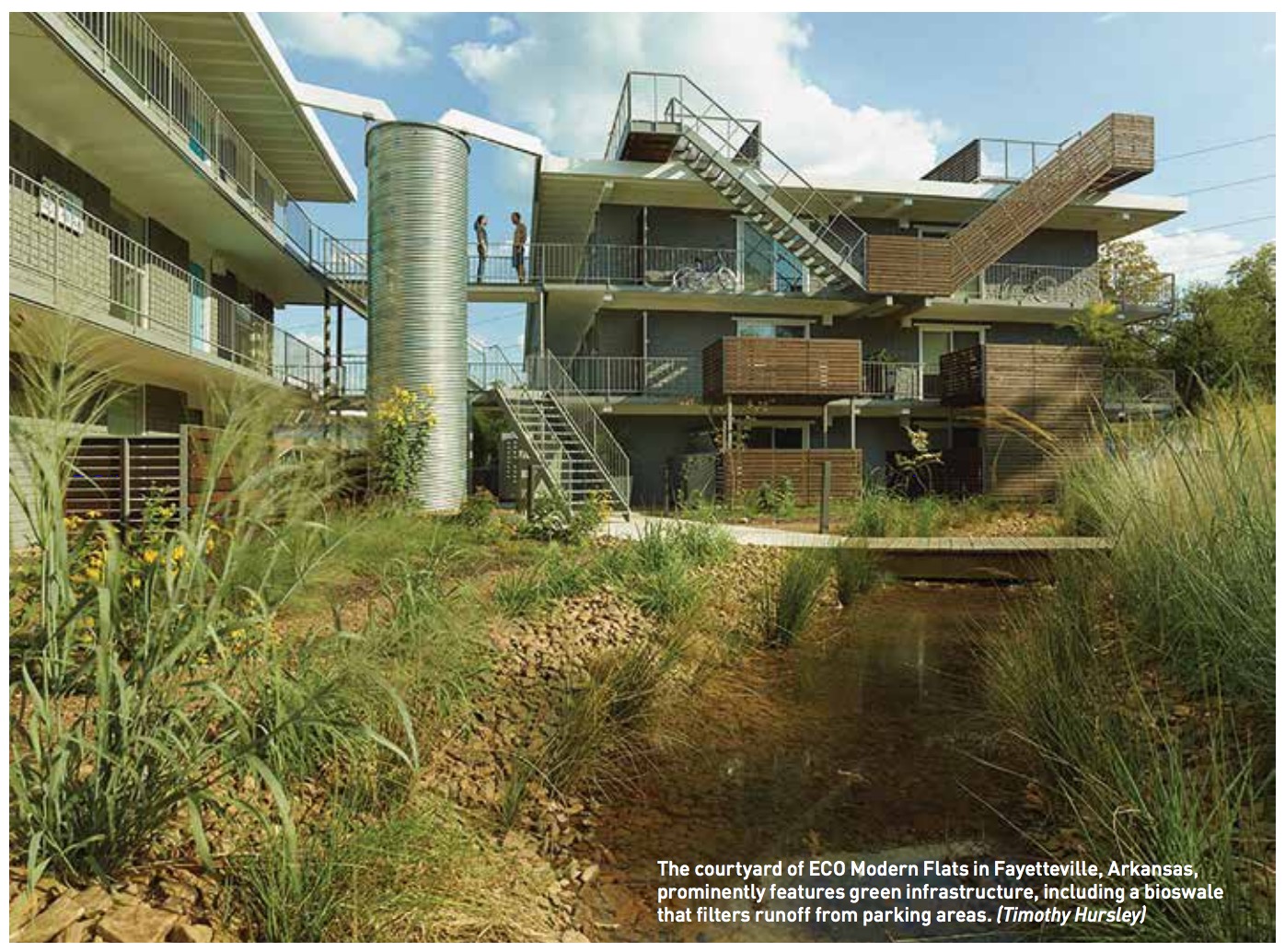

At the heart of many new stormwater policies is the concept of green infrastructure. The phrase has emerged as a catch-all term for approaches to managing stormwater with natural systems as an alternative to traditional gray drainage infrastructure, such as pumps and pipes. Green infrastructure is intended to capture stormwater, enhance water and air quality, and create attractive green spaces. Visible green infrastructure, such as rain gardens, bioswales, and green roofs, are accompanied by unseen technologies for water reuse, such as cisterns and rainwater recycling systems. Approaches to green infrastructure, on both the citywide and project scale, also enhance urban resilience by using flexible interventions to improve preparedness for both flooding and drought.

