SECURING AMERICA’S ENERGY FUTURE

ENERGY SECURITY LEADERSHIP COUNCIL

Summary for Policymakers

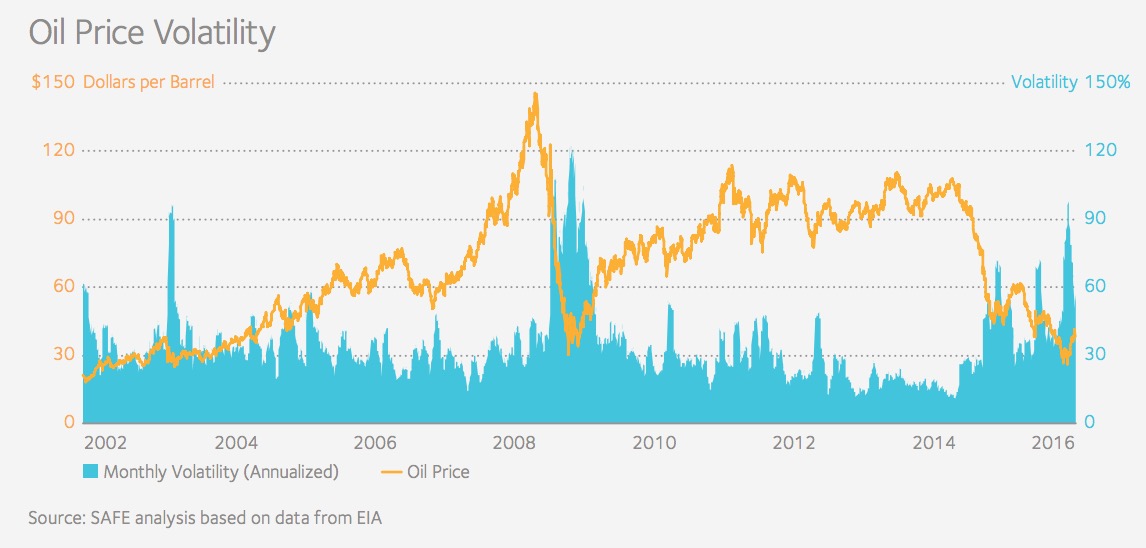

Rarely in history has Americans’ perception of the nation’s energy security oscillated as wildly as it has over the past decade. In 2008, amid a historic oil supply crunch and record run-up in global oil prices, U.S. spending on oil reached nearly 6 percent of GDP, a level historically associated with recession. The nation, heavily dependent on fuel purchased from overseas, sent a record $388 billion abroad for oil, accounting for well over half of the country’s trade deficit. And with no alternatives to oil in transportation, American households saw their spending on gasoline double in a few short years, draining thousands of dollars from the typical family’s disposable income.

While the ensuing global recession—triggered in part by high oil prices—offered temporary relief at the pump, geopolitical instability and a host of other factors led to the nearly immediate return of near-record oil prices beginning in 2010. High and volatile oil prices would act as a consistent drag on American economic growth for much of the period immediately following the recession, from 2010 to 2014. Yet quietly, in the background, a revolution was underway.

After decades of decline and stagnation, the American oil industry did what great American industries do: they invented and engineered a turnaround of historic proportions. Driven by the rapid expansion of the domestic shale industry, U.S. field production of liquid fuels surged by 55 percent from 2010 to 2014, reaching all-time highs. The shale industry created 220,000 direct American jobs in just five years and supported hundreds of thousands more, all while investing nearly a trillion dollars throughout the domestic supply chain. From Pennsylvania and Ohio to North Dakota and Texas, shale increased economic growth, employment, and government revenues.

Meanwhile, U.S. oil policy took important steps forward. New fuel-economy regulations enacted in 2011 and 2012 promised to cut American dependence on oil through 2025 by as much as 3 million barrels per day (mbd), leading to sharply declining oil intensity which fundamentally means that we could generate more GDP using less oil. Investments in advanced battery manufacturing and support for plug-in electric vehicles (PEVs) and other advanced technology mobility sparked a nascent industry, with dozens of models available to U.S. consumers in showrooms around the country. American consumers were opting for more efficient vehicles and driving fewer miles.

