MINETA TRANSPORTATION INSTITUTE

Executive Summary

General consensus among transportation professionals claims that there is a dearth of funding available to invest in and maintain existing infrastructure. This is compounded by the increasing incidence of extreme weather events, which are exacerbated by a changing climate. Superstorm Sandy, which hit New Jersey in October 2012, is a case in point, as it caused widespread damage to the transportation network. This research seeks to understand public attitudes in New Jersey about funding more resilient infrastructure in the immediate aftermath of Superstorm Sandy

A statewide survey was administered approximately four months after Superstorm Sandy. This survey instrument gathered data on attitudes about five potential temporary revenue-raising approaches for funding vulnerability mitigations. Data on attitudes about the importance of investing in transportation infrastructure were also gathered, as well as a set of attitudinal questions typically used to characterize political beliefs.

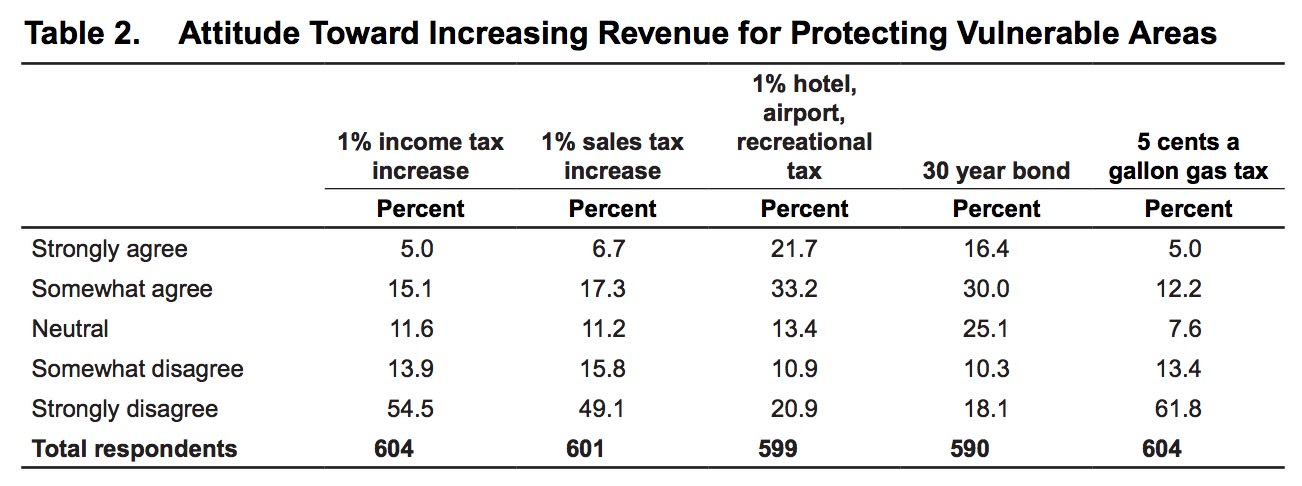

The results show little to no support for the revenue-raising policies proposed in the survey. Specifically, the majority of respondents did not support raising revenue by way of a five cent gasoline tax increase, a one percent income tax increase, or a one percent sales tax increase, all of which were presented with a five-year sunset provision. There was a small majority support for a hotel/recreational tax of one percent, again, with a five-year term, and a plurality of support for issuing 30-year bonds. The authors characterize these latter as policies that “tax others”—i.e., visitors and future generations—while the former policies are characterized as “tax myself.” At the same time, the study find that a majority of respondents agree that it is important to invest in new roads, new transit, and maintenance and protection for existing transportation infrastructure.

Multivariate analysis of factor scores for these two characterizations of the revenue-raising policies find no demographic associations. The main finding is that those who are more “left-leaning” in their political beliefs are more likely to support taxing themselves. The authors also found that those who agree that investing in public transit and protecting infrastructure are important also support self-taxation policies. There are no parallel associations in the models for “taxing others,” none of which pass standard tests of model fit.

The authors further examine the approximately 10 percent of the sample who, while disagreeing with all five revenue-raising policies, demonstrate majority support for the importance of investing in, maintaining, and protecting transportation infrastructure.

Even after the most costly disaster in New Jersey history, the New Jersey public deeply opposes tax increases—especially gasoline taxes—but still wants better infrastructure. Unfortunately, there is no way to have both.

I. Introduction

Nationally, a long-term funding crisis in transportation is due primarily to increased maintenance and infrastructure needs coupled with flat and declining revenue from the federal gasoline tax (National Surface Transportation Policy and Revenue Study Commission 2007). Some states have coped with this crisis by increasing their own state gasoline taxes, dedicating sales tax revenues to transportation projects, or issuing bonds to fund their own transportation trust funds. New Jersey is a case in point, with a transportation trust fund that is nearly insolvent, with no prospect of increasing what is now the second-lowest fuel tax in the nation, and with an extensive backlog of maintenance needs. Moreover, the state faces forecasts of increasing demand, especially on commuter rail links to New York City. A recent New York Times headline succinctly stated: “New Jersey Faces a Transportation Funding Crisis, With No Clear Solution” (Fitzsimmons 2015).

