DELOITTE

Executive summary

Fifth generation mobile networks (5G) are now poised for field testing and launch worldwide. The technology unlocks unprecedented potential to build seamless digital ecosystems, reshaping the way citizens live, work, and interact.

Fifth generation mobile networks (5G) are now poised for field testing and launch worldwide. The technology unlocks unprecedented potential to build seamless digital ecosystems, reshaping the way citizens live, work, and interact.

Wireless networks were at a similar inflection point as 4G services launched early in the decade. The United States took action as government made new spectrum available and carriers responded to accommodate radical, twenty-fold growth in global mobile data traffic. The massive investment in wireless network infrastructure rewarded the US consumer with more coverage at affordable prices, and the US economy generated up to 700,000 jobs as a result.

An equally transformative moment is coming with 5G, but with two important differences. First, the economic stakes are potentially much higher, where connected devices, applications and business models could dramatically stimulate economic productivity. Second, the United States is not as well prepared to take full advantage of the potential, lacking needed fiber infrastructure close to the end customers (deep fiber).

Deep fiber is the next front in the battle to lead the world in Internet speed and capacity

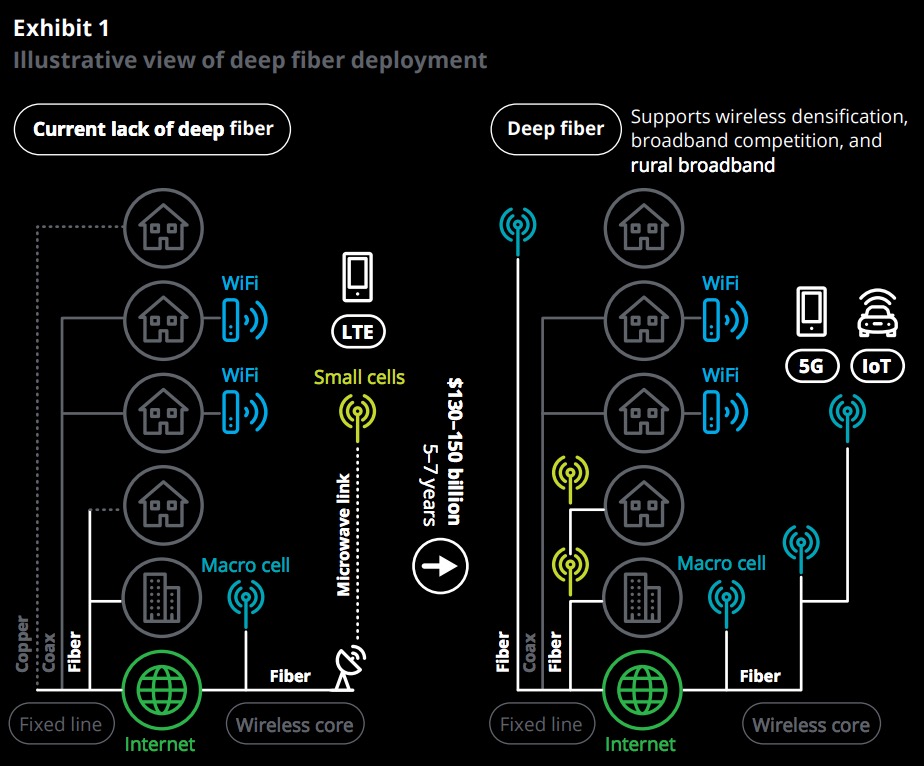

Unlocking the full potential of 5G in the United States rests on a key assumption: the extension of fiber deep into the network. Despite the demand and potential economic benefits of fiber deployment, the United States lacks the fiber density in access networks to make the bandwidth advancements necessary to improve the pace of innovation and economic growth. Increased speed and capacity from 5G will rely on higher frequencies and network densification. Carriers will deploy many more small cells, homespots, and hotspots in higher bands, with a coverage radius measured in meters versus kilometers. Without more deep fiber, carriers will be unable to support the projected four-fold increase in mobile data traffic between 2016 and 2021.

