OXFORD ECONOMICS

GLOBAL INFRASTRUCTURE HUB

Executive Summary

Across the globe, a well-functioning, modern infrastructure is central to economic development and to quality of life. From the roads and railways needed to transport people and goods, to the power plants and communications networks that underpin Economic and household activity, to the basic human need for clean water and sanitation, infrastructure matters to people and business everywhere.

Infrastructure investment is crucially important for the most advanced economies and those at the early stages of development alike. In developing economies, as roads are built, reliable electricity installed and clean water made available to all, infrastructure can have a truly transformative impact on the lives of citizens and the prospects of businesses. In more mature economies too, keeping pace with demand, and building new and upgraded infrastructure, is integral in efforts to sustain economic growth.

Attempts to track and monitor infrastructure investment, however, and to break this down by sectors and countries, and over time, are limited. This has made it difficult to predict how, where and when investment is most needed. This study addresses this knowledge gap. It explores how much the world needs to invest in infrastructure in the years to 2040, and in which sectors this investment will be needed. It considers the countries that appear to be on the right track, and identifies those that need to do more.

As well as exploring how infrastructure investment will develop based on current trends, this study adopts an innovative approach to assess infrastructure needs based on comparison with countries’ best performing peers. The granularity this study provides is unique: it collates data and creates forecasts for seven sectors in 50 countries, over a period of 25 years.

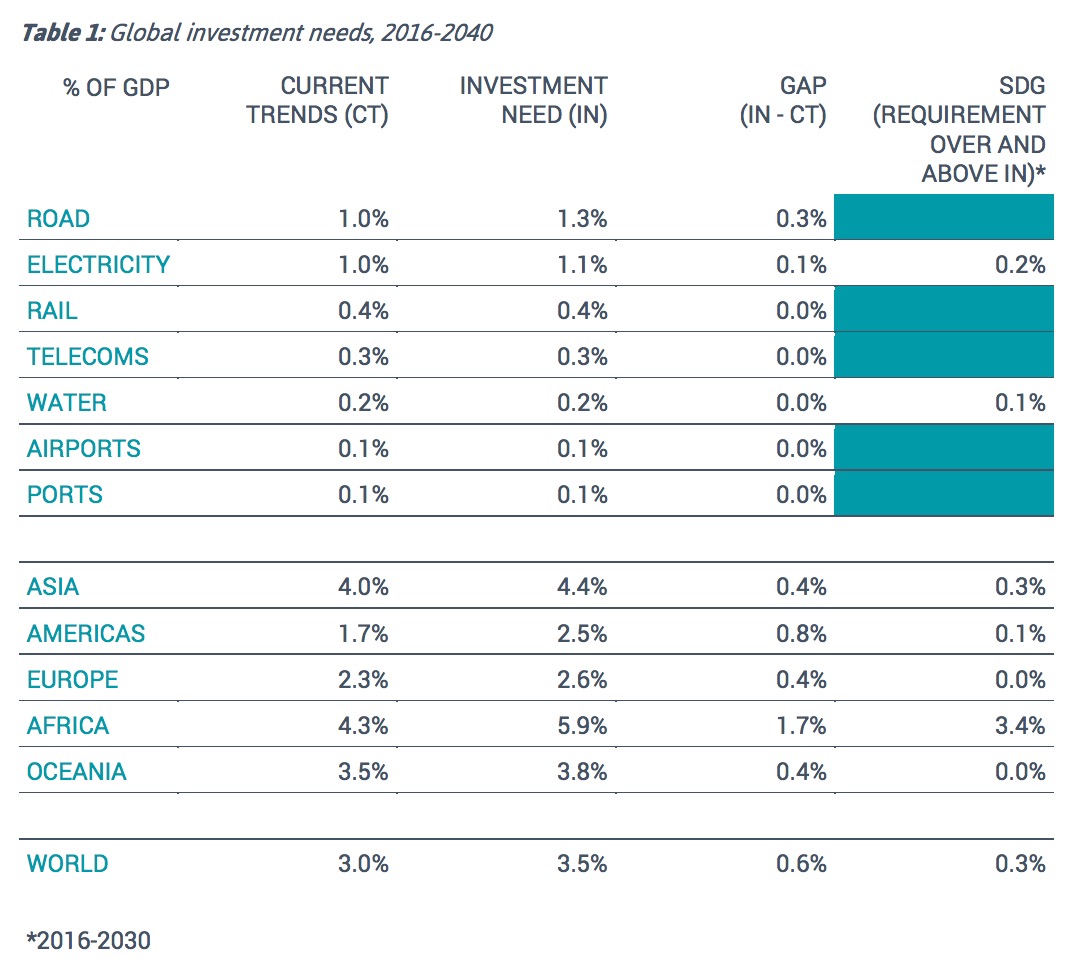

We estimate global infrastructure investment needs to be $94 trillion between 2016 and 2040. This is 19 percent higher than would be delivered under current trends, and is an average of $3.7 trillion per year. To meet this investment need, the world will need to increase the proportion of GDP it dedicates to infrastructure to 3.5 percent, compared to the 3.0 percent expected under current trends.