Whereas the concept of green infrastructure is not new, the notion of municipal policies creating a coordinated citywide green infrastructure network—including both public and privately owned sites—is. These networks require extensive participation from the private sector, enforced through policy requirements for newly developed and refurbished sites. In short, municipalities envision the public sector incorporating green design into public spaces, buildings, and rights-of-way while the private sector does the same for privately owned buildings, open spaces, and roofs.

Municipalities are increasingly requiring or incentivizing this approach in real estate projects and encouraging reductions in impervious surfaces such as concrete. Local governments are also providing frameworks supporting citizens, community groups, and institutions interested in incorporating green infrastructure into their properties, whether through grant programs, big data projects, demonstration projects, or idea competitions.

Many real estate developers are responding to new regulations by incorporating the requirements into their business models. Indeed, some developers have successfully leveraged stormwater management mechanisms not only to reduce and manage runoff, but also to add value to their buildings.

Whether by increasing potential development yield, introducing tangible amenities for residents, reducing operating costs, or building on a broader placemaking strategy, innovative stormwater management strategies can create value and contribute to quality of life and resilience in cities.

Case Studies

Developers across the United States are increasingly incorporating green infrastructure into their projects, whether on account of stormwater policy requirements or for other reasons that range from marketing value to compliance with green rating systems to cost savings.

Alongside an analysis of city policies, this report introduces the following real estate projects that have included green infrastructure and seen successful development outcomes:

- Atlantic Wharf, Boston, Massachusetts—a 31-story Class A office, retail, and residential development, described as “Boston’s first green skyscraper,” with a pioneering stormwater management system;

- Burbank Water and Power Eco Campus, Burbank, California— a campus for a community-owned utility site, which is the first power plant in the world to run on 100 percent recycled water;

- Canal Park, Washington, D.C.—a neighborhood park developed by a public/private partnership and located on the site of a former D.C. waterway, with 95 percent of the park’s irrigation, fountain, toilet-flushing, and ice-rink water provided through rainwater recycling;

- Encore!, Tampa, Florida—a 28-acre public/private, mixed-use, mixed-income development with an 8,000-square-foot stormwater retention harvesting system and a stormwater vault designed as the centerpiece of a public park;

- High Point, Seattle, Washington—a HOPE VI redevelopment, currently the Seattle Housing Authority’s largest residential project at 1,700 affordable and market-rate homes, with an extensive natural drainage system featuring bioswales and constructed wetlands;

- Market at Colonnade, Raleigh, North Carolina—a 57,000-square-foot commercial development capable of capturing up to 800,000 gallons of rainwater, including a Whole Foods Market that chose to include a visible cistern as part of its branding for the site;

- Meier & Frank Delivery Depot, Portland, Oregon—an office development in a National Register of Historic Places building in downtown Portland, with a rainwater recycling system that saves an estimated 193,000 gallons of water annually;

- Penn Park, Philadelphia, Pennsylvania—a community open space developed through public/private partnership by the University of Pennsylvania and designed in response to Philadelphia’s Green City, Clean Waters plan and the university’s Climate Action Plan;

- Stonebrook Estates, Harris County, Texas—a Houston-area residential development with a low-impact development approach that stood up to catastrophic flooding during the Tax Day floods of 2016;

- The Avenue, Washington, D.C.—a mixed-use, transit-oriented development in downtown Washington that features a robust stormwater management system set in an inviting residential courtyard; and

- The Rose, Minneapolis, Minnesota—a 90-unit mixed-income residential project designed for on-site treatment of all stormwater, with features that include a rain garden and cisterns.

Lessons Learned

Cities often choose to incentivize or require stormwater management from the real estate sector because of top-down regulatory measures addressing water quality. Indeed, the U.S. Environmental Protection Agency (EPA) estimates that approximately 860 communities representing 40 million residents are affected by combined stormwater and sewage runoff in the United States.1 Much of the municipal interest in enhanced stormwater management originates from regulatory measures addressing these water quality problems, such as the EPA’s consent decrees to mitigate combined sewer overflows (CSOs). The 1972 Clean Water Act underpins these actions.

