ANALYSIS GROUP

Executive Summary

It is a common occurrence for the issue of reliability to be raised when market, technology or policy changes are affecting the financial outlook of different segments of the electric industry. This phenomenon has occurred several times over the past two decades, as the prospect of new industry and market structures, technological advancement, air pollution controls and customer-driven changes stood to alter the operations and economics of various types of power plants on the electric system. Sometimes these warnings spring from genuine concerns, such as the need to address the localized reliability impacts of potential plant closures; other times they reflect a first line of defense by opponents of the changes underway in the industry.

Recently, some have raised concerns that current electric market conditions may be undermining the financial viability of certain conventional power plant technologies (like existing coal and nuclear units) and thus jeopardizing electric system reliability. In addition, some have suggested that federal and state policies supporting renewable energy are the primary cause of the decline in financial viability. The evidence does not support either hypothesis.

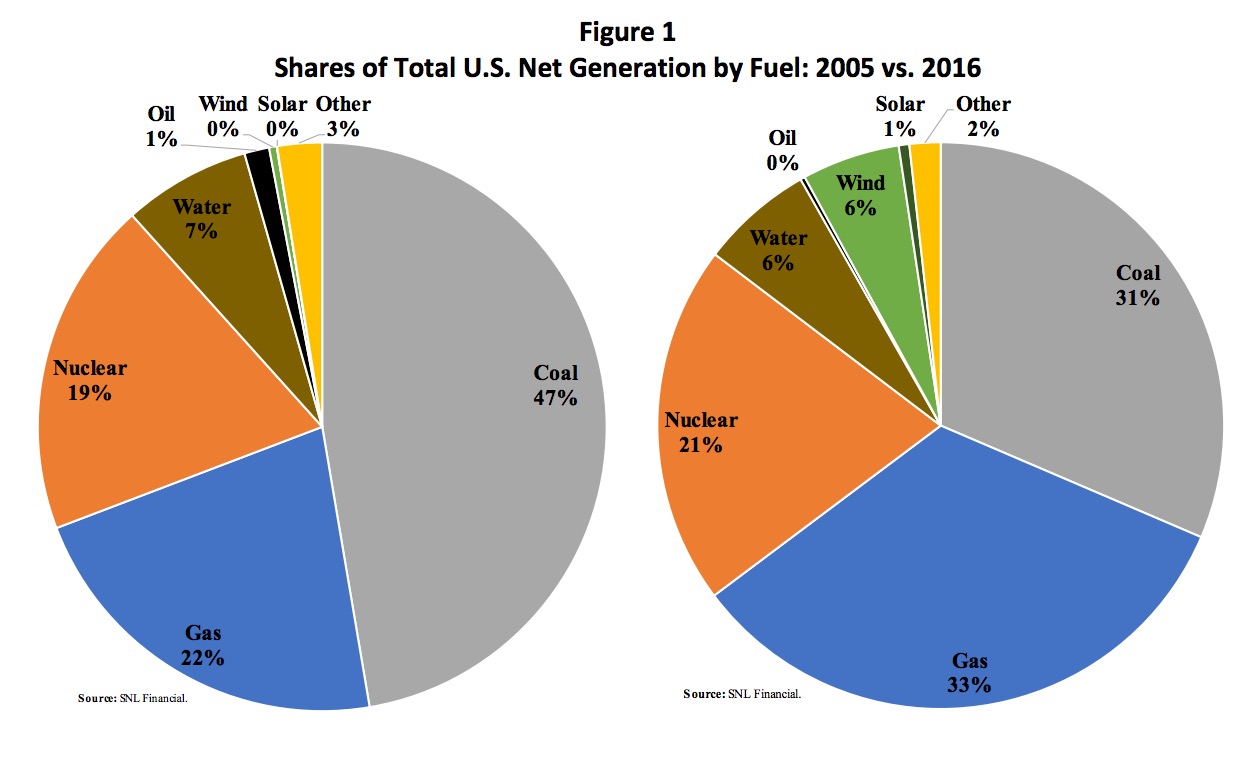

There is little doubt that the transition under way in the industry will lead to a power system resource mix and consumption patterns quite different from the ones to which the industry has grown accustomed in recent decades. The ongoing diversification of generation supply (See Figure 1) has lowered wholesale electricity costs in most parts of the U.S. and has contributed to recent declines in consumers’ overall cost of living.

Yet the nature and pace of change have raised two fundamental questions in public debates among electric industry participants, regulators, stakeholders and practitioners:

First, what exactly are the primary drivers of the transition underway in the electric industry?

Second, are the changes impacting the mix of generating resources in a way that could undermine power system reliability?

In this Report we evaluate both questions. Based on our review, we arrive at the following observations and conclusions:

1. Market Forces are Driving the Change in the Generation Mix, to the Benefit of Consumers

- Fundamental market forces — the addition of highly efficient new gas-fired resources, low natural gas prices, and flat demand for electricity — are primarily responsible for altering the profitability of many older merchant generating assets in the parts of the country with wholesale competitive markets administered by Regional Transmission Organizations (RTOs). As a result, some of these resources (mostly coal- and natural gas-fired generating units, but also many oil-fired power plants and a handful of nuclear power plants) have retired from the system or announced that they will do so at a future date.

