UPPER GREAT PLAINS TRANSPORTATION INSTITUTE

1. INTRODUCTION

Drilling shale oil wells generates a large amount of truck traffic. Heavy loads required by drilling activities damage local roads, resulting in the need for several hundred million dollars for repair and maintenance. To support logistical activities for efficient energy development, a proactive approach is required for allocating investments for paving road and timely maintenance. Forecasting load impact on a road network is essential for estimating pavement and repair costs to support energy logistics.

Long-range transportation planning requires reasonably accurate information for transportation agencies and legislators to make appropriate decisions and justify strategic long-term budget allocations. Such planning requires an understanding of the equipment movement and traffic sources required for large-scale and comprehensive efforts over widespread oil production zones.

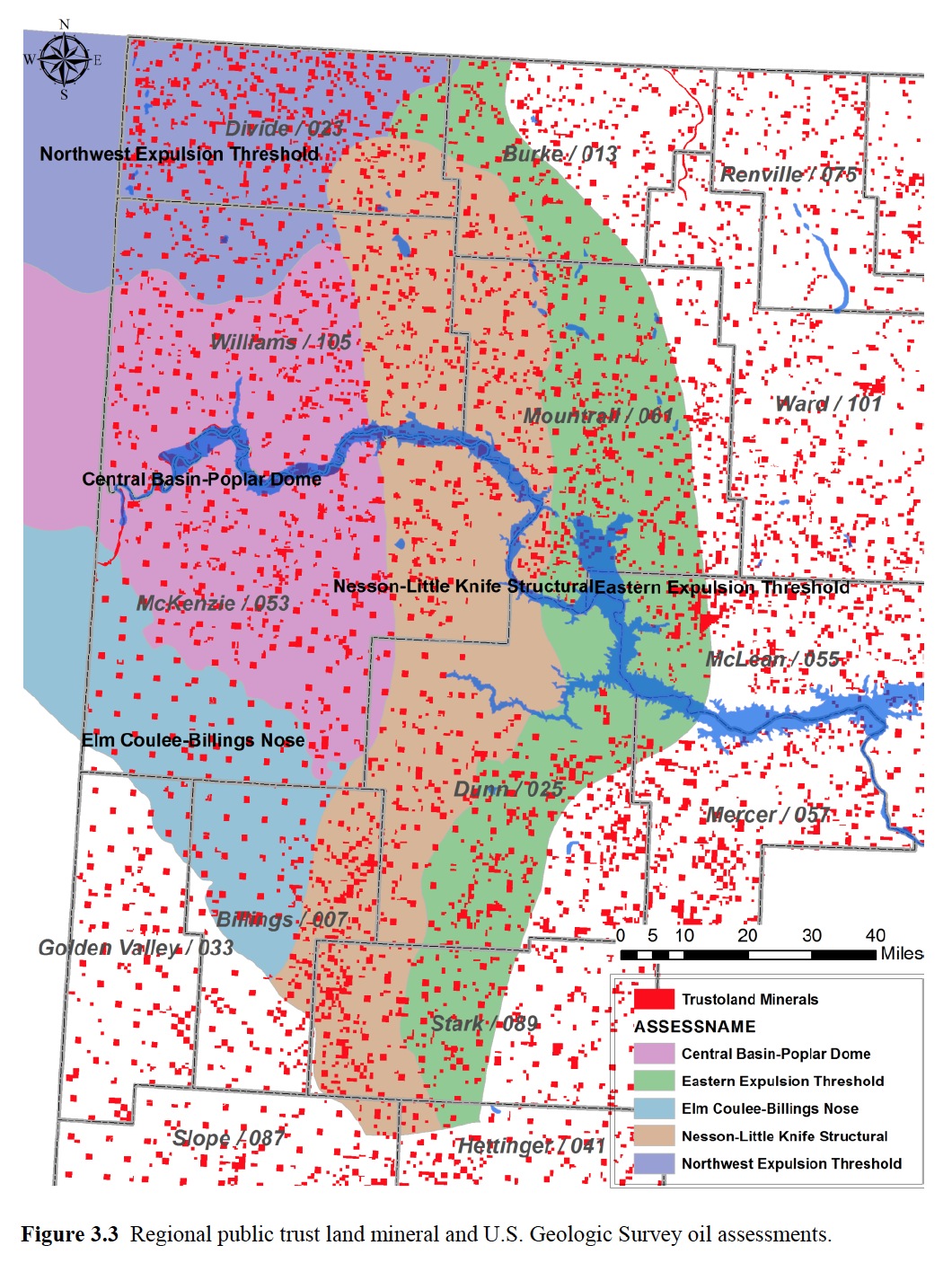

This paper focuses on the prediction of oil drilling locations in order to predict rig movements between current drilling locations and the next drill locations for the next 20-year planning period where producing wells need to be fractured in order to increase oil production. Oil-related traffic models involve historical and current oil wells across 17 oil counties in North Dakota.