A second motivation for “deep fiber” deployment is to increase broadband service choice for residential and business customers. Deep fiber is a key tool for the national infrastructure imperative to provide consumers high-speed broadband connections no matter where they live at prices they can afford, closing the “digital divide.”

Wireline broadband access supports as much as 90 percent of all Internet traffic even though the majority of the traffic ultimately terminates on a wireless device. However, twelve years after the first fiber to the home (FTTH) deployments, only 38 percent of homes have a choice of two providers offering speeds of at least 25 Mbps. In rural communities, only 61 percent of the population have access to 25 Mbps wireline broadband, and when they do, they can pay as much as a three times the premium over suburban customers.

To meet future broadband needs, the United States needs an estimated $130– 150 billion of fiber infrastructure investment

A Deloitte Consulting LLP analysis estimates that the United States requires between $130 and $150 billion over the next 5–7 years to adequately support broadband competition, rural coverage and wireless densification. Such ambitious infrastructure investment could derive from a variety of sources including communications service providers, financial investors and public-private partnerships.

Our estimates include funding for three broad categories of fiber deployment: fiber for wireless densification, fiber to increase consumer and business broadband competition and fiber to serve rural/ underserved geographies. Moreover, our models suggest massive synergies between the build required for wireless densification and adding broadband competition in urban areas. There are also additional benefits between densification and underserved communities. With more than 60 percent of total costs for construction, permits and design,8 fiber providers may need to share last mile access routes and rights of way where possible to realize such synergies.

The current wireline industry construct does not incent enough fiber deployment

Some wireline carriers are reluctant or unable to invest in fiber for the consumer segment despite the potential benefits. Expected wireline CAPEX ranges between 14–18 percent of revenue. Wireline OPEX can be 80 percent of revenue.9 Fiber deployment in access networks is only justified today if a short payback period can be guaranteed, a new footprint is being built, repairs from rebuilding after a storm or other event justifies replacement, or in subsidized geographies where Universal Service funds can be used.

The largest US wireline carriers spend, on average, five to six times more on operating expenses than capital expenditures.10 Excessive operating expenditures caused, in part, by legacy TDM network technology restrict carriers’ ability to leverage digital technology advancements. Worse, as legacy TDM networks continue to descale, the percentage of fixed costs overwhelms the cost structure leading to even greater margin pressure.

In the last five years, wireline carriers have lost seven points of market share in broadband access, mainly to cable operators. Cable operators, who have the advantage of a more modern coax network, do not have these legacy constraints and have aggressively deployed high-speed broadband access using DOCSIS 3.0 and 3.1 upgrades. Cable operators currently cover more than 85 percent percent of US homes with Internet speeds of 25 Mbps or greater.

Generating sufficient cash flow to motivate fiber upgrades means building a business model based on simplicity and capital productivity. This will not happen without completing the migration from TDM to an all-IP network. The complexity imposed on IP services by legacy product iteration and cumbersome IT systems increases operational costs, drives up failure rates, and leaves customers unhappy.

- Mobile operators, not required to support legacy services, require approximately one-eighth the care staff and receive half as many inbound calls per customer compared to wireline network operators.

- A survey by Nemertes Research found a reduction in average time to repair from 21 hours to 5 hours for a single, end-toend IP network.

- French wireless and wireline provider, Iliad, operates an all IP network with approximately 3 to 4 employees per 10,000 customers compared to 12 to 15 employees per 10,000 customers for US providers.

Carriers stand to gain tremendous efficiency from deploying new IP networking architectures like Software Defined Networks (SDN) and Network Function Virtualization (NFV). This technology is also important to provide the scale and elasticity required to support 5G networks in the future. However, the requirement to operate and maintain legacy networks and systems (TDM based) limits carriers’ ability to take advantage of the savings and shift capital to deep fiber deployment.

Carriers and policymakers can share responsibility for motivating investment in fiber

The lack of funding and motivation to deploy fiber leaves the future of wireless and wireline connectivity uncertain. Wireline telecommunications companies are choosing to invest in areas other than fiber deployment including satellite TV, advertising, content and advanced business services. Similarly, infrastructure funds and REITs have made few investments in telecommunications assets. Many wireline carriers depreciate 1.2x–1.3x as much PPE as they add in a given year, leaving a declining net asset base to service increased demand.