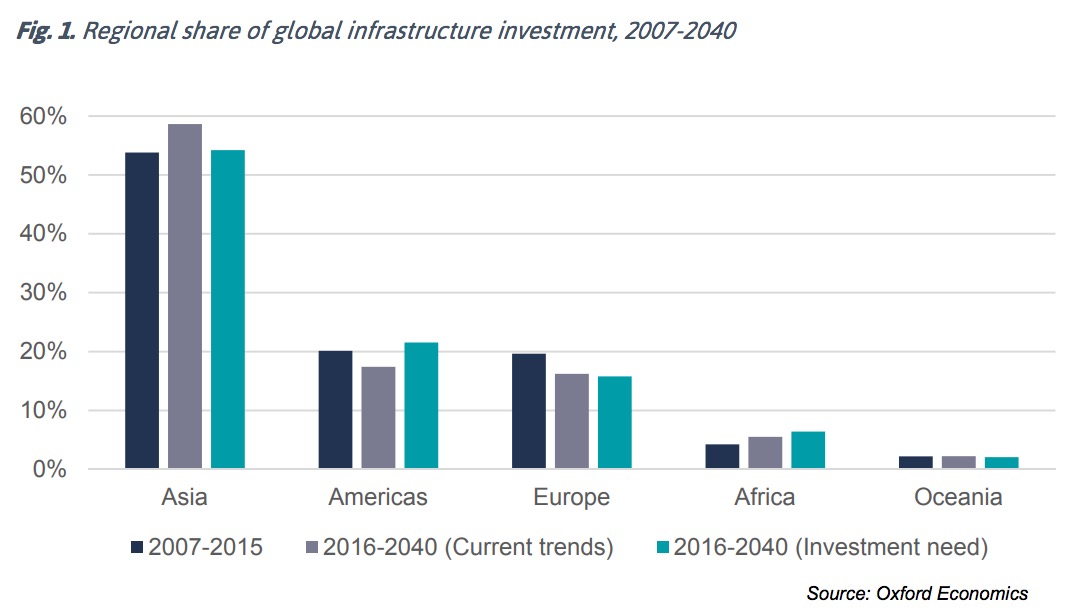

Asia will dominate the global infrastructure market in the years ahead as it does at present. Asia accounts for some 54 percent of global infrastructure investment needs to 2040, compared to 22 percent for the Americas, the next largest region. Indeed, just four countries account for more than half of global infrastructure investment requirements to 2040: China, the US, India and Japan. China alone is estimated to account for 30 percent of global infrastructure needs.

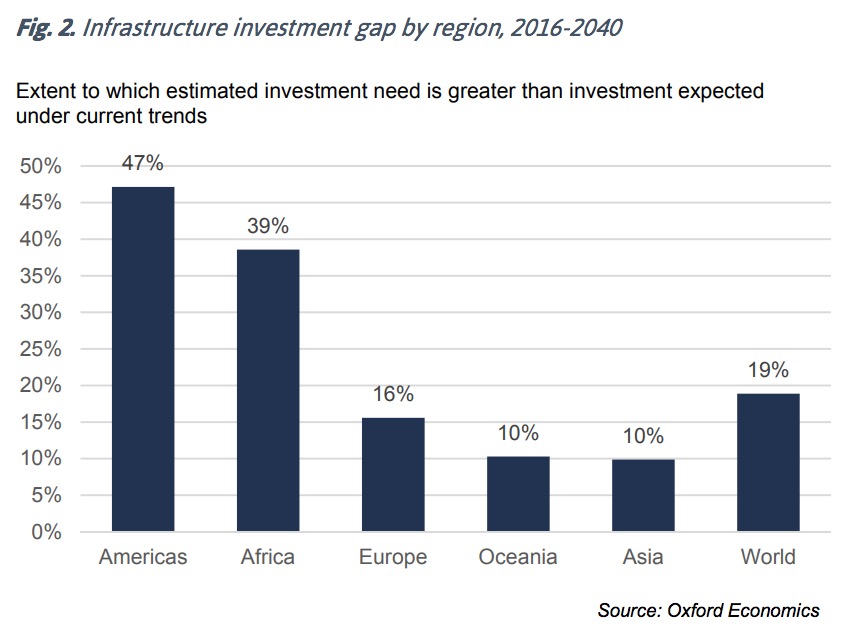

The infrastructure investment gap is proportionately largest for the Americas and Africa. Comparing our forecasts of infrastructure need to what would be delivered under current trends enables us to estimate the infrastructure investment ‘gap’. Our analysis suggests that investment needs in the Americas are 47 percent greater than forecast investment under current trends. For Africa the equivalent figure is 39 percent. While the latter offers considerable growth potential, the African infrastructure market remains small in absolute terms: the region accounts for 6 percent of global infrastructure investment need.