Measurable progress began to surface: U.S. oil import levels plummeted from a record 60 percent of supplies in 2005 to just 26 percent in 2014, keeping hundreds of billions of dollars of American wealth at home, where it could be productively deployed. Oil spending as a share of GDP returned to less dangerous levels. Household spending on oil pulled back from historic highs.

If the previous five years were the age of the American energy security renaissance, 2015 was the year of OPEC. Driven largely by surging American oil production, the global oil market entered a period of significant oversupply in which OPEC market share was shrinking, and global oil prices were declining. For the national governments that comprise OPEC, whose budgets and economies depend overwhelmingly on export revenues from state-run national oil enterprises, these dynamics were an existential threat. Following a tumultuous meeting of the cartel in November 2014, Saudi Arabia and its allies in the Gulf region embarked on a deliberate strategy of global price war designed to rebalance the market on terms more favorable to global oil producers—and more predatory to global oil consumers.

In the months that followed, global oil prices collapsed at an incredible pace, shedding 40 percent of their value in just two months. Despite falling prices, Saudi Arabia took the extraordinary step of sharply increasing its production in order to put additional pressure on markets. After averaging $100/bbl from 2011 to 2014, prices averaged $52/bbl in 2015 and are expected to average just $34/bbl in 2016.

In normal market conditions, low oil prices are an unalloyed benefit for the U.S. economy. Indeed, U.S. households in 2015 enjoyed a roughly $94.6 billion reduction in oil spending, a cut on par with the 2011 payroll tax cut, which totaled $108 billion. But in the transformed domestic energy landscape, low prices present the economy with complex tradeoffs, stimulating consumption while undermining a key growth sector—the domestic oil industry. Perhaps more importantly, today’s rapid and severe plunge in oil prices are transitory, and simply reflect Saudi Arabia’s strategy to wrest control of the global oil market back from the competitive forces that led to this moment, and to restore the cartel’s ability to more effectively manipulate markets for its own gain.

The Saudi strategy appears to be working. In sharp contrast to the robust growth it enjoyed from 2011 to 2014, relatively high cost U.S. oil production has plateaued and begun to decline at an increasingly rapid rate. The U.S. oil and gas industry has shed more than 150,000 jobs in just 18 months and cut capital spending to its lowest level in a decade. Meanwhile, investment in capital-intensive oil supplies around the world, including deepwater resources and Canadian oil sands, has declined by more than $225 billion, leading analysts to warn of an impending supply crunch by the end of the decade.

As dramatic as the supply-side impacts have been, developments on the demand side have arguably been more concerning. After improving by 12 percent between 2011 and 2014, the efficiency of cars and trucks sold in the United States has actually declined slightly over the past year, creating a difficult environment for the federal government’s upcoming review of new standards. Americans purchased pick-up trucks and sport-utility vehicles at a record pace in 2015, and gasoline demand returned to levels last seen in 2007. Growth in the sales of vehicles powered by electricity and natural gas have stalled.

On its current trajectory, the net effect of these trends will be a substantially tighter oil market by 2020. The International Energy Agency has warned that a global shortfall in oil supplies will emerge in 2018 and average roughly 1 mbd from 2019 to 2021, steadily eroding the glut in supplies that built up over the past two years. While shale production would likely fill a portion of this gap, investment in much higher-cost supplies will ultimately be needed to fill the hole, which will take time. In short, the low prices of today are already cementing the higher prices of tomorrow.

Download full version (PDF): A National Strategy for Energy Security

About the Energy Security Leadership Council

secureenergy.org/about/energy-security-leadership-council

The Energy Security Leadership Council (ESLC) brings together some of America’s most prominent business and military leaders to support a comprehensive, long-term policy to reduce U.S. oil dependence and improve energy security. The ESLC works aggressively to build bipartisan support.

Tags: Energy Security, Energy Security Leadership Council, Fossil Fuels, Oil, Petroleum, Securing America's Energy Future

RSS Feed

RSS Feed