Many countries, including the United States, prioritize ubiquitous affordable broadband as a policy objective. The United States ranks tenth in the world for average broadband speed and percentage of users with over 25 Mbps.16 This is remarkable, as the United States has almost six times the cumulative land area of the nine countries ranked above it. Removing legacy regulations that constrain competition and investment may enable market forces to solve many of the deep fiber and broadband coverage challenges in the United States. Furthermore, empowering market forces may enable the government to focus on a more limited set of geographies that are very expensive to serve or have low income/ affordability issues.

Carriers should consider:

- Establishing deep fiber as a top priority investment for the long term.

- Redesigning business models and processes based on digital sales and care channels.

- Providing a more limited set of standard IP products to substitute legacy TDM products.

US policymakers should consider:

- Eliminating regulatory barriers that prevent carriers from operating a single IP network, impede deployment of additional fiber assets, or restrict the types of services that may be offered.

- Avoiding regulation that limits carrier innovation in creating new monetization mechanisms or voluntary sharing of deep fiber and associated communications infrastructure such as trenches, conduit, rights of way and cell sites.

- Dispersing Universal Service support more efficiently to coordinate/ encourage deep fiber programs.

Reforms to the Universal Services Administrative Company (USAC) to improve operational efficiency is a prerequisite to implement a coordinated deep fiber program. Recently, USAC has come under growing criticism regarding its operations and the resulting impact to end-users, such as consumers, schools, libraries and companies. Meanwhile, USAC’s internal expenses are growing approximately at 12 percent per year.17 In the past, the Federal Communications Commission (FCC) has considered putting USAC’s operations out for competitive contract to save costs and improve responsiveness to organizations seeking funds to close the digital divide. At minimum, reforming USAC internal operations seems warranted to meet broader goals of expanding fiber infrastructure and addressing rural Internet access.

New monetization mechanisms needed to encourage deep fiber investment

Important as they are, IP migration and regulatory reforms will not be enough to create the financial case for deep fiber deployment that is needed for broadband and densification. Wireless, wireline and cable require creative new ways to monetize “last mile” access as an incentive for massive fiber deployment. We contemplate three potential models:

Synergies between deep fiber and adjacent services in an ‘unlimited’ world

Gartner predicts that affluent households will have up to 500 connected devices by 2022.18 In some cases, IoT services offer the prospect of new revenue, however, most connected devices will require low bandwidth or be WiFi enabled and, therefore, may not provide carriers with incremental revenue. In such cases, carriers have an opportunity to increase revenue by offering integration, network security, and traffic management services within the increasingly complex mix of IoT devices and ecosystems.

Partnership between carriers and OTT players to fund deep fiber

As limited fiber availability constrains increased wireless densification and fiber broadband, over the top players may choose to fund fiber deployment, including owning assets or forming partnerships with carriers.

Deep fiber as a financial investment

Insufficient supply of deep fiber and overwhelming demand growth are strong fundamentals for fiber investment. As interest grows from non-traditional fiber investors, we expect shared infrastructure models to emerge for last mile fiber access. Fiber as leased real estate could allow carriers to maximize asset utilization.

Carrier investment and regulatory reform can provide key ingredients to address the deep fiber shortage. As carriers are already making 5G investment decisions, fiber investment is top of mind. Lack of action may lead carriers to commit to investments inconsistent with the goal of better densification, broadband competition and closing the digital divide.

Download full version (PDF): The Need for Deep Fiber

About Deloitte

www.deloitte.com

“Deloitte” is the brand under which tens of thousands of dedicated professionals in independent firms throughout the world collaborate to provide audit, consulting, financial advisory, risk management, tax, and related services to select clients. These firms are members of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”). Each DTTL member firm provides services in particular geographic areas and is subject to the laws and professional regulations of the particular country or countries in which it operates.

Tags: 5G, Deep Fiber, Fiber Optic, Internet, Mobile Internet, Wireless

RSS Feed

RSS Feed