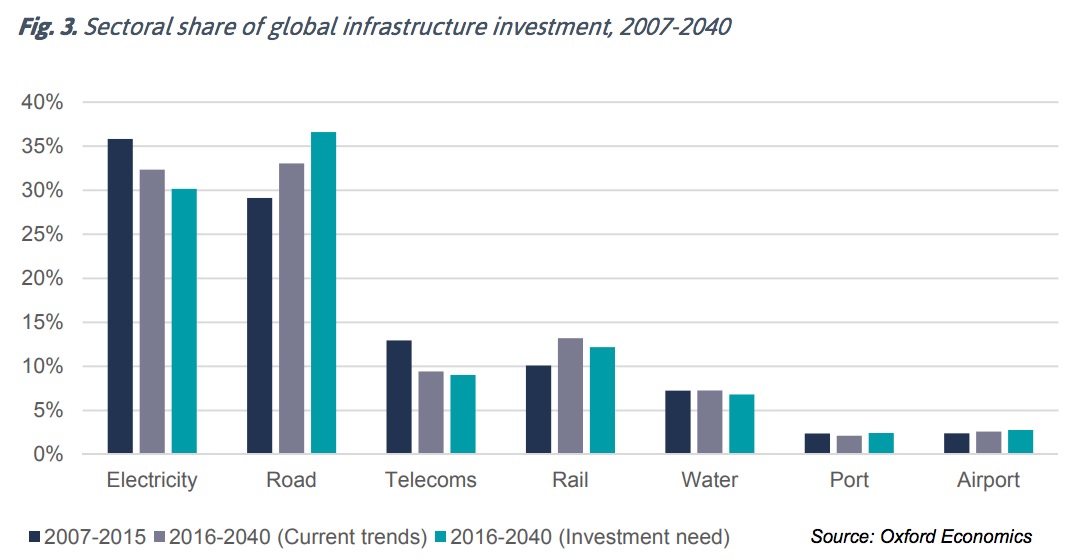

Electricity and roads are the two most important sectors―together they account for more than two-thirds of global investment needs. The investment gap between the two scenarios is greatest in the roads sector, where investment needs are 31 percent higher than would be delivered under current trends. The gap is also relatively large for ports and airports, where investment needs are 32 percent and 26 percent greater than our current trends forecast, respectively.

If GDP growth is higher than forecast, the requirement for infrastructure will be higher still. We also, therefore, explored a scenario under which global GDP growth is assumed to be 0.4 percentage points higher for the duration of the forecast period. Under this scenario, the total global spending requirement for 2016 to 2040 would be some $9-10 trillion, or 11 percent more.

Meeting the UN Sustainable Development Goals for universal access to drinking water, sanitation and electricity by 2030 increases the global infrastructure need by a further $3.5 trillion by 2030. We find that meeting the SDGs for drinking water and sanitation will require investment of $1.9 trillion, while providing universal access to electricity by 2030 will be particularly challenging for the world’s poorest countries, requiring some $3.9 trillion of investment. To meet these objectives, the total global infrastructure investment need to 2030 would be some $3.5 trillion higher than in our main scenario, equivalent to an additional 0.3 percent of world GDP.

Countries all over the world need to invest heavily in infrastructure to meet the needs of their citizens and underpin productivity throughout their economies. This study provides a detailed analysis of the countries and sectors where this investment will be needed. It represents a timely and significant addition to the debate.

Download full version (PDF): Global Infrastructure Outlook

About Oxford Economics

www.oxfordeconomics.com

Oxford Economics is a key adviser to corporate, financial and government decision-makers and thought leaders. Our worldwide client base now comprises over 1000 international organisations, including leading multinational companies and financial institutions; key government bodies and trade associations; and top universities, consultancies, and think tanks.

About Global Infrastructure Hub

www.gihub.org

Global infrastructure Hub is a G20 initiative with the goal of increasing the flow and quality of private and public infrastructure, by facilitating knowledge sharing, highlighting reforms and connecting public and private sectors globally.

Tags: G20, Global Infrastructure Hub, Investment Gap, Oxford Economics

RSS Feed

RSS Feed