In 2010, more than 100 million barrels of crude oil was produced in North Dakota, which was about a 42% increase from 2009. This level of production represents 309,679 barrels oil per day, making the state the fourth largest oil producing state in the United States. By April 2012, North Dakota had become the second largest oil producing state in the United States, surpassing Alaska, and producing almost one million barrels per day. However, there is only one crude oil refinery in the state, located near Mandan, with a capacity of 58,000 barrels per day. The rest of the state’s oil production is transported through five major pipe transloading facilities and 18 BNSF and Canadian National railroads crude-by-rail facilities to oil refineries in Texas, Oklahoma, and Louisiana. In addition to crude oil, 13 natural gas processing plants handle 80 billion cubic feet of the total 114 bcf of natural gas produced as by-products of oil drilling in 2011. Drilling rig count is a prime barometer for measuring oil and gas activity. The count averaged 200 rigs per day in North Dakota in 2011, breaking the record of 126 rigs per day set in 2010 and 182 in 2011.

Thus, estimating drilling locations plays an important role in estimating truck trips for long-term planning. Oil production-related traffic is generated by directional shipments: inbound shipments of sand, fresh water, pipes, gravel, and supplies and outbound shipments of salt-water as by-products and crude oil. Truck traffic generated between origins and destinations is based on commodities that must be shipped. Horizontal drilling using hydraulic fracturing generates about 2,024 inbound and outbound truck movements [2]. Approximately half of the trips are loaded. Based upon the projected number of rigs and drilling activities, the number of oil wells can be estimated. Drilling activities vary by the duration of the drilling process as well as by the locations in each county or smaller unit. In general, it takes six weeks to two months to drill one oil well.

Predicting drilling locations among more than 7,000 oil lease units shows a random pattern with uncertainty. A spacing unit is the land which covers an area at least as large as can be “efficiently and economically be drained by one well” [3]. The spacing units within an oil field have uniform sizes and shapes in general; nonetheless, the sizes and shapes can differ within in the same oil field. Most of the spacing units for horizontal wells are either 640 acres or 1,280 acres [4]. Instead of drilling one well in a new spacing unit, some wells are drilled horizontally, crossing into neighboring spacing units. The challenges of the choice-based prediction stem from the unknown history of the rigs’ movements and their pattern and randomness under uncertainty of oil price and rig activity. Because of the severity of traffic and the uncertainty of the drilling and production locations, estimating well locations to estimate traffic generation plays an important role in long-range transportation planning (LRTP).

The paper regards this prediction problem of predicting oil spacing units as choice-based prediction using maximum likelihood method. Twenty-year multi-period forecasting architecture is proposed for use in this study. State transportation agencies and legislators require long-term traffic estimations and cost analysis in order to make appropriate decisions and to justify strategic, long-term budget allocations. Thus, this study estimates drilling probability on each spacing unit using the maximum likelihood estimation in order to forecast truck movements with respect to frequency and paths for a 20-year period.

Download full version (PDF): Spatio-Temporal Estimates of Long-Term Drilling Locations

About the Upper Great Plains Transportation Institute

www.ugpti.org

The Upper Great Plains Transportation Institute (UGPTI) is a research, education, and outreach center at North Dakota State University which is guided, in part, by an advisory council composed of representatives of various organizations, industries, and agencies affecting or affected by transportation.

Tags: Fracking, Hydraulic Fracturing, ND, North Dakota, UGPTI, Upper Great Plains Transportation Institute

RSS Feed

RSS Feed

As mentioned, there is a lot of logistics to consider in dealing with oil drilling. It’s important to consider these things when a company is considering various locations to drill. It’s interesting that there is only one refinery located in North Dakota, especially since it’s moved up to the second highest oil producing state. The map predicting likelihood of oil is very interesting. I think it would be cool to be the person making these predictions. Thanks for the article!

http://www.terraserver.com