However, although the impetus to address stormwater management is often top-down, American cities’ approaches to stormwater policy have differed across local markets, responding to differing markets conditions, annual rainfalls, and climate challenges. Conversations with real estate developers, designers, planners, and policy makers active in stormwater management shed light on numerous themes and lessons common to communities involving the real estate sector in stormwater management:

For cities, green infrastructure offers an opportunity to enhance environmental performance and save money, compared to costly gray infrastructure projects that do not offer other community benefits. Cities across the United States are embracing green infrastructure approaches because they offer social, economic, and environmental benefits while addressing water challenges. Green infrastructure cost-effectively reduces sewer system overflows and manages stormwater runoff, improves local water quality, decreases the use of potable water, reduces heat-island effects, improves public health, enhances recreational opportunities, increases employment, and stimulates economic growth—all at a lower cost than gray infrastructure solutions alone.

Unlike large-scale CSO pipe-and-tunnel mitigation projects, a green infrastructure approach allows small-scale interventions and participation by private landowners. Lower upfront and maintenance costs can also make green infrastructure more accessible, resilient, and cost-effective than large-scale gray infrastructure investments.

For real estate developers, green infrastructure provides opportunities for cost saving by freeing up more developable land than traditional water management solutions. Using green infrastructure or low-impact development (LID) can be a more cost- and space-efficient means of achieving stormwater management requirements than gray infrastructure or traditional approaches such as detention ponds. Numerous projects profiled in this report chose to take innovative approaches to water management to free up space on constrained sites and achieve a larger developable area.

Green infrastructure can enhance the attractiveness and value of a property and reduce operating costs. Real estate developers, designers, and building operators interviewed for this report emphasized the multiple benefits that green infrastructure and stormwater management mechanisms have brought to their properties, often leading to increased real estate value.

From improving the design of the public realm to creating educational opportunities and amenities, many interviewees saw green infrastructure as offering social and community benefits that contribute to real estate value and marketing opportunities. Many also spoke of the opportunities to operationalize green infrastructure, generating savings on utilities, maintenance, water use, and upkeep.

The emerging range of green infrastructure policies and strategies works in different markets and contexts. Cities across the country have used policies in different combinations appropriate to their local market conditions and environmental needs. Real estate projects profiled in this report include historic buildings and high-density developments as well as open space–rich and suburban projects.

Green infrastructure mechanisms can be effectively implemented in scenarios when space is at a premium. Stormwater credit-trading systems, such as the system recently launched in Washington, D.C., offer an alternative strategy for achieving compliance in densely developed areas by supporting off-site green infrastructure within the same watershed.

Green infrastructure may require an initial learning curve, but the payoff can be large. Interviewed policy makers and city-planning practitioners indicated that the real estate community is often initially hesitant about new stormwater policies. Property developers and owners also indicated that design and operation of stormwater projects requires a learning curve, particularly in terms of landscape maintenance for green infrastructure installations such as bioswales and rain gardens.

However, after local designers and developers had learned how to accommodate green infrastructure requirements and work them into the initial stages of the design process, incorporating green infrastructure became part of business as usual.

With this increasing familiarity, the real estate community also recognized the opportunities for improved amenities, aesthetics, and marketing appeal that can be derived from green infrastructure. As stormwater management policies continue to gain traction, cities and developers can learn from each other and gauge the success of different models through research and practitioner networking programs.

Real estate owners and operators value green infrastructure’s performance during peak weather events and the added security this brings to their investments. Green infrastructure can be a particularly valuable investment during peak weather events such as floods, which can damage properties and shut down day-to-day activities across communities. In this way, investment in stormwater management can enhance the resilience of buildings, neighborhoods, and communities, thereby ensuring that lives and livelihoods are not interrupted while also improving quality of life and environmental performance on a day-to-day basis.

Download full version (PDF): Harvesting the Value of Water

About the Urban Land Institute (ULI)

uli.org

The Urban Land Institute is a global, member-driven organization comprising more than 40,000 real estate and urban development professionals dedicated to advancing the Institute’s mission of providing leadership in the responsible use of land and creating and sustaining thriving communities worldwide.

Tags: bioswales, Center for Sustainability and Economic Performance, Green Infrastructure, ULI, Urban land Institute, Water

RSS Feed

RSS Feed