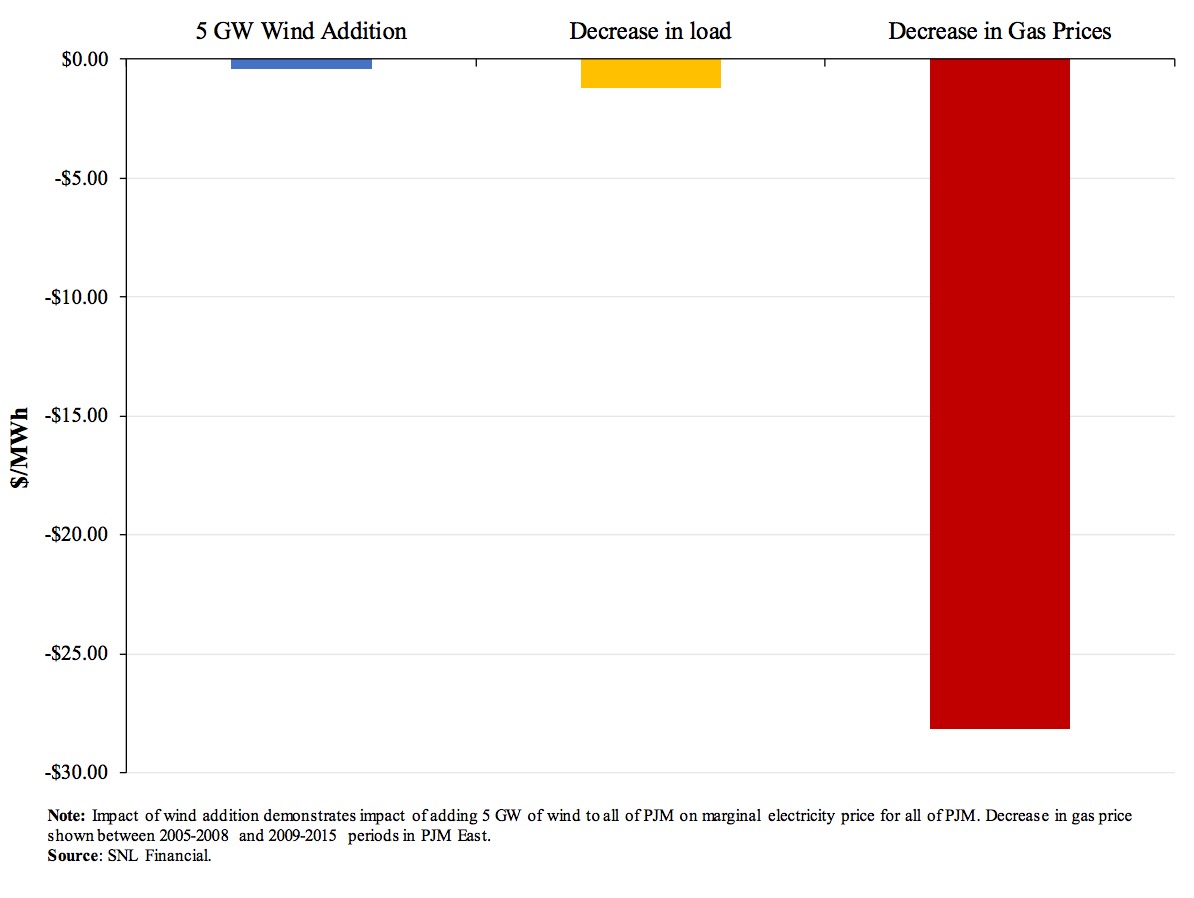

- Other factors — such as rapid growth in newer energy technologies (whose costs have declined significantly in recent years), and state policies and consumers’ actions that support such technologies — also contribute to reducing the profitability of less economic assets. These are, however, a distant second to market fundamentals in causing financial pressure on merchant plants without long-term power contracts. In the PJM regional market, which accounts for a large share of the nation’s coal plant retirements, decreases in natural gas prices have had a much larger impact on the profitability of conventional generators than the growth of renewable energy, as illustrated in Figure 2.

Figure 2: Relative Incremental Impact of Three Factors on Prices per MWh in PJM’s Wholesale Energy Market: Illustrative Impacts of Changes in Natural Gas Prices, Electricity Demand and Entry of Wind Resources

- The retirement of aging resources is a natural element of efficient and competitive market forces, and where markets are performing well, these retirements mainly represent the efficient exit of uncompetitive assets, resulting in long-run consumer benefits.

2. The Transition Underway in the Electric Resource Mix is Not Harming Reliability

- Although some commentators have raised concerns that the declining financial viability of certain conventional power plant technologies (like coal and nuclear power plants) that operate as merchant units in several wholesale electricity markets may be jeopardizing electric system reliability, there is no evidence supporting that conclusion. In fact, a recent reliability review by the National Electric Reliability Council (NERC) — the nation’s designated reliability organization – – shows that the changes in regional wholesale markets are not leading to lower bulk-power-system reliability metrics.

- Many advanced energy technologies can and do provide reliability benefits by increasing the diversity of the system. The addition of newer, more technologically advanced and more efficient natural gas and renewable technologies is rendering the power systems in this country more, rather than less, diverse. These newer generating resources are also contributing to the varied reliability services — such frequency and voltage management, ramping and loadfollowing capabilities, provision of contingency and replacement reserves, black start capability, and sufficient electricity output to meet demand at all times — that electric grids require to provide electric service to consumers on an around-the-clock basis. As a result, increasing quantities of natural gas and renewable generation are increasing the diversity of the power system and supporting continued reliable operations.

Download full version (PDF): Electricity Markets, Reliability and the Evolving U.S. Power System

About Analysis Group

www.analysisgroup.com

Analysis Group provides economic, financial, and business strategy consulting to leading law firms, corporations, and government agencies. The firm has more than 700 professionals, with offices in Boston, Chicago, Dallas, Denver, Los Angeles, Menlo Park, New York, San Francisco, Washington, D.C., Montreal, and Beijing.

Tags: Advanced Energy Economy, AEE, AG, American Wind Energy Association, Analysis Group, AWEA, Renewables

RSS Feed

RSS Feed