On top of these funding needs, the state has seen two recent natural disasters—Hurricane Irene in 2011, followed a year later by Superstorm Sandy. Sandy devastated communities along the New Jersey shore, while Irene delivered significant flooding along streams and rivers. These events are within recent memory, and both had a major destructive impact on the transportation network. These extreme adverse weather events underscore the need to increase the system’s resilience as well as demonstrate first-hand the need to make various infrastructure repairs. The most notable damage to existing infrastructure, the degradation of the Hudson River tunnel to New York City, was due to salt water intrusion from flooding during Sandy (Higgs 2014). That tunnel is now forecasted to have a limited lifetime of less than 20 years (Strunsky 2014).

The objective of this research is to assess whether natural disasters and experience with damaged infrastructure affect views on whether public funding should be dedicated to protecting the vulnerability of communities. Survey data were collected via a random-digit dialing phone survey approximately four months after Superstorm Sandy with the explicit research purpose of gathering information on attitudes and opinions following a major disaster. This provides a unique opportunity to assess, under extreme events, whether the public supports increasing various tax revenues or floating a bond issue dedicated to reducing vulnerability.

To collect the necessary data, the questionnaire was authored to make clear to the respondent that transportation infrastructure is a substantial part of the state’s vulnerability. The survey specifically probed whether there is any support for very small increases in income tax rates, sales taxes, hotel and recreation taxes, gasoline taxes, all with a five-year sunset provision, or a 30-year bond issue as potential revenue sources. In this analysis, the authors examine various attitudinal correlates with support for these five revenue-raising policies; in particular, they examine associations with attitudes toward the need to build, maintain, or protect transportation infrastructure.

Other work in this stream examined post-extreme weather event attitudes toward global climate change (Weiner 2014; Weiner 2015a), limiting the number of times homeowners can receive disaster relief (Greenberg, Weiner 2014), as well as support for public policies to reduce risk (Greenberg et al. 2014). The risk policy study found a strong preference to reduce risks to individuals, families, and communities, and yet an unwillingness to support funding for that risk reduction. Rather than approaching the issue from the human risk reduction perspective, one can learn a great deal from the other side of the coin, i.e., the public’s support for transportation infrastructure funding.

More than two years after Sandy, the funding situation for transportation in New Jersey has not changed. Despite an obvious demonstrated need for funding to maintain and protect infrastructure, why has no solution been found? Why does no credible plan appear in sight even at this writing? While the answers to these questions are likely political, why does the public tolerate, much less not protest, the current state of the infrastructure? To that point, an April 2015 Quinnipiac University Poll found for the first time a slim majority approval for a gasoline tax increase to fund highways and transit (50% approval vs. 47% disapproval) although the margin of sampling error was ±2.6% (Quinnipiac University Poll 2015). The same survey found that 89% of respondents believe that it was “very” or “somewhat” important that the Hudson Bay tunnel between New Jersey and New York City be repaired, and 68% had a similar belief in the need to construct a second rail tunnel. At this writing, Amtrak is planning a new tunnel, but funding for this has not been decided (Higgs 2014). This comes on the heels of the cancellation of a previous tunnel project by the Governor of New Jersey (Chris Christie) in 2010, one that would have been near completion as of this writing.

Prior New Jersey state-wide polls showed less support for gasoline tax increases. A 2014 Quinnipiac University Poll found only 33% support for raising the gasoline tax (by an unspecified amount) to balance the state budget (Quinnipiac University Poll 2014). A 2009 poll by Quinnipiac found that only 37% of those surveyed supported a gasoline tax for “road improvements and mass transportation” (Agrawal, Nixon 2014). Five years later, little had changed: A 2014 Rutgers-Eagleton Institute poll found 56% of New Jersey residents opposed an unspecified gasoline tax increase and only slightly more opposed a specified (25-cent per gallon) increase. Most respondents believed that state roads were in good shape (48%) or excellent shape (6%); likewise there was a plurality of support that local roads are in good or excellent shape (39%) (Rutgers Eagleton Institute of Politics 2014). This suggests that the infrastructure funding crisis perceived by some transportation professionals may not be perceived by the general public as critically important or, in some cases, at all.

While the research presented here poses a slightly different question than most transportation finance surveys, it found limited support to increase tax revenue. The analysis focuses on the correlates associated with supporting or not supporting the various policies that were presented to the survey respondents. Taxes that directly affect residents, such as gasoline, income, and sales taxes, had virtually no support. However, there was moderately more support for visitor taxes and bond financing. Correlates demonstrated that political party affiliation was a key factor.

Download full version (PDF): Funding Resilient Infrastructure in New Jersey

About the Mineta Transportation Institute

transweb.sjsu.edu

The Mineta Transportation Institute (MTI) conducts research, education, and information and technology transfer, focusing on multimodal surface transportation policy and management issues. It was established by Congress in 1991 as part of the Intermodal Surface Transportation Efficiency Act (ISTEA) and was reauthorized under TEA-21 and again under SAFETEA-LU. The Institute is funded by Congress through the US Department of Transportation’s (DOT) Research and Innovative Technology Administration, by the California Legislature through the Department of Transportation (Caltrans), and by other public and private grants and donations, including grants from the US Department of Homeland Security.

Tags: Mineta Transportation Institute, MTI, Natural Disasters, New Jersey, NJ, Resiliency, San Jose State University

RSS Feed

RSS Feed