BLACK & VEATCH INSIGHTS GROUP

2016 Report Background

The Black & Veatch 2016 Strategic Directions: Water Industry Report is a compilation of quantitative and qualitative data and analysis from industry-wide surveys. This year’s online survey was conducted from 15 March through 1 April 2016 and reflects the input of 358 qualified utility, municipal, commercial and community stakeholders. To supplement the survey and broaden our report focus to regions outside the United States, the Black & Veatch team conducted more detailed surveys with water utility leaders in key Black & Veatch markets abroad.

…

Executive Summary

Many, if not all issues considered most important to the water industry in 2016 appear linked to funding and cost concerns – the cost of addressing outdated systems at a time when traditional revenue streams are drying up and the political cost of pitching rate cases or alternative financing strategies to skeptical stakeholders.

Or, the cost of water as it’s widely perceived by the public, whose understanding of the resources needed to treat and deliver a safe supply may compete with the industry’s ever-growing – and deferred – maintenance bill.

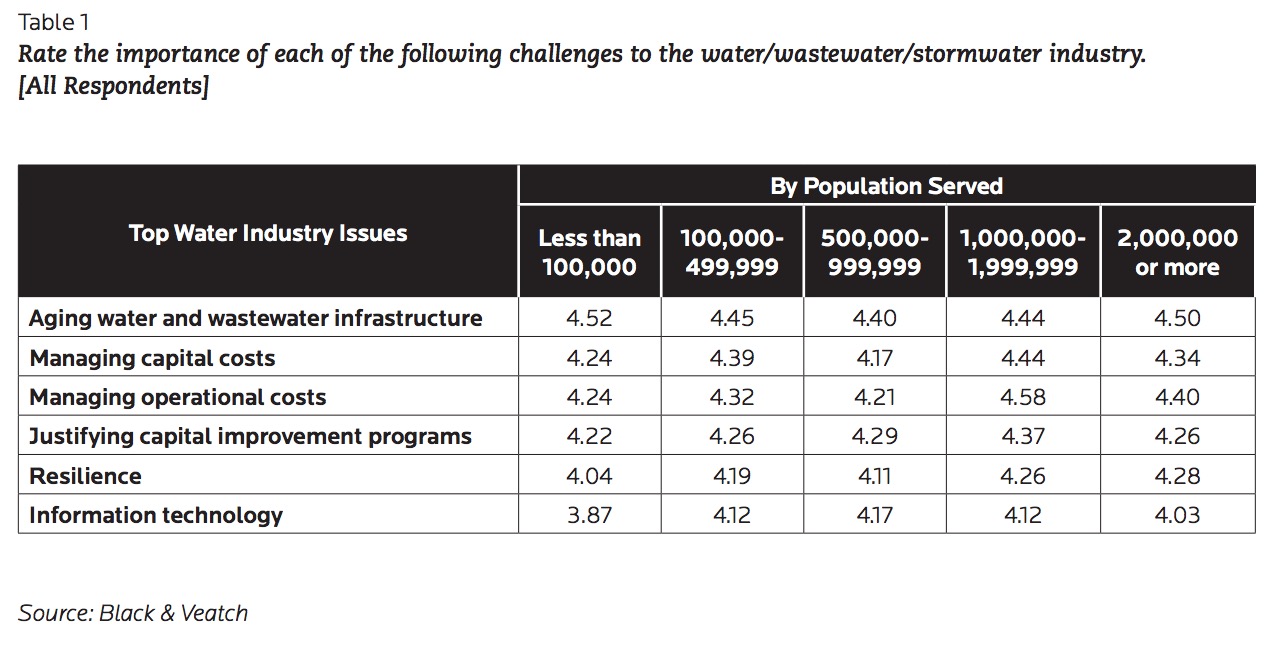

Concerns reflected in the 2016 Strategic Directions: Water Industry Report may at first feel overly familiar. Aging water and wastewater infrastructure, questions of capital and operational costs and resilience all echo the worries and priorities of years past (Table 1).

Time certainly hasn’t cured many of these concerns, and taken individually, any of them would present a challenge for an industry edging closer to the limits of its infrastructure. What is remarkable is that in 2016, new headlines about safe drinking water supplies and lingering concerns over past droughts, and those to come, are energizing a necessary national conversation around how much stakeholders up and down the water chain are willing to spend to ensure a safe, reliable supply.

There is little doubt that the problems in Flint, Michigan, are fueling new debates over America’s water infrastructure. Utilities are hearing from customers in the wake of Flint, and utilities are also moving quickly to engage customers about the state of their local systems.

Closing the Financial Gap

Changing customer behaviors, drought and the continued slow pace of residential construction all remain drags on utility revenue, respondents said. But a discouraging statistic mirrors larger worries about the ability of providers to meet their obligations using existing revenue levels: only 28 percent said their existing streams would cover maintenance, debt service, capital investment and reserves (Table 2) – a drop from the 36 percent that was reported the year previous.

Our report explores the nascent but growing popularity of alternative financing schemes, particularly the rise of public-private partnerships as a way to join eager private investors with increasing public needs. The strategies employed in international markets – particularly Asia, Australia and Canada – may offer lessons for U.S. providers as they strive to balance revenues and infrastructure requirements.

We also analyze one of the foundational blocks against adequate funding of infrastructure: the public’s historic undervaluing of water. The American Society of Civil Engineers reported in 2015 that over the next four years, a nearly $85 billion gap will exist between our current level of spending and needed investments in treatment plants, pipes and wet weather management. The Environmental Protection Agency believes that gap will reach more than $300 billion by 2036.

History holds some clues about the disconnect over water’s valuation among customers. Ann Bui, Black & Veatch Managing Director for Water Services, notes that one in three Americans is older than 50, meaning that roughly two-thirds of Americans may struggle to recall the last federal grant program of the 1970s despite directly benefiting from the facilities built with that money. Simply put: many of today’s water customers may not remember having to pay for large infrastructure improvements, which contributes to a public that is accustomed to paying for water at rates that do not reflect its current cost.

The Promise of Alternative Water Supplies

Issues of cost also affect the implementation of alternative water supply strategies aimed at building diversified and resilient sources of water. A full 60 percent of respondents listed cost/financial as the biggest challenge holding back projects.

The interest is there, even if the capital isn’t. Encouragingly, survey responses signal a new willingness to consider alternative water supplies. Nearly 50 percent of respondents say they either have or plan to develop a master plan for water reuse. Strategies vary by region, but many utility leaders are smartly taking the long-term view on supply and are open to new approaches. How such projects will be financed is the key question.

Recent weather conditions are adding a new wrinkle to source and supply questions. In recent years, California and Texas have been key examples of fighting drought through the development of alternative water supplies, when severe drought led to major water restrictions. However, despite recent rains in California and flooding in Texas, there remains resolve to proceed with drought planning, reflecting an understanding that a single year of abundant moisture likely won’t replenish historically depleted water stores.

Download full version (registration required): 2016 Strategic Directions – Water Industry Report

About the Black & Veatch Strategic Directions Reports

bv.com/reports

The annual Strategic Directions Report series offers analysis and insight into key issues and trends facing the electric, natural gas, smart city/smart utility and water utility sectors.

Tags: Black & Veatch, Black & Veatch Insights Group, Strategic Directions Reports, Water, Water Industry

![Table 2 My utility’s current revenue levels cover: [Water Service Providers]](https://www.infrastructureusa.org/wp-content/uploads/2016/06/water-industry-table-2.jpg)

RSS Feed

